Kate Spade & Co (NYSE:KATE) was downgraded by equities researchers at Vetr from a "buy" rating to a "hold" rating in a note issued to investors on Monday, MarketBeat.com reports. They currently have a $23.96 target price on the stock. Vetr's target price would indicate a potential upside of 3.32% from the stock's current price.

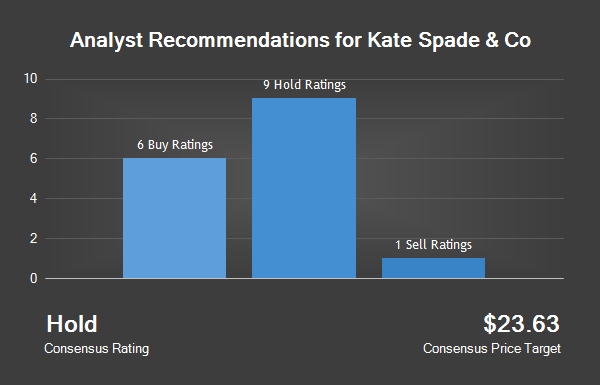

Other analysts have also recently issued reports about the stock. William Blair restated a "buy" rating on shares of Kate Spade & Co in a report on Friday, February 17th. Mizuho raised their target price on shares of Kate Spade & Co from $21.00 to $25.00 and gave the stock a "buy" rating in a report on Friday, February 17th. Wunderlich restated a "buy" rating and set a $24.00 target price on shares of Kate Spade & Co in a report on Thursday, February 16th. Oppenheimer Holdings Inc. restated a "hold" rating on shares of Kate Spade & Co in a report on Thursday, January 12th.

Finally, Zacks Investment Research upgraded shares of Kate Spade & Co from a "sell" rating to a "hold" rating and set a $25.00 target price for the company in a report on Friday, February 17th. One research analyst has rated the stock with a sell rating, twelve have issued a hold rating and seven have issued a buy rating to the stock. Kate Spade & Co presently has a consensus rating of "Hold" and an average target price of $23.56.

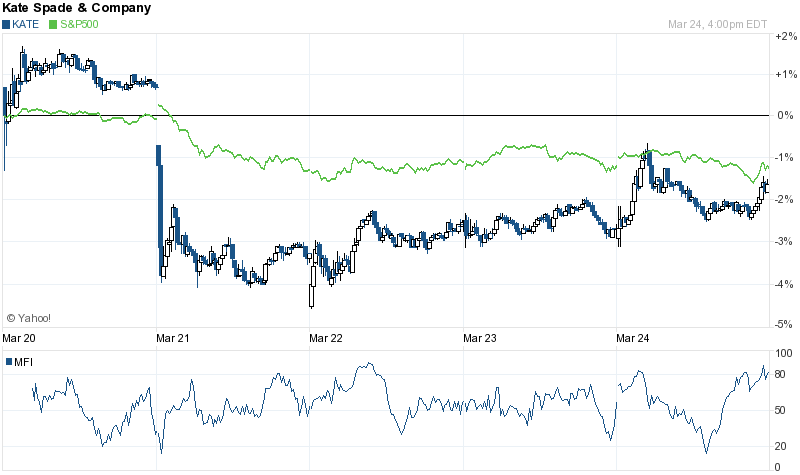

Shares of Kate Spade & Co opened at 23.19 on Monday, MarketBeat.com reports. The stock's 50 day moving average price is $22.32 and its 200-day moving average price is $18.43. Kate Spade & Co has a 12-month low of $14.02 and a 12-month high of $26.46. The firm has a market capitalization of $2.98 billion, a P/E ratio of 19.55 and a beta of 1.62.

Kate Spade & Co last issued its earnings results on Thursday, February 16th. The company reported $0.41 earnings per share for the quarter, topping the Zacks' consensus estimate of $0.35 by $0.06. The firm earned $470 million during the quarter, compared to analysts' expectations of $472.80 million. Kate Spade & Co had a net margin of 9.67% and a return on equity of 27.34%. The firm's revenue for the quarter was up 9.8% compared to the same quarter last year. During the same period last year, the firm posted $0.32 earnings per share. On average, equities analysts expect that Kate Spade & Co will post $0.87 EPS for the current year.

Large investors have recently modified their holdings of the stock. A.R.T. Advisors LLC bought a new stake in shares of Kate Spade & Co during the fourth quarter worth about $1,202,000. Peregrine Capital Management LLC bought a new stake in shares of Kate Spade & Co during the third quarter worth about $15,575,000. Harris Associates L P raised its stake in shares of Kate Spade & Co by 0.7% in the third quarter. Harris Associates L P now owns 6,343,511 shares of the company's stock worth $108,664,000 after buying an additional 45,700 shares during the period.

Boston Partners bought a new stake in shares of Kate Spade & Co during the third quarter worth about $2,636,000. Finally, State of New Jersey Common Pension Fund D raised its stake in shares of Kate Spade & Co by 4.6% in the third quarter. State of New Jersey Common Pension Fund D now owns 229,750 shares of the company's stock worth $3,936,000 after buying an additional 10,000 shares during the period. 98.36% of the stock is owned by institutional investors.

Kate Spade & Co Company Profile

Kate Spade & Company is engaged in the design and marketing of a range of accessories and apparel. The Company operates through three segments, which include KATE SPADE North America, KATE SPADE International and Adelington Design Group. The KATE SPADE North America segment consists of the Company's kate spade new york and JACK SPADE brands in North America.