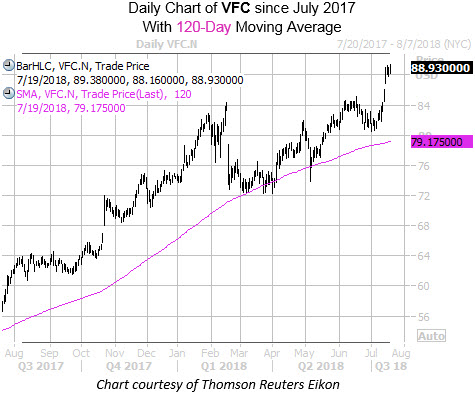

Apparel and footwear concern VF Corp (NYSE:VFC) stock was up 0.8% at $88.93 in Thursday afternoon trading and fresh off an all-time high of $89.38, after earlier receiving a price-target hike to $94 from $82 at Cowen and Company. From a broader perspective, VFC has been a long-term outperformer, picking up 57% over the past 12 months, with a recent pullback quickly contained by the rising 120-day moving average.

The retailer is slated to report fiscal first-quarter earnings before market open today. Digging into its earnings history, VFC stock has closed lower the day after the company reported in four of the past eight quarters -- including an 11.1% swing lower in February. On average, the shares have moved 3.9% in the subsequent session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a slightly larger 5.3% next-day move for tomorrow's trading.

Looking at options data, the 10-day call/put volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) comes in at 4.99, ranking in the 82nd percentile of its annual range. This suggests that during the past two weeks, calls have been purchased over puts at a faster-than-usual clip, pointing towards a bullish pre-earnings skew among options traders.

During this time frame, both the July 87.50 call and weekly 7/27 83.50-strike call saw notable increases in open interest, with nearly 14,200 total contracts added. However, data indicates that at least some of the former's call activity was sell to open, meaning the sellers expect the shares to limit their journey to no higher than $87.50 in the near term.

In terms of analyst sentiment, those following the stock have been optimistic, with 11 of the 17 brokerage firms covering North Carolina-based concern sporting "strong buy" recommendations. Further, the equity's average 12-month price target of $90.24 stands in record-high territory.