After spiking above 50 back in February -- its highest mark since August 2015 -- the Cboe Volatility Index (VIX) has retreated back to the 13 mark, below its average daily reading of 13.58 over the past year. Options traders have responded to this apparent lack of fear in the stock market with complacency.

Following yesterday's expiration of July-dated VIX options, VIX call open interest clocks in at 3.98 million -- a new 52-week low. Likewise, the 1.28 million options in put open interest on the volatility index also arrive at the bottom of their 12-month range.

Nevertheless, the bulk of those who have targeted VIX options appear to be bracing for (or hedging against) a short-term volatility spike. The August 30, 20, and 28 calls make up the top three open interest positions, where more than 534,000 contracts collectively reside, and data from the Chicago Board Options Exchange (CBOE) confirms mostly buy-to-open activity.

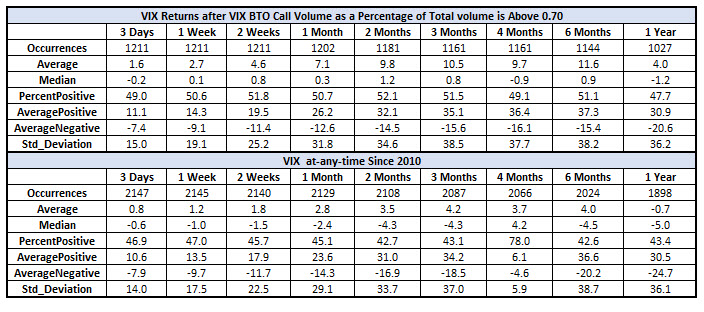

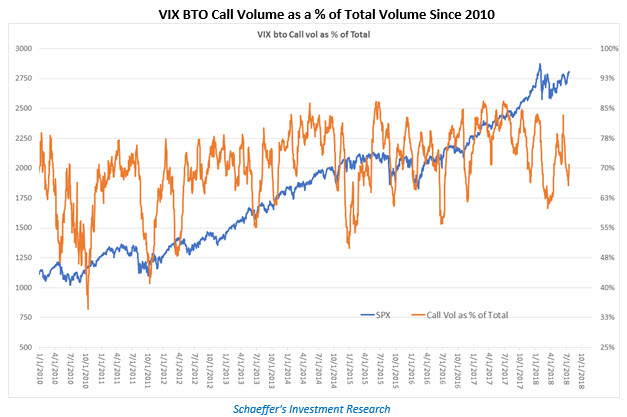

This particular attention to calls could signal outsized upside for the market's "fear gauge" in the near term, according to data from Schaeffer's Quantitative Analyst Chris Prybal. Since 2010, VIX call volume has accounted for 70% of options volume on the index, over an average 20-day period. There have been 1,200 instances in the past eight years where 20-day VIX buy-to-open call volume has exceeded 70% of total volume, like it does now -- which we'll call a "signal."

Following these previous call-skew signals, VIX returns exceeded the comparable at-any-time returns across all time frames going out one year. The most outsized gains come at the two- and six-month marks, where the post-signal returns nearly tripled the anytime returns.

And while a recent stock market study done by Schaeffer's Senior Quantitative Analyst Rocky White found that the index could be headed toward a new low by month's end, this would just echo a VIX seasonal trend. In fact, as Schaeffer's Senior V.P. of Research Todd Salamone noted in an article around this time last year, the volatility index has historically hit year-to-date lows in July, before bursting higher into August through October.