VIX challenged its weekly mid-Cycle resistance at 18.86, after rising above its Model supports. Despite the efforts to slam it down all day, it closed positive for the week. A breakout above the Ending Diagonal at 18.90 gives the VIX a much higher target than the Head & Shoulders pattern.

SPX consolidates.

SPX marked 9 down days of 12since September 19.It closed above Short-term support are at 1680.00 after challenging the lower trendline of its Broadening Wedge formation at 1665.00. Once beneath them, the SPX is capable of accelerating its decline.This marks the first week of the government partial shutdown with no resolution in sight.

(ZeroHedge) The dump into last night's close marked the lows of the last 24 hours as US equities decided that worrying about government shutdowns, near-record negative earnings pre-announcements, disappointing job growth, debt-ceiling dynamics that are increasingly feared in money markets, and a reversal in the key "soft" survey data was not enough to stop them BTFATH (thanks to confused banter from several Fed heads).

NDX continues its throw-over.

NDX continues in a throw-over of its Ending Diagonal formation, making a new high on Wednesday. It also sports a Broadening Wedge formation with the same lower trendline as the Ending Diagonal, suggesting an average decline to 2344.00 once it declines beneath 3000.00. A decline beneath the Diagonal formation may quickly lead to a break of the formation as well, triggering a multiple bearish formation.

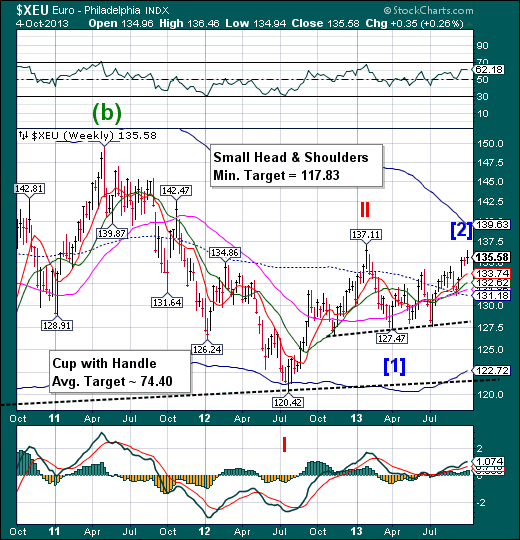

Merkel won. Is that good for the Euro?

TheEurosurged into Thursday to complete its upside pattern and reversed on Friday.Many traders are selling the dollar and buying the Euro, but it may not be able to maintain its uptrend. Beneath those supports are a small Head & Shoulders formation and Cup with Handle pattern that suggests the ensuing decline may be swift and deep.

(BBCNews) Nobody in Germany has a scintilla of doubt that this is a stunning victory for Angela Merkel.

Her nickname "Mutti" was on the CDU's own banners - "Mummy".One German pundit explained that: "Your mummy is always there for you. She doesn't care what she looks like but you can rely on her. Sometimes she might tell you to clean up your room but she's always there for you."

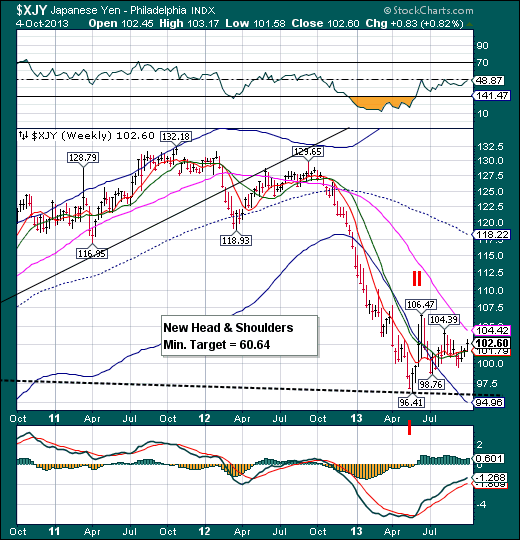

The Yen retraces toward Long-term resistance.

The Yen retraced nearly 75% of its decline from 104.39, but could not reach Long-term resistance at 104.42.The Cycles Model suggests an imminent sharp decline that may challenge the Head & Shoulders neckline at 96.00.As the Yen loses its supports, the decline may shortly resume beneath the neckline in a Cycle Wave III, the strongest decline yet.

(BBCNews) Japan's Prime Minister Shinzo Abe said his government will raise the rate of sales tax to 8% from 1 April next year, from the current 5%.

Policymakers have argued that the hike is key to reducing Japan's public debt - which now stands as around 230% of its gross domestic product (GDP).There have been concerns that such a move may hurt domestic demand.

However, analysts said recent data showing signs of a recovery in the economy had helped allay those fears.

