Weekly CFTC Net Speculator VIX Report

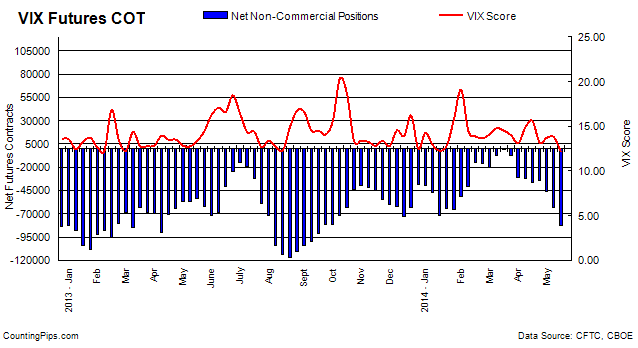

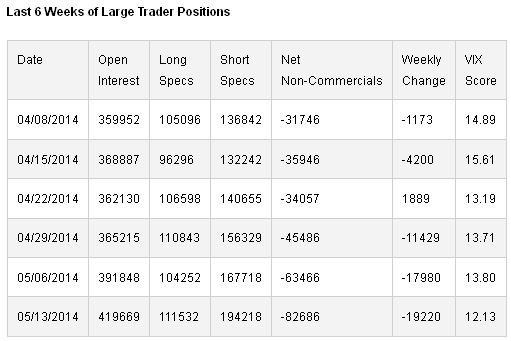

VIX Futures Contracts: Large traders and speculators added to their overall bearish bets in the VIX market last week for a third straight week and to the highest level since September, according to the latest data from the Commodity Futures Trading Commission (CFTC) released on Friday.

The VIX non-commercial futures contracts, comprising of large speculator and hedge fund positions, totaled a net bearish position of -82,686 contracts in the data reported for May 13th. This was a change of -19,220 contracts from the previous week’s total of -63,466 net contracts that was registered on May 6th.

The third straight weekly increase in bearish positions brings overall net contracts to the highest bearish level since September 17th 2013 when net positions stood at a level of -91,017 contracts.

Meanwhile, the VIX index over the same reporting time-frame last week edged lower from a 13.80 reading on Tuesday May 6th to a 12.13 reading on Tuesday May 13th, according to the Chicago Board Options Exchange (CBOE) Volatility Index.

Commitment of Traders (COT) Report: The weekly Commitment of Traders Report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and non-reportable traders (usually small traders/speculators).