Earnings continue to be in the spotlight. This week, we have had earnings releases from a number of video game companies including Activision Blizzard Inc. (NASDAQ:ATVI) , Sony Corp. (NYSE:SNE) , Take Two Interactive Software (NASDAQ:TTWO) Zynga Inc. (NASDAQ:ZNGA) and many more.

Recap of the Developments

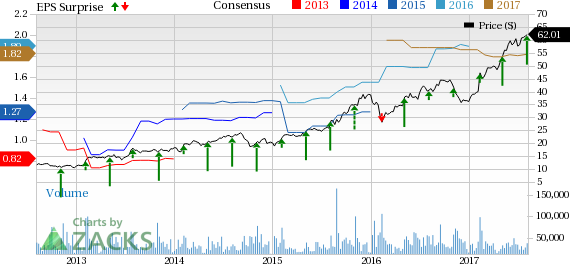

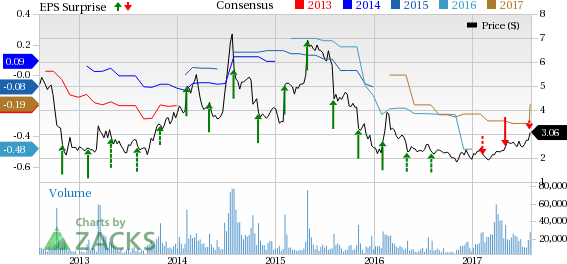

Activision Blizzard posted second-quarter 2017 adjusted earnings of 51 cents and revenues (excluding deferrals) of $1.418 billion, easily beating the respective Zacks Consensus Estimate of 25 cents and $1.214 billion. However, on a year-over-year basis, revenues were down approximately 10%.

Including deferral revenues, Activision reported sales of $1.631 billion, up 3.9%.The top line was driven by continued strength in digital revenues, success of Overwatch and the buyout of King Digital Entertainment. Digital online revenues grew 15% year over year to $1.309 billion and contributed 80% of total revenue in the quarter.

Activision earned $1 billion of in-game revenues in the quarter. Also, the company announced the first seven-team sales for its Overwatch league.

For third-quarter 2017, Activision anticipates non-GAAP revenues and earnings to be $1.385 billion and 34 cents per share, respectively.

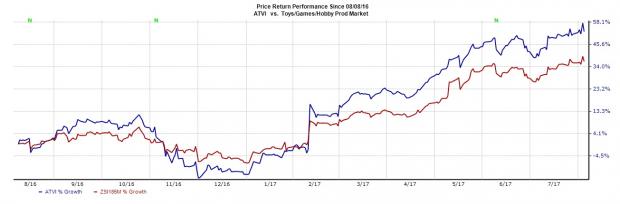

Currently, the company carries a Zacks Rank #3 (Hold). Shares of Activision have registered impressive growth in the past one year. The stock generated a return of 52.7% compared with the industry’s gain of 36.6%.

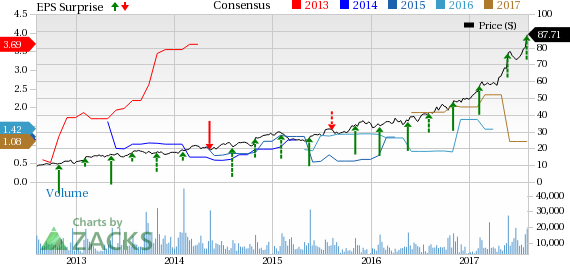

Take Two Interactive reported spectacular first-quarter fiscal 2018 results, wherein adjusted earnings were 44 cents per share compared with the Zacks Consensus Estimate of breakeven. Net sales (excluding deferred revenues) of $348.3 million beat the Zacks Consensus Estimate of $287.1 million.

On a year-over-year basis, revenues were up 11.8% driven by continued increase in digital revenues and strength in games like Grand Theft Auto V, Grand Theft Auto Online, NBA 2K17, WWE 2K17 and Mafia III.

Digitally-delivered net sales were up 47% to $280.9 million. Recurrent consumer spending bookings increased 71% and represented 72% of total digitally-delivered bookings.

For the second quarter, the company expects GAAP net revenues to be in the band of $400–$450 million. The company projects earnings per share in the range of 15–25 cents.

Currently, Take Two carries a Zacks Rank #3. In the last year, the company has returned 114.6% compared with the industry’s gain of 36.6%.

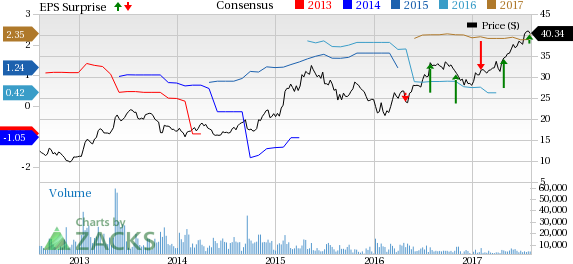

Sony reported first-quarter fiscal 2017 earnings per share of ¥62.70 (56 cents), which widely beat the Zacks Consensus Estimate of 48 cents. Also, earnings grew a massive 281.4% from the year-ago quarter figure due to strong revenue growth.

