VIX Non-Commercial Speculator Positions:

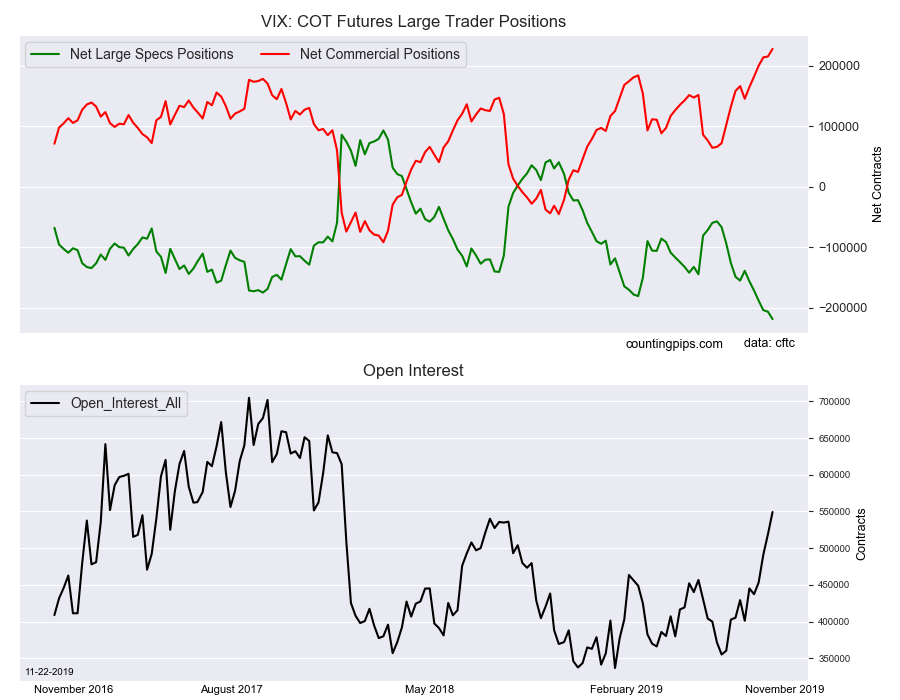

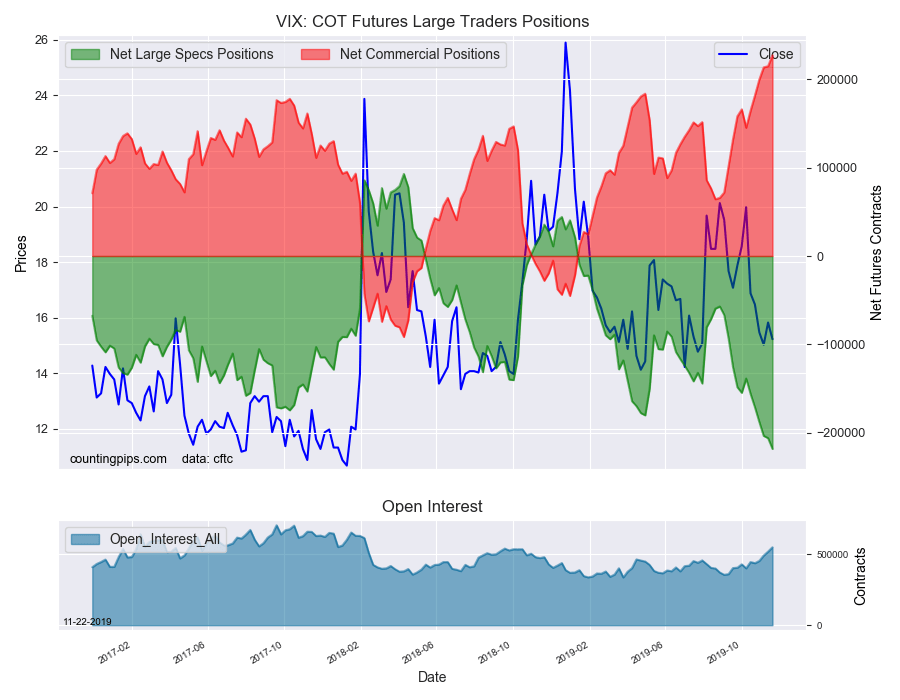

Large volatility speculators continued to push their bearish net positions higher in the VIX futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -218,362 contracts in the data reported through Tuesday, November 19th. This was a weekly change of -12,205 net contracts from the previous week which had a total of -206,157 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by 2,526 contracts (to a weekly total of 94,359 contracts) while the gross bearish position (shorts) increased by a greater amount of 14,731 contracts for the week (to a total of 312,721 contracts).

VIX speculators raised their bearish bets for a sixth consecutive week and for the eleventh time out of the past twelve weeks. This pushes the current VIX bearish position to another all-time record high at -218,362 contracts and marks the fourth straight week of new record highs.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 227,456 contracts on the week. This was a weekly uptick of 12,569 contracts from the total net of 214,887 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $15.22 which was a decrease of $-0.60 from the previous close of $15.82, according to unofficial market data.