VIX Non-Commercial Speculator Positions:

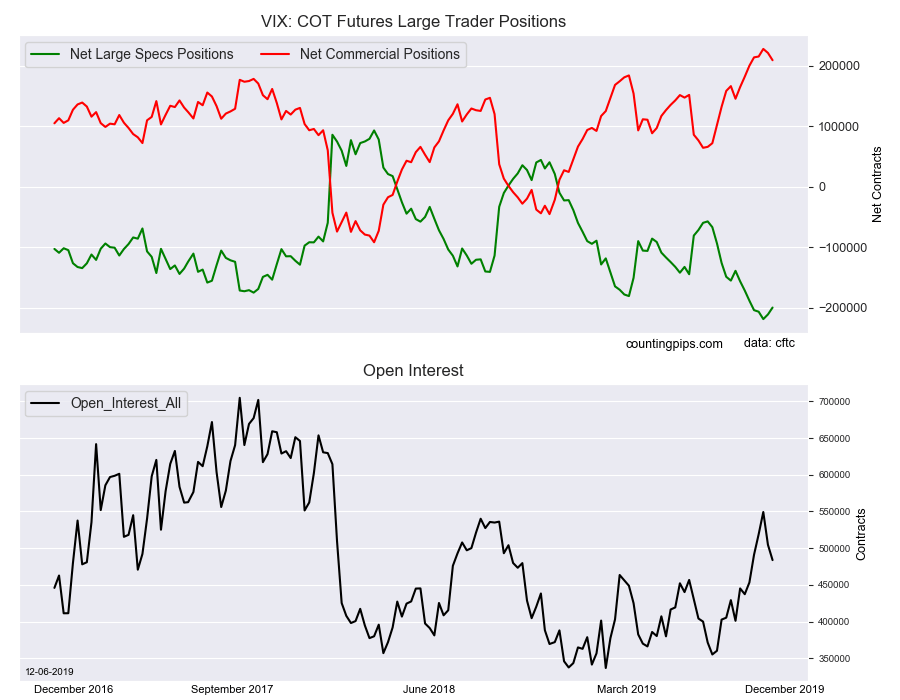

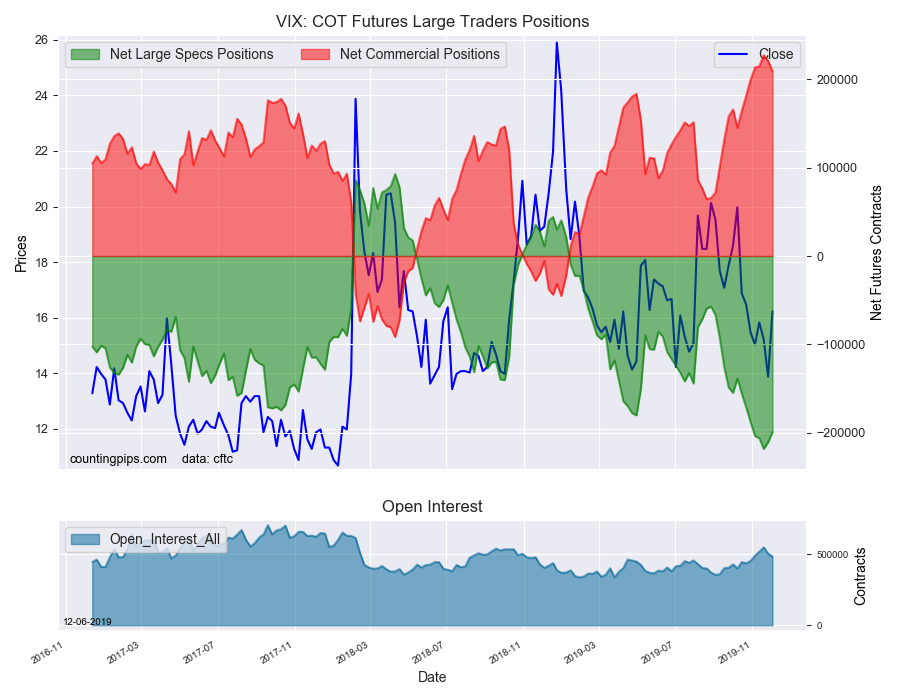

Large volatility speculators dropped their bearish net positions in the VIX futures markets for a second straight week this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -199,312 contracts in the data reported through Tuesday December 3rd. This was a weekly change of 11,387 net contracts from the previous week which had a total of -210,699 net contracts.

The week’s net position was the result of the gross bullish position (longs) sliding by -4,902 contracts (to a weekly total of 75,209 contracts) while the gross bearish position (shorts) fell by a larger amount of -16,289 contracts for the week (to a total of 274,521 contracts).

VIX speculators decreased their bearish positions for two straight weeks and by a total of 19,050 contracts over that period. Previously, speculative positions had risen to an all-time record high bearish level for four consecutive weeks with the latest bearish top coming in at a total of -218,362 contracts on November 19th. This week’s total standing of -199,312 contracts marks the first time contracts have been under -200,000 since late October.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 208,807 contracts on the week. This was a weekly shortfall of -12,052 contracts from the total net of 220,859 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $16.22 which was a rise of $2.35 from the previous close of $13.87, according to unofficial market data.