Sales and operating revenues at the Game & Network Services (“GN&S”) segment grew 5.4% to ¥348.1 billion ($3.1 billion). Improvements in the PS4 software sales (including sales through the network) and impressive market traction of PlayStationVR proved conducive to increase in sales.

Currently, the company expects total sales to be around ¥8,300, up 3.8% from the earlier figure of ¥8,000. The upward revision is largely attributable to lesser-than-expected impact of foreign exchange rates. Overall, the GN&S segment is anticipated to benefit from higher network sales.

Sony currently carries a Zacks Rank #1 (Strong Buy). In the last one year, the company has returned 24.9% compared with the industry’s gain of 19.9%.

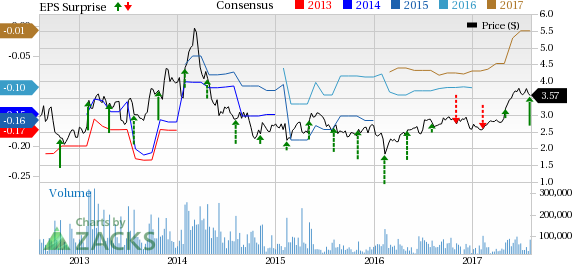

Zynga reported second-quarter 2017 earnings per share of a penny that came ahead of the Zacks Consensus Estimate of loss of a penny. Revenues of $209.2 million beat the consensus mark of $206.4 million. The top-line grew 15% year over year driven by strong performance of CSR2 and Social Slots. Zynga’s mobile daily active users (DAU) increased 18% year over year to 19 million. Revenues from mobile were up 30% to 180 million while bookings surged 33% to $181.6 million.

As a part of its cost optimisation strategy, Zynga leased out 287,000 square feet of east tower of its SanFrancisco headquarters to Airbnb for nine years as an anchor tenant.

For the third quarter of 2017, bookings are expected to be around $205 million. Revenues are expected to be $210 million.

The stock has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We note that Zynga has underperformed the industry over the last year. The stock increased 26.6% compared with 25.2% gain recorded by the industry.

Glu Mobile Inc (NASDAQ:GLUU) reported second-quarter 2017 loss per share of 15 cents compared with the Zacks Consensus Estimate of a loss of 13 cents. However, revenues (including deferred) of $82.5 million beat the consensus mark of $72.5 million and grew 70.7% year over year.

Glu also talked about signing the multi-year licensing agreement with WWE, to develop a mobile game that will be released in 2018. However, analysts observe that app store competition is fierce, with three WWE mobile games already live in the market – Warner Bros.' WWE Immortals, Scopely's WWE: Champions and Take-Two's WWE SuperCard.For the third quarter of 2017, bookings are expected to range from $78 million to $80 million.

The stock has a Zacks Rank #3. We note that the company’s shares have gained nearly 36.6% in the past year, almost same as the industry.

Performance

The following table shows the price movement of the major video game companies over the past five trading days as well as the last six months:

Company | Last 5 Days | Last 6 Months |

ATVI | 0.91% | 54.29% |

EA | -0.87% | 43.79% |

GLUU | 11.68% | 23.39% |

MSFT | -0.49% | 14.2% |

NTES | -2.97% | 17.71% |

TTWO | 9.5% | 61.83% |

ZNGA | -1.92% | 40.55% |

Over the last five trading sessions, Glu Mobile was up 11.68%, while NetEase was down nearly 3%.

In the last six-month period, Take Two surged the most (61.38%). The company continues to benefit from its popular offerings like Grand Theft Auto V and Grand Theft Auto Online, along with its other releases like NBA 2K and WWE 2K. In fact, higher sales of the digital version of the games add to the company’s margins. Take Two continues to expect growth in digital revenues, driven by higher sales of full game downloads and increase in recurrent consumer spending.

The company forayed into the free-to-play games space with the acquisition of game developer Social Point. The acquisition will help it to boost performance going forward. Management expects Social Point to contribute 6% of the total revenue in the current fiscal year. Also, the company’s attempts to strengthen its presence in the lucrative e-sports market are prudent in our view.

Want to learn more about video game stocks? Make sure to check out our podcast below!

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Zynga Inc. (ZNGA): Free Stock Analysis Report

Sony Corp Ord (SNE): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Take-Two Interactive Software, Inc. (TTWO): Free Stock Analysis Report

Glu Mobile Inc. (GLUU): Free Stock Analysis Report

Original post

Zacks Investment Research