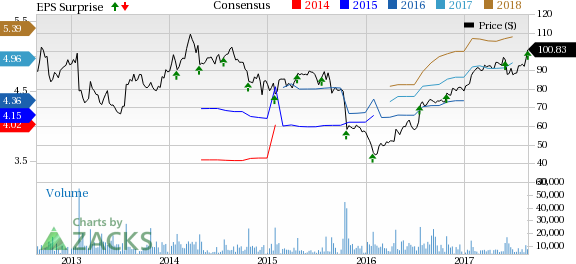

VMware Inc.’s (NYSE:VMW) second-quarter fiscal 2018 non-GAAP earnings of $1.19 per share easily beat the Zacks Consensus Estimate of$1.15 while increasing 72.5% from the year-ago quarter.

Notably, VMware revised its fiscal calendar effective Jan 1, 2017. The company’s first fiscal year under its revised calendar began on Feb 4, 2017 and will end on Feb 2, 2018. Hence, itssecond quarter fiscal 2018 began on May 6 and ended on Aug4, 2017.

Revenues of $1.9 billion also topped the consensus mark of $1.89 billion and increased 12.2% on a year-over-year basis. At the end of the quarter, unearned revenues were $5.5 billion.

The strong top-line growth can be attributed to robust performance ofits product offerings like NSX, AirWatch, vSphere, and vSAN. During the quarter, VMware unveiled major updates across its VMware vRealize Cloud Management Platform.

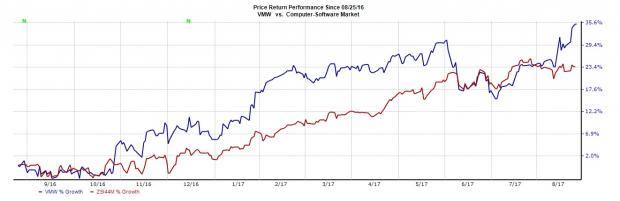

Shares were slightly down in after-market trading. We note that VMware has returned 35.3% in the past one year, much better than the industry’s gain of 23.5%.

We believe that expanding product portfolio, partnerships with the likes of Intel (NASDAQ:INTC) , Samsung (KS:005930), Fujitsu, Pivotal, Alphabet (NASDAQ:GOOGL) , and Microsoft (NASDAQ:MSFT) along with continuing enterprise deal wins, will help the stock maintain its momentum in the rest of fiscal 2018.

Hybrid Cloud & SaaS, NSX, vSAN Bookings Shine

Services revenues (61.5% of total revenue) increased 11.3% to $1.17 billion, driven by 10.9% and 14.2% growth in Software Maintenance and Professional Services revenues, respectively.

License revenues increased 13.7% year over year to $732 million. NSX licensed bookings grew over 40% on a year-over-year basis driven by strong demand for micro segmentation security solution. NSX was included in all the top 10 deals made in the quarter. The company signed its biggest Telco deal with Vodafone (LON:VOD) in the second quarter.

vSAN licensed bookings surged more than 150%, with customer count reaching 10000. Further, EUC license bookings were up over 20% on the back of healthy growth in both mobile and desktop businesses.

Region wise, U.S. revenues (50.7% of total revenue) increased 10.7%, while International (49.3%) grew 13.9% from the year-ago quarter.

VMware’s hybrid cloud and SaaS offerings now represent more than 9% of revenues. The increase was driven by continued strong adoption of vCloud Air Network, which surged over 30% on a year-over-year basis.

Cloud management bookings were up in double digits. Cloud management licensed bookings were up in the mid single digits on a year-over-year basis.

Operating margin expanded 76 basis points (bps) to 30.8% in the reported quarter.

Aggressive Share Repurchase to Support BottomLine

VMware announced a new $1 billion share buyback program which expires in August 2018. VMware currently has $900 million remaining under its $1.2 billion repurchase authorization, which extends through the end of fiscal 2018. Additionally, the company has agreed to repurchase $300 million of stock in the quarter from Dell Technologies.

Guidance

In third-quarter fiscal 2018, revenues are expected to be in the range of $1.930–$1.980 billion (midpoint of $1.955 billion). License revenues are expected to be within the $755–$785 million range (midpoint of $770 million).

Non-GAAP operating margin is anticipated to be 33.4%. Non-GAAP earnings are expected to be in the range of $1.25–$1.28 per share (midpoint $1.265).

The Zacks Consensus Estimate is currently pegged at $1.27 on revenues of $1.94 billion.

For fiscal 2018, revenues are expected to be $7.830 billion, up from $7.610 billion projected earlier. License revenues are expected to be $3.075 billion, up from $2.975 billion guided earlier.

Non-GAAP operating margin is expected to be 32.7%, better than the prior guidance of 32.5%. Non-GAAP earnings are expected to be $5.06 per share, up from the previous guidance of $4.91.

The Zacks Consensus Estimate is currently pegged at $4.96 on revenues of $7.73 billion.

Capital expenditure is expected to be $260 million. Operating cash flow and free cash flow for the fiscal are expected to be $3 billion (up from $2.70 billion) and $2.74 billion (up from $2.44 billion), respectively.

Currently, VMware carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Vmware, Inc. (VMW): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research