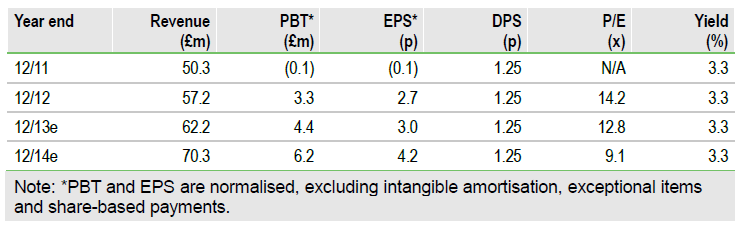

The interim results demonstrate the effectiveness of management’s long-term strategy, which is delivering profitable growth from expansion in the Surveillance segment, penetration in geographies such as the Middle East, and the introduction of new multi-mode broadcast products. We adjust our estimates to reflect the recent acquisition of Amplifier Technology, which extends the group’s presence in the defence and surveillance sectors, and now see fair value at 52p, rather than 41p previously.

Improvement in order book underpins H113

Order intake during the period was up 32% year-on-year, underpinning a substantial quarter-on-quarter rise in revenues during Q2, which resulted in H113 revenues growing by 2% year-on-year to £28.0m. A 1.2pp improvement in gross margin and tight control of costs delivered a 48% jump in adjusted pre-tax profit to £2.2m. The balance sheet remained strong, with £7.2m net cash (£0.9m lower than December 2012) at the period end. The H113 results highlight the increasing importance of the Surveillance segment (16% H113 revenues) and activities outside the traditional core markets such as the Middle East. Management reiterated its target of annualised revenues of £80m generating £8m adjusted EBIT by FY14, with the balance of £10m revenues and £1.8m profit being realised from further acquisitions.

Progress toward strategic targets

The acquisition of Amplifier Technology for £2m cash (plus a contingent £2m) is part of management’s strategy to extend the product offer for the Security division and to build scale. Our model assumes the transaction will be earnings neutral in FY13 and contributes an additional £1.1m pre-tax profit in FY14. In addition, Vislink has announced a strategic partnership with C-COM Satellite Systems, which is expected to help Vislink extend its presence in regions such as Russia and in industry verticals such as oil and gas, mining and disaster recovery. The group continues to introduce new products that complement its core broadcast offer such as the NewStream multi-mode mobile broadcast transmission system.

Valuation: Discount to peers and NAV

Vislink shares continue to trade at a discount to its peers in the broadcast and satellite communications sector. If we apply the average prospective sample P/E multiple (16.6x) to EPS adjusted for a full year’s contribution from Amplifier Technology, with a 15% discount for a smaller market cap company, we see fair value at 52p.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Vislink: Profitable Growth From Expansion

Published 08/29/2013, 06:07 AM

Updated 07/09/2023, 06:31 AM

Vislink: Profitable Growth From Expansion

Fourth consecutive profitable half year

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.