VIX Non-Commercial Speculator Positions:

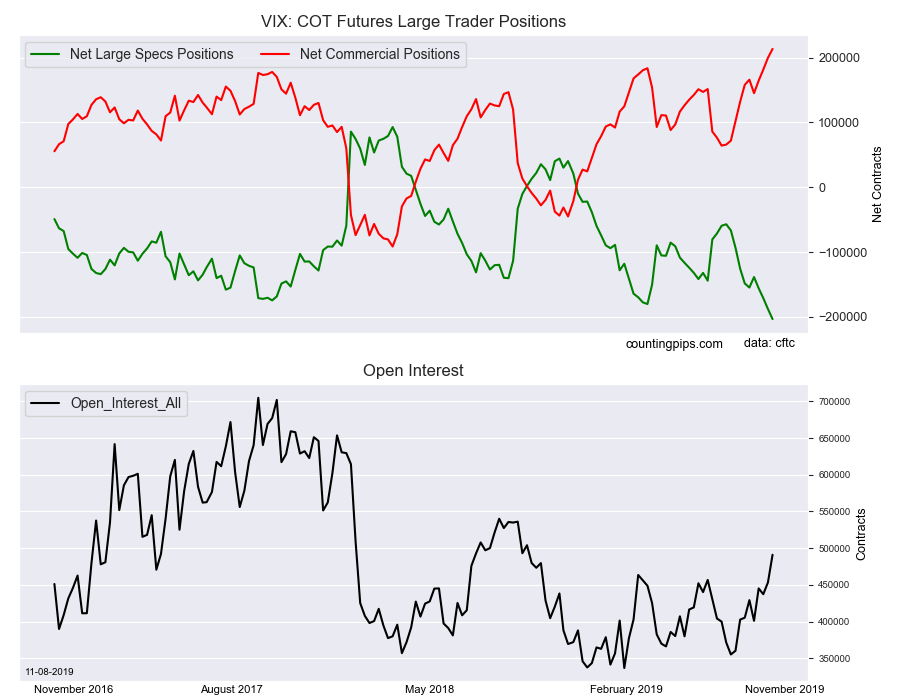

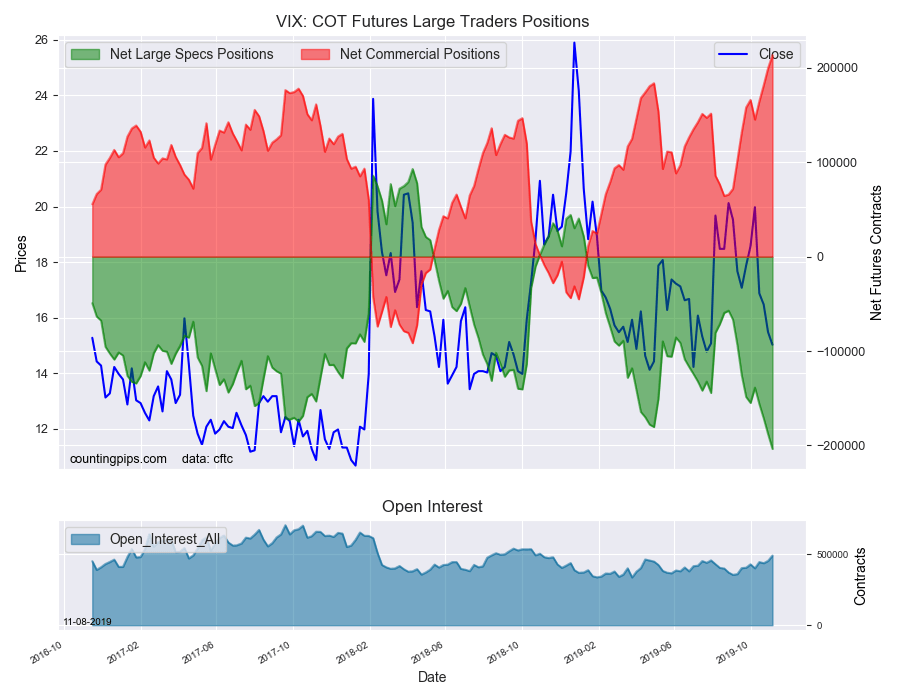

Large volatility speculators sharply raised their bearish net positions higher in the VIX Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of VIX futures, traded by large speculators and hedge funds, totaled a net position of -203,598 contracts in the data reported through Tuesday, November 5th. This was a weekly change of -15,650 net contracts from the previous week which had a total of -187,948 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 3,932 contracts (to a weekly total of 84,775 contracts) while the gross bearish position (shorts) jumped by 19,582 contracts for the week (to a total of 288,373 contracts).

VIX speculators boosted their bearish bets for a fourth consecutive week and for the ninth time in the past ten weeks. Speculators have added a total of -64,918 contracts to the net position in just the past four weeks and by a total of -146,445 contracts in the past ten weeks. This continued bearishness has pushed bearish bets to a new record high level for a second straight week and it is the first time in history that bearish positions have been above the -200,000 net contract level.

VIX Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 213,539 contracts on the week. This was a weekly advance of 13,796 contracts from the total net of 199,743 contracts reported the previous week.

VIX Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the VIX Futures (Front Month) closed at approximately $15.02 which was a drop of $-0.45 from the previous close of $15.47, according to unofficial market data.