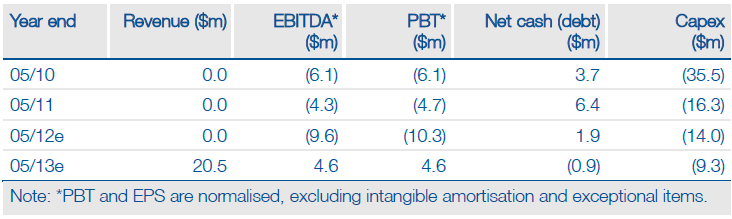

The recent Victoria Oil & Gas (VOG.L) update highlighted the first production and cash flows from the Logbaba project and pointed to a revision of 2012 production guidance. Year-end targets have been revised from 8 to 5mmscfd. However, it still expects to approach 20mmscfd by the end of 2013 and the recently-announced confirmation of reserves should allow debt financing in Q412. The current share price represents a discount to our reduced core NAV of 9.2p.

2012 targets have slipped, but 2013 remain

The chairman’s letter illustrates the difficulties encountered in the first steps of production. First gas volumes of 1mmscd slipped from May to July and the company revised its 2012 production targets to 5mmscfd (from 8mmscfd). Initial teething problems are not uncommon and the company has kept guidance for year end 2013 at around 20mmscfd – a measure of its confidence in the ramp-up.

More customers should link up by year end

Four thermal customers are currently connected and a further 13 have signed Gas Sales Agreements (GSAs), which could increase demand to 2.5mmscfd by the turn of the year. Power generation should add a further 2.5mmscfd to this; three LOIs have been signed and the company is hopeful of further progress in the coming months. October will be a key month for sales increases and could bring cash flow neutrality.

CPR confirms reserves and points to upside potential

The CPR indicated a lower-than-previous estimate for 1P reserves (39 vs 47bcf), but included contingent reserves in the lower Logbaba formation that point to a considerable increase in 1P+1C reserves (72bcf vs 47bcf). This is good news for longer-term production at Logbaba and lays the groundwork for debt financing in Q412.

Valuation: Upside still to work for

Investors have been reluctant to price the company more fully, given the early difficulties it has had in generating sales. However, VOG is one of the few in this space with a proven asset base producing cashflows. Even with a reduced core NAV of 9.2p (due to delayed ramp-up and higher costs), we still see significant upside in the shares. We would stress that success in hitting near-term production targets will be crucial to gaining investors’ confidence in the longer-term strategy.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Victoria Oil & Gas: 2012 Targets Have Slipped, Upside Potential Remains

Published 10/09/2012, 06:51 AM

Updated 07/09/2023, 06:31 AM

Victoria Oil & Gas: 2012 Targets Have Slipped, Upside Potential Remains

Proving the concept

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.