VIX Non-Commercial Speculator Positions:

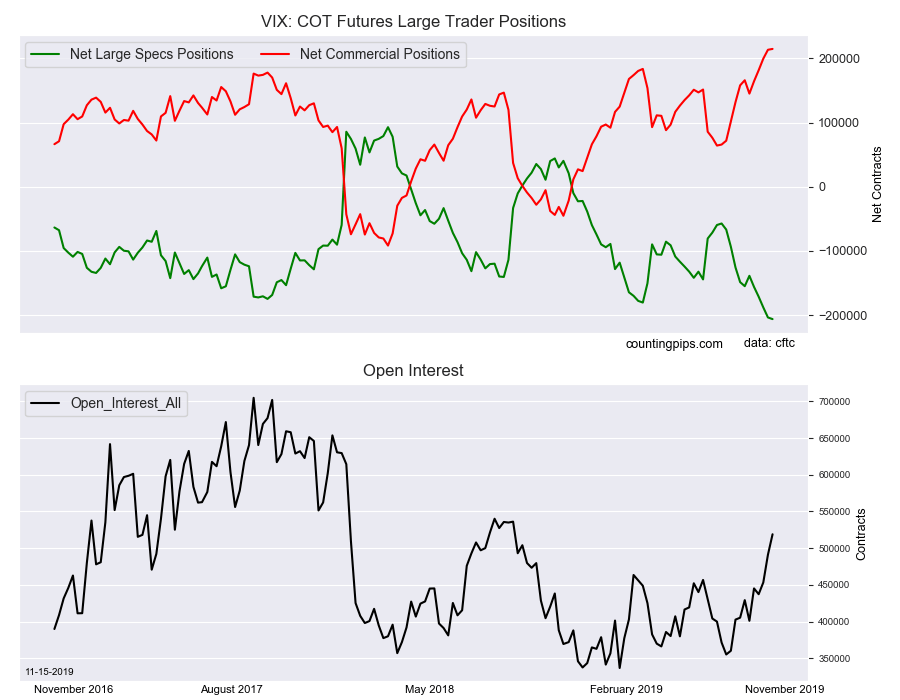

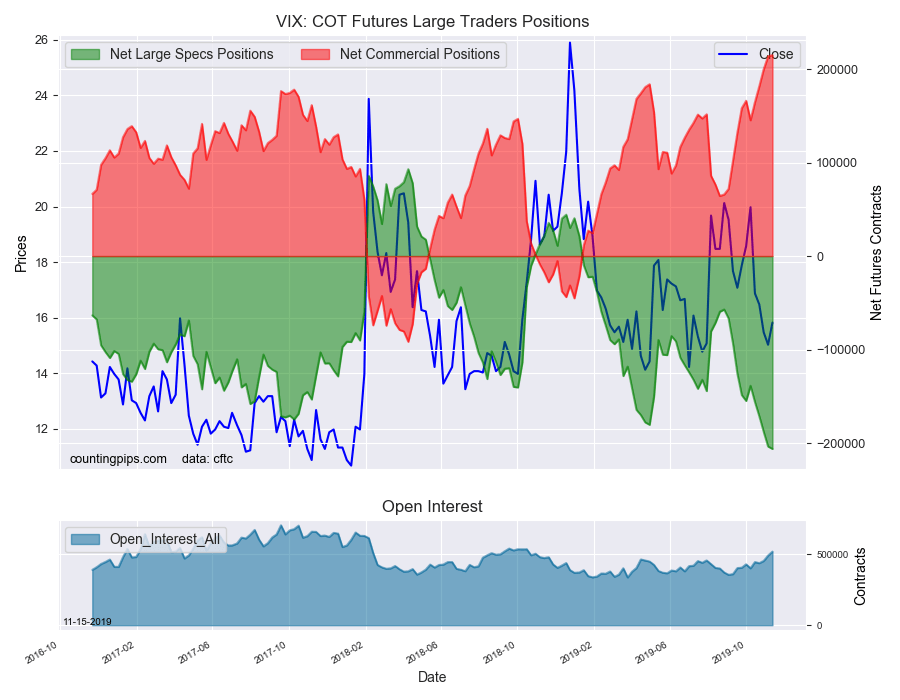

Large volatility speculators once again raised their bearish net positions in the VIX Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -206,157 contracts in the data reported through Tuesday November 12th. This was a weekly change of -2,559 net contracts from the previous week which had a total of -203,598 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 7,058 contracts (to a weekly total of 91,833 contracts) while the gross bearish position (shorts) gained by a larger amount of 9,617 contracts for the week (to a total of 297,990 contracts).

VIX speculators continued to add to their bearish bets for a fifth straight week and for tenth time out of the past eleven weeks. This week’s total (-206,157 contracts) marks a new record bearish position which is the third consecutive week that specs have recorded a new all-time high. Speculators have now been bearish on the VIX for forty-four straight weeks with the last overall bullish position (+21,062 contracts) coming on January 8th of this year.

VIX Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 214,887 contracts on the week. This was a weekly advance of 1,348 contracts from the total net of 213,539 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $15.82 which was a gain of $0.80 from the previous close of $15.02, according to unofficial market data.