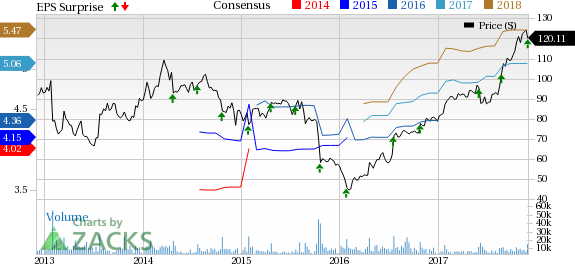

VMware Inc.’s (NYSE:VMW) fiscal third-quarter 2018 non-GAAP earnings of $1.34 per share easily beat the Zacks Consensus Estimate of $1.27 while increasing 59.5% from the year-ago quarter.

Notably, VMware revised its fiscal calendar effective Jan 1, 2017. The company’s first fiscal year under its revised calendar began on Feb 4, 2017 and will end on Feb 2, 2018. Hence, its fiscal third quarter 2018 began on Aug 5 and ended on Nov 3, 2017.

Revenues of $1.98 billion also topped the consensus mark of $1.96 billion and increased 11.1% on a year-over-year basis. At the end of the quarter, unearned revenues were $5.6 billion.

The strong top-line growth can be attributed to robust performance of its product offerings like NSX, vSphere and vSAN.

During the quarter, VMware unveiled two major offerings, VMware AppDefense and Pivotal Container Service (PKS).

PKS is the result of its collaboration with Pivotal Software Inc and Alphabet’s (NASDAQ:GOOGL) Google Cloud. VMware is extending its partnership with IBM (NYSE:IBM) to enhance security offerings with the addition of AppDefence along with IBM’s QRadar offering.

Availability of VMware cloud on Amazon's (NASDAQ:AMZN) Amazon Web Services (AWS) holds high growth potential for the company in the long run.

Moreover, the company announced its plans to acquire VeloCloud Networks that will enable it to enhance its product offerings and gain more customers going forward. The deal is expected to close in the fourth quarter.

We note that VMware shares have gained 52.6% year to date, substantially outperforming the industry’s gain of 36.1%.

We believe that expanding product portfolio, partnerships with the likes of Intel (NASDAQ:INTC) , Samsung (KS:005930), Fujitsu, Pivotal, Alphabet, AWS and Microsoft (NASDAQ:MSFT) along with continuing enterprise deal wins, will help the stock maintain its momentum in the rest of fiscal 2018.

Quarter Details

Services revenues (60.3% of total revenue) increased 9.6% to $1.19 billion.

License revenues increased 14% year over year to $785 million. NSX licensed bookings grew over 100% on a year-over-year basis driven by strong demand for micro segmentation security solution. Notably, the NSX platform benefited from the company’s deal with DXC Technology. The company currently has over 3,100 NSX customers.

vSAN licensed bookings surged more than 150% backed by growth in vSAN and hyper converged storage software offerings like VxRail. Further, EUC license bookings were up over 40% on the back of healthy growth in both mobile and compute bookings. Workspace ONE is also gaining traction.

Region wise, U.S. revenues (49.5% of total revenue) increased 6.8%, while International (50.5%) grew 15.8% from the year-ago quarter. Management noted that all three geographies witnessed strong and balanced growth, with EMEA reporting an exceptional quarter.

VMware’s hybrid cloud and SaaS offerings now represent more than 8% of revenues. The increase was driven by continued strong adoption of VMware Cloud Provider Program (formerly vCloud Air Network), which surged over 30% on a year-over-year basis.

Cloud management bookings were flat this quarter. Cloud management licensed bookings were down in low-single digits on a year-over-year basis.

Non-GAAP operating income increased 16% year over year to $689 million. Operating margin expanded 140 basis points (bps) to 34.8% in the reported quarter.

Balance Sheet

VMware exited the quarter with total cash and cash equivalents (and short-term investments) of $11.6 billion compared with $7.99 billion as on Dec 31, 2016.

Cash flow from operating activities was $970 million and free cash flow was $911 million as of Nov 3, 2017.

Aggressive Share Repurchase to Support Bottom Line

VMware currently has $1 billion remaining under its $1.2 billion repurchase authorization, which extends through fiscal 2018. Additionally, the company completed repurchases of $300 million worth of stock in the quarter from Dell Technologies and $555 million in the open market.

Guidance

In fourth-quarter fiscal 2018, revenues are expected to be $2.263 billion. License revenues are expected to be $1.028 billion.

Non-GAAP operating margin is anticipated to be 36.9%. Non-GAAP earnings are expected to be in the range of $1.62 per share.

For fiscal 2018, revenues are expected to be $7.875 billion, up from $7.830 billion projected earlier. License revenues are expected to be $3.155 billion, up from $3.075 billion guided earlier.

Non-GAAP operating margin is expected to be 33%, better than the prior guidance of 32.7%.

Non-GAAP earnings are expected to be $5.13 per share, up from the previous guidance of $5.06.

VMware carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Vmware, Inc. (VMW): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research