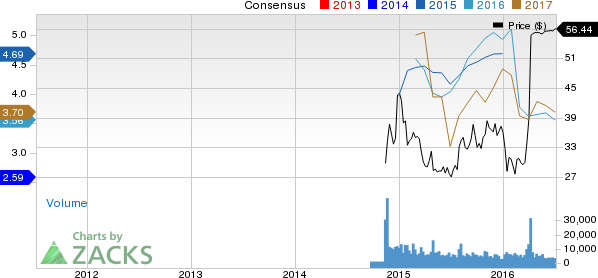

Shares of CA-based low-cost airline Virgin America (NASDAQ:VA) hit a 52-week high of $56.46 on Jul 1, before closing the day a bit lower at $56.44. Shares of the carrier, partly owned by British billionaire investor Richard Branson, have appreciated over 40% ever since the Seattle, WA-based Alaska Air Group (NYSE:ALK) inked a $4 billion deal (inclusive of debt and capitalized aircraft operating leases) to acquire Virgin America in April this year. The deal is expected to close by Jan 1, 2017.

The deal (if it materializes) will benefit Virgin America’s shareholders greatly as the offer price of $57 a share represents hefty premium to Virgin America’s closing price on the last trading day (Apr 1) prior to the announcement of the deal. While all eyes will be on the deal’s fate, we note that Virgin America is an impressive brand even on a stand-alone basis.

Virgin America has performed well ever since it went public in late 2014. The low-cost carrier has an impressive earnings history having outshined the Zacks Consensus Estimate in three of the last four quarters, at an average of 8.10%. Results have been aided by low fuel costs. We expect this tailwind to prevail going forward too. Even in valuation terms, the stock looks attractive based on P/E (F1) as the metric is lower than the industry average of 16.70.

Moreover, Virgin America is making constant efforts to expand its operations. We are also impressed by the disciplined cost structure at the company. Moreover, the carrier’s practice of flying a single aircraft type (Airbus A320 family), high asset utilization and outsourcing of activities like baggage delivery, heavy maintenance and reservations are encouraging.

Zacks Rank & Key Picks

Virgin Americacurrently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the airline space include Cathay Pacific Airways Ltd. (OTC:CPCAY) and GOL Linhas Aereas Inteligentes S.A. (NYSE:GOL) , both of which sport a Zacks Rank #1 (Strong Buy).

GOL LINHAS-ADR (GOL): Free Stock Analysis Report

CATHAY PAC AIR (CPCAY): Free Stock Analysis Report

ALASKA AIR GRP (ALK): Free Stock Analysis Report

VIRGIN AMERICA (VA): Free Stock Analysis Report

Original post

Zacks Investment Research