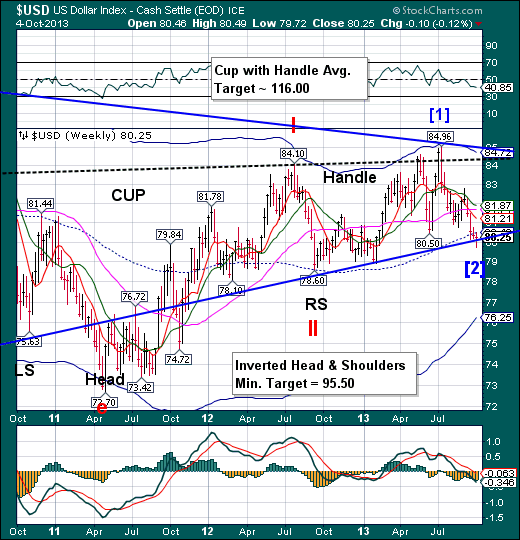

The US Dollar challenged its long-term trendline.

USD challenged its long-term trendline at 80.00 this week, but closed marginally above it.The trading community, which has been overwhelmingly bearish on the dollar, got their wish. It’s now time to change horses, since the trend is about to turn.

(VoiceOfAmerica) The dollar rose against a basket of major currencies on Friday after five straight sessions of losses but remained within striking distance of an eight-month low hit the previous day, as the U.S. government closure continued.

October 17 is the date Congress must raise the nation's borrowing authority or risk default, and members of Congress now expect it to be the flashpoint for a larger clash over the U.S. budget as well as President Barack Obama's healthcare law.

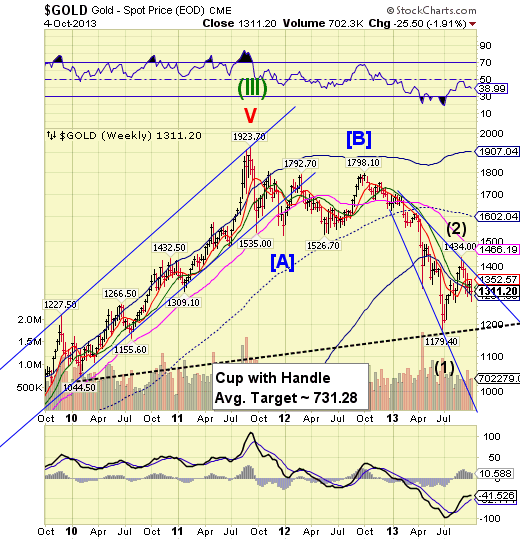

Gold temporarily supported at its Cycle Bottom.

Gold dropped below its weekly Cycle Bottom support at 1297.05 this week, but managed to climb back above it, closing below the support/resistance cluster, but above the important Cycle Bottom.If broken again, it may allow gold to free-fall over the next several weeks. The Cup with Handle formation offers a possible target for the decline.

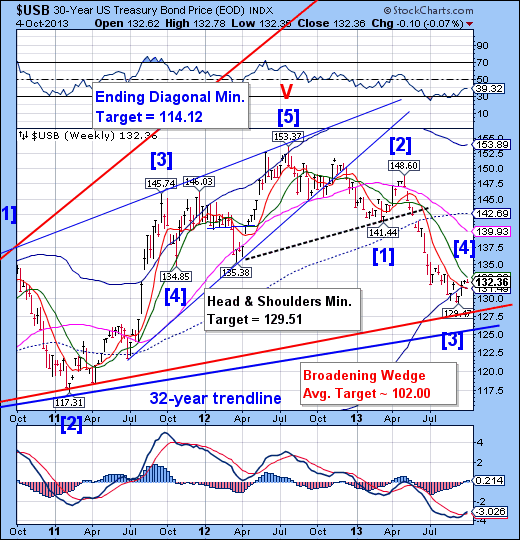

Treasuries may challenge Intermediate-term resistance.

USBhoveredin place for a third week and may challenge Intermediate-term resistance at 133.06.Theunfilled gap remains beneath itat 127.04, which may also initiate a new downside target with the violation of the Broadening Wedge trendline at 127.60.

(ZeroHedge)What if the Treasury were to go over the X date (date beyond which the Treasury cannot honor all its payments) without the debt ceiling being raised? As BofAML notes, the Treasury estimates the X date to be October 17, though they believe that the Treasury may have enough cash and incoming tax receipts to last a few more days. In either case, the date is not too far out. Market concerns over possible postponed payment have been rising as indicated by the performance of October and November bills.What are the options of for the Treasury?

Crude bounces again from the neckline.

Crudemay have used the Head & Shoulders neckline again as a support for its next bounce higher. There is no assurance that a new high may be made.The Cycles Model suggests an important high may be coming around the second week of October.

