L Brands (NYSE:LB) just released its second quarter fiscal 2017 earnings results, posting earnings of $0.48 per share and revenue of $2.755 billion. Currently, L Brands has a Zacks Rank #3 (Hold), and it is down 7.81% to $36.46 in after-hours trading shortly after its earnings report was released.

L Brands:

Beat earnings estimates.The company posted adjusted earnings of $0.48 per share, beating our Zacks Consensus Estimate of $0.45. L Brands’ earnings decreased 31.4% year-over-year.

Missed revenue estimates.The company saw revenue figures of $2.755 billion, just missing our estimate of $2.76 billion. Revenue decreased year-over-year by 4.7% from $2.890 billion.

L Brands reported a comparable sales decrease of 8%. The exit of the swim and apparel categories from Victoria’s Secret stores had a negative impact on the total company’s comparable sales by 6%.

Looking ahead, L Brands has lowered its guidance from $3.10 to $3.40 to $3.00 to $3.20 for 2017 full-year earnings. The company expects to earn between $0.25 and $.30 per share in the third quarter.

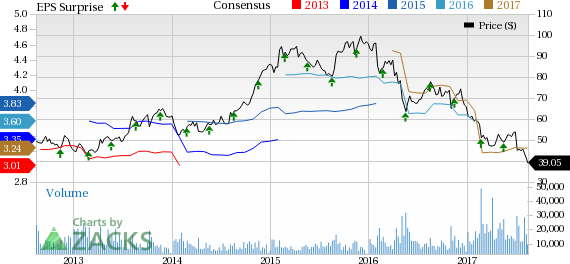

Here’s a graph that looks at L Brands price, consensus, and EPS surprise:

L Brands, Inc. operates as a retailer of women's intimate and other apparel, beauty and personal care products and accessories primarily in the United States. Its brand includes Victoria's Secret, Victoria's Secret Pink, Bath & Body Works, La Senza and Henri Bendel. The company sells its product through franchise, license, wholesale partners, websites, catalogue, and other channels. L Brands Inc., formerly known as Limited Brands Inc., is headquartered in Columbus, Ohio.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

L Brands, Inc. (LB): Free Stock Analysis Report

Original post