Stabilising economy supports realisation plans

With growing indications through the past year that the Vietnamese economy has stabilised, the stock market outperformed most emerging market peers in 2013; Vinaland, (VNLq) shares also showed recovery despite a still challenging real estate market, perhaps reflecting growing optimism that the trough may have been reached or is close at hand. A weak banking sector poses risks and structural reforms may be needed to take GDP growth from c 5% back to the pre-crisis level of c 7%. However, with VNL at a c 45% discount to NAV, asset price stability and any acceleration in VNL’s asset disposal programme should be taken positively by investors.

Realisations and cash returns to accelerate?

VNL is in a cash return period, aiming to realise assets and distribute cash while continuing the limited development of selected projects in order to maximise value. Realisations progressed slowly through 2013 and valuations weakened further, but VNL still estimates it will be able to divest up to US$227m of assets to support up to US$125m of distributions by the time shareholders consider a three-year continuation vote in November 2015.

Working capital flexibility could enhance value

Somewhat paradoxically, VNL has recently raised £15m in a zero coupon preference share issue. The cash is designed to enhance portfolio value creation, providing working capital to refinance project debt (15.5% of NAV) at potentially lower rates, accelerate existing developments and restructure investments for disposal. This means VNL is less likely to be seen as a forced seller going forwards.

The economy appears to have stabilised

GDP growth accelerated to 5.4% in 2013 and inflation fell to 6%, allowing interest rates to fall. With the trade balance positive and FDI up 54% in the year, the currency is stable and foreign exchange reserves higher. There is growing optimism that real estate may be at or near the trough, despite a still weak banking sector.

Valuation: Plenty of room for discount to narrow

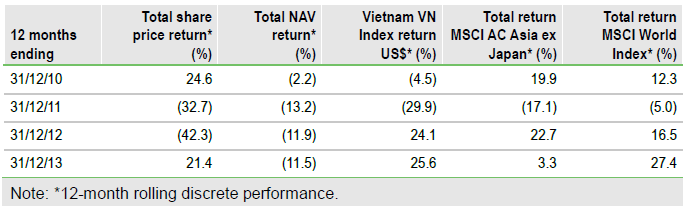

The discount has narrowed to c 45%, as the share price rose 21.4% in 2013, despite the NAV falling 11.5%. Stability of valuations and accelerated realisations at around NAV would be sufficient triggers for further discount narrowing. The disclosure, in early December, of early stage discussions regarding a possible sale of assets or acquisition of shares has had little impact on the shares.

To Read the Entire Report Please Click on the pdf File Below