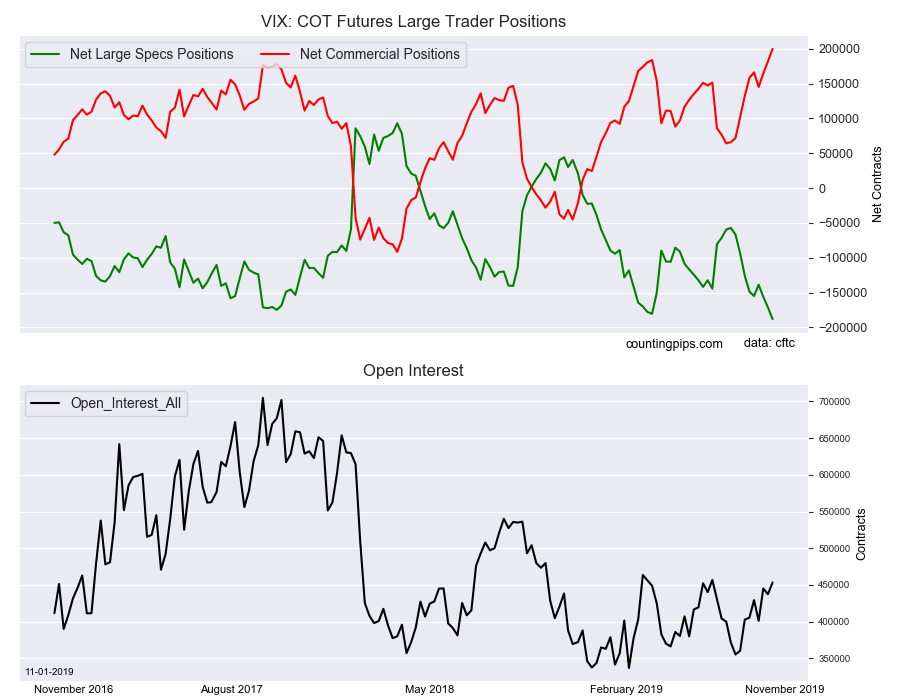

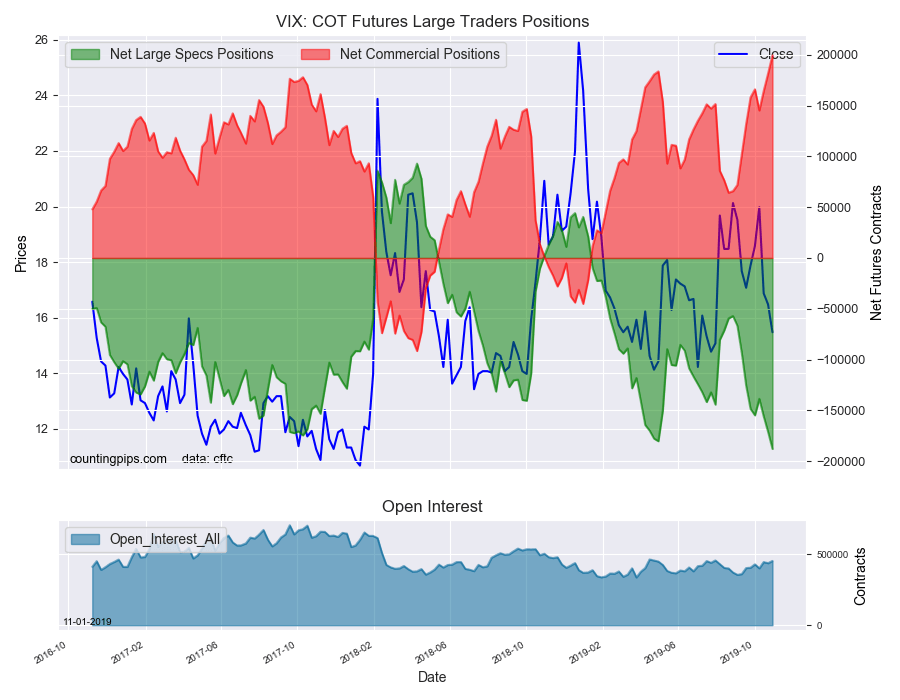

VIX Non-Commercial Speculator Positions:

Large volatility speculators sharply raised their bearish net positions in the VIX futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -187,948 contracts in the data reported through Tuesday October 29th. This was a weekly change of -16,712 net contracts from the previous week which had a total of -171,236 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -4,495 contracts (to a weekly total of 80,843 contracts) while the gross bearish position (shorts) saw a gain of 12,217 contracts for the week (to a total of 268,791 contracts).

VIX speculators continued to raise their bearish positions for the ninth consecutive week and have now added a total of -130,795 contracts to their bearish position over that nine-week period. This brings the current bearish standing to a total of -187,948 contracts which surpasses the previous record high bearish level of -180,359 that was reached on April 30th.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 199,743 contracts on the week. This was a weekly advance of 18,082 contracts from the total net of 181,661 contracts reported the previous week.

This week’s total also marks a record high position for the commercials but on the bullish side of the ledger. The previous record high was +183,724 contracts on April 30th.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $15.47 which was a decrease of $-1.00 from the previous close of $16.47, according to unofficial market data.