Visa Inc. (NYSE:V) is scheduled to report third-quarter fiscal 2017 results on Jul 20, after market close.

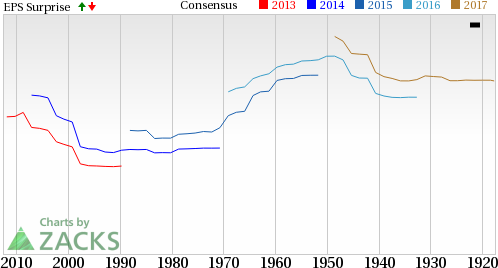

Last quarter, Visa surpassed the Zacks Consensus Estimate by 8.86%.

Let’s see how things are shaping up for this announcement.

Q3 Flashback

We expect fiscal third-quarter earnings to gain traction from the company’s digital initiatives. Visa Checkout, a digital payment platform, is sustaining tremendous growth, reaching more than 20 million enrolled accounts. Its other digital initiatives Visa Direct and mVisa are continuing to expand globally.

The company will likely report an increase in U.S. payments’ volumes driven by the gain of USAA and Costco (NASDAQ:COST) clients.

The company’s Service Revenue is likely to increase on higher global U.S. debit as well as credit card payment volumes.

Also, growth in processed transaction is likely to push up Data Processing fees.

The company’s disciplined capital allocation plan by way of share buyback and dividend payments should add to its bottom line.

Fiscal third-quarter earnings are also likely to be benefited by a lower adjusted tax rate driven by the reorganization of Visa Europe and other subsidiaries.

Nevertheless, higher operating cost and forex headwinds will be the dampeners.

Earnings Whispers

Our proven model does not conclusively show that Visa is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank of #1, 2 or 3 for this to happen. That is not the case here as you will see below.

Zacks ESP: Visa has an Earnings ESP of 0.00%. This is because the Most Accurate estimate stands at 81 cents per share, in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Visa carries a Zacks Rank #2 (Buy), which increases the predictive power of ESP. However, an Earnings ESP of 0.00% makes surprise prediction difficult.

We caution against Sell-rated stocks (Zacks Rank #4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Humana Inc. (NYSE:HUM) is expected to report second-quarter 2017 earnings results on Aug 2. The company has an Earnings ESP of +0.98% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cigna Corp. (NYSE:CI) has an Earnings ESP of +0.81% and a Zacks Rank #2. The company is expected to report second-quarter earnings results on Aug 4.

Comerica Inc. (NYSE:CMA) has an Earnings ESP of +4.67% and a Zacks Rank #2. The company is expected to report second-quarter earnings results on Jul 18.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Comerica Incorporated (CMA): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Humana Inc. (HUM): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Original post

Zacks Investment Research