The global payments industry continues to undergo a dynamic change. Technology and innovation is shifting consumer habits and driving growth opportunities in ecommerce, mobile payments, block chain technology and digital currencies.

Industry insiders expect demand for debit and credit cards and online payments to continue to surge in the years ahead, as the style of payments shift from cash and checks to plastic and electronic mode. An improving jobs market and low unemployment have set a positive trend in consumer spending by increasing the number or average purchase amount of transactions involving payment cards and devices. These shifts in macroeconomic factors bode well for the industry’s growth.

Despite the increased adoption of digital payments, cash continues to be in the mainstream and still make up for nearly 85% of global transaction. This proves that the industry still remains underpenetrated and provides ample scope for long-term growth.

Stocks Under Consideration

The two leading companies in this thriving industry are MasterCard Inc. (NYSE:MA) and Visa Inc. (NYSE:V) .

MasterCard is one of the world's largest payment solutions companies, processing transactions from more than 210 countries and territories and in more than 150 currencies. It commands a well-established brand name and extensive merchant-acceptance network.

Visa on the other hand operates the world's largest retail electronic payments network, with more than 2.3 billion Visa-branded credit and debit cards in circulation globally. Both stocks have a Zacks Rank #3 (Hold).

It will be interesting to note which stock is better positioned in terms of fundamentals.

Some better-ranked players in the same space are Total System Services Inc. (NYSE:TSS) and Vantiv, Inc. (NYSE:V) . Each of these stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1Rank stocks here.

Price Performance

Both MasterCard and Visa have surged 29.6% and 33.4%, respectively, year to date, significantly outpacing the industry’’s growth of 24.31%. Here, Visa remains an outperformer.

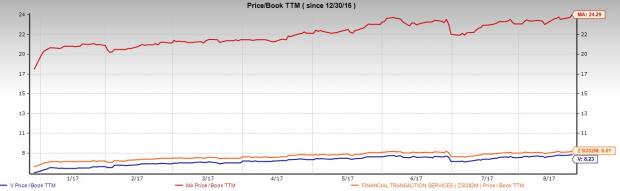

Valuation

Compared with the industry’s trailing 12-month P/B ratio of 8.5, Visa is underpriced with a reading of 8.2. Meanwhile, MasterCard seems too expensive with a trailing 12-month P/B ratio of 24.3. On this basis too, Visa seems worth buying.

Dividend Yield

MasterCard has a current dividend yield of 0.7% and a five-year growth rate of 66.2%, while Visa has a dividend yield of 0.6% and a five-year growth rate of 30.1%.

Though both stocks have a dividend yield that is below the industry’s average of 0.9%, they are good at increasing their dividend. Comparatively, MasterCard has an edge over Visa here.

Earnings Surprise History

Considering a more comprehensive earnings history, both Visa and MasterCard have delivered earnings surprises over each of the prior four quarters. While MasterCard has an average earnings surprise of 6.2%, Visa stands out with an average earnings surprise of 8.4%.

Earnings Estimate Revisions and Growth Projections

MasterCard has seen the Zacks Consensus Estimate for 2017 and 2018 earnings being revised upward by 1.9% and 1.4%, respectively, over the last 60 days.

On the other hand, the same for Visa has moved upward for 2017 and 2018 by 1.8% and 1.3%, respectively, over the same time frame.

The Zacks Consensus Estimate for MasterCard’s earnings per share is $4.37 and $5.06 for 2017 and 2018, respectively, reflecting year-over-year growth of 16% and 15.8%.

The Zacks Consensus Estimate for Visa’s earnings per share is $3.42 and $3.98 for 2017 and 2018, respectively, reflecting year-over-year growth of 20.3% and 16.4%.

Return on Equity (ROE)

The ROE ratio reflects a company’s profitability. MasterCard’s return on equity of 74.9% has significantly outpaced the industry average of 34.5%. However, Visa’s return on equity of 31% underperformed the industry. This reflects MasterCard’s tactical efficiency in using shareholders’ funds.

Conclusion

Our comparative analysis shows that Visa is poised better than MasterCard when considering valuation, price performance, earnings surprise history, earnings estimate revisions and growth projections. MasterCard wins on return on equity and dividend yield.

The winner here would have to be Visa, which has better growth figures compared to MasterCard.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Total System Services, Inc. (TSS): Free Stock Analysis Report

Vantiv, Inc. (VNTV): Free Stock Analysis Report

Original post