(OilPrice) Saudi Arabia, along with OPEC neighbors Kuwait and the United Arab Emirates, exported a record high of crude oil this August. Despite pumping out 10.2 million barrels per day, the fastest rate in 32 years, Saudi Arabia was unable to offset OPEC’s 0.8 percent decrease in oil production, attributed largely to instability in Libya and tough sanctions on Iran. As a number of OPEC countries face stagnant or falling production and oil prices creep steadily upwards, the question of whether Saudi Arabia can offset further shortages is more pressing than ever.

China consolidates beneath Long-term support/resistance

The Shanghai Index appears to be consolidating beneath Long-term support at 2192.50.Thismay prove to be a double whammy to the recent uptrend in the Chinese stock market. The Cycles Model suggests thedecline may continue through the end of October.

(WSJ) A new set of guidelines by China National Tourism Administration, issued late last month ahead of the key Golden Week vacation period that kicked off on Oct. 1 National Day, aims to set such tourists right.

Among the admonitions contained in the 64-page illustrated handbook: Don’t sneeze in front of others.Ditto for picking noses and teeth.

As China completes day three of its Golden Week holiday period, images of Chinese tourists behaving badly are already doing the rounds online. China Central Television piled on with Thursday night’s national news broadcast, showing shots of tourist graffiti on bamboo trees and the walls of a temple.

The India Nifty bounces back above supports.

India Niftydropped down to Short-term support at 5700.07and bounced strongly back above the longer-termCycle supports.The trigger to activate the formation lies at the bottom trendline at 5400.00The probable target for Intermediate Wave (C) appears to be the Lip of the Cup with Handle near 4550.00.The decline from this top may be faster than the rally.

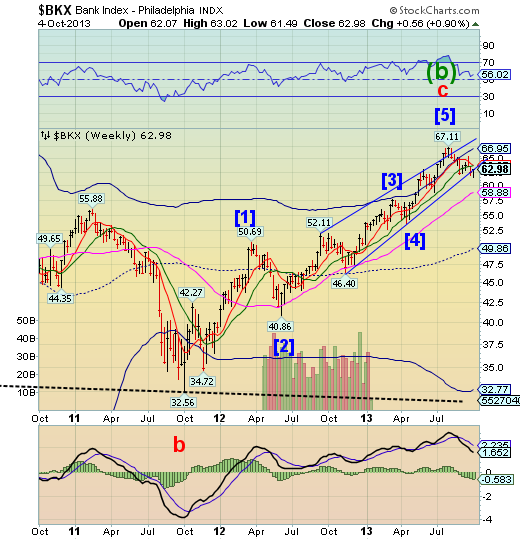

The Bank Index retests its broken trendline.

BKXclosed last week just beneath its Ending Diagonal trenline. This week confirmed the break with a retest of the trendline. This is known as the “kiss of death” and signals a swift retracement to the weekly Cycle Bottom support at 32.77,near the October 2011 low.

(ZeroHedge) Even as the fearmongering over the debt ceiling hits proportions not seen since 2011 (when it was the precipitous drop in the market that catalyzed a resolution in the final minutes, and when four consecutive 400 point up and down DJIA days cemented the deal - a scenario that may be repeated again), some banks are taking things more seriously, and being well-aware that when it comes to banks, any initial panic merely perpetuates more panic, have taken some radical steps. The FT reports that "two of the country’s 10 biggest banks said they were putting into place a “playbook” used in August 2011 when the government last came close to breaching the debt ceiling. One senior executive said his bank was delivering 20-30 per cent more cash than usual in case panicked customers tried to withdraw funds en masse.

(ZeroHedge) Hidden deep in the pages of JPMorgan's Living Will report just realesed by the FDIC, the WSJ has found that CEO Jamie Dimon (still Chairman of the overall JPM entity) has relinquished his position as Chairman of the banking conglomerate's major deposit-taking subsidiary. While the bank claims this is "solely to create a more uniform structure among our subsidiary boards," one can't help but feel this is driven by unrelenting pressure from the administration (and its regulators) as the deposit-taking subsidiary had its confidential management rating downgraded from a 2 to a 3 on a scale of 5, a rare score for such a large institution; and faces public enforcement actions demanding changes to alleged risk-management, anti-money-laundering and debt-collection weaknesses.

(ZeroHedge) Say what you will about the quality of financial earnings in 2013 (and we have said quite a bit, making it very clear over the past three quarters that a substantial portion of financial "earnings" has been accounting gimmickry such as loan-loss reserve releases and other "one-time" addbacks which mysteriously end up becoming quite recurring), but one thing that is indisputable is that of the nearly $52 in non-GAAP, adjusted S&P500 EPS so far in 2013, over 20% is attributable to financials.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

VIX Positive, SPX Consolidates, NDX Hits New Highs

Published 10/07/2013, 01:39 AM

VIX Positive, SPX Consolidates, NDX Hits New Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.