That didn’t take long!

Just seven days ago, I laid out specific trading instructions to profit from an inevitable uptick in volatility in October.

Remember, it had nothing to do with the ongoing squabble in Washington, D.C. Instead, it was based solely on the historical tendency for October to be an abnormally volatile month.

History certainly didn’t mislead us.

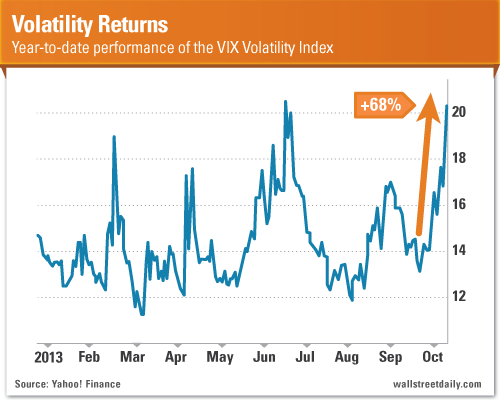

Since October 1, the VIX Volatility Index (^VIX) spiked almost 25% to hit its highest level this year.

For those of you who followed my original recommendation, you should be sitting on profits north of 103%. Not too shabby for a seven-day holding period.

For those of you who didn’t follow my suggestion, however – thanks for having zero faith in me!

The good news for the doubters? It’s not too late to profit.

Here’s what everyone needs to know.

Thank You, Washington!

First off, although the trade wasn’t based on government shenanigans, we have to thank the politicians for helping our trade work out much faster than anticipated.

The ongoing stalemate over the government shutdown and debt ceiling proved too troublesome for the markets. After hanging tough for seven days, stocks caved and volatility surged.

The VIX jumped more than four full points in no time – from 16.6 to 20.76.

Of course, the November $15 calls I recommended on the iPath S&P 500 VIX Short Term Futures ETN (VXX) rallied even more. Much more.

The call options went from trading for $1.48 on October 3 to $3 as of this writing. As I mentioned above, that’s a 103% move.

Keep in mind, the historical average level for the VIX in October is about 23. We’re still below that level, which means there’s more upside left in our trade.

I’m not the only one who thinks so, either.

Two Out of Two Experts Agree

On Tuesday, Mohamed El-Erian, Chief Executive Officer and Co-Chief Investment Officer at PIMCO, told Bloomberg TV that even as the probability of a U.S. debt default is “very, very small,” volatility in the market is bound to increase in the coming days.

Meanwhile, the number crunchers over at Bespoke Investment Group noted that a short-term spike in the VIX has been a common occurrence this year. Moves from trough to peak of 50% (or more) have happened five times already.

More importantly, though, is the fact that the latest spike from the trough on September 20 isn’t the biggest this year. For that to be true, the VIX needs to rally to 23.49.

That number should sound eerily familiar. It’s right in line with the long-term average level for the VIX in October. So a record run is certainly not out of the question. Therefore, it’s not too late to profit from the situation.

What’s an investor to do, then?

Well, if I’ve learned anything during my tenure on Wall Street, it’s this: Pigs get fat and hogs get slaughtered. Or, more simply, don’t be overly greedy.

For those of you who already doubled your money on the trade, sell half of your position and let the rest ride for even bigger profits. They’re coming.

I’ve also learned that if you don’t act on a trade, it’s impossible to profit. There are no paper traders sitting atop the Forbes 400 list. Just saying.

That means for those of you who didn’t enter this trade yet, there’s no time like the present. If this month pans out to be an average October, volatility-wise (which I expect), the VIX needs to rally higher from here.

And as policymakers will undoubtedly do something to undermine the market yet again (maybe even tomorrow), it’s even more likely that the VIX will continue its upward trajectory.

Rest assured, I’ll continue to keep you updated on this trade, including when to exit it for good. However, this venue isn’t the best way to do so.

There’s too much of a time delay between me writing up an alert and then having it edited and sent out to you via email.

Instead, I plan to provide updates via Twitter. That means you need to follow me, which you can do by simply clicking on the button below.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

VIX Volatility Index: What Everyone Needs To Know Now

Published 10/10/2013, 06:28 AM

Updated 05/14/2017, 06:45 AM

VIX Volatility Index: What Everyone Needs To Know Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.