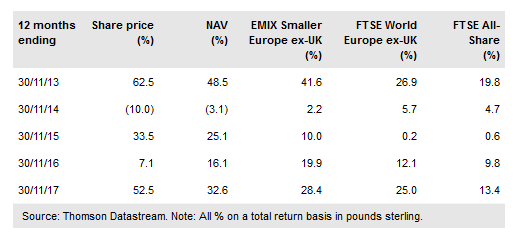

JPMorgan (NYSE:JPM) Euro Small Companies Trust Plc (LON:JESC) was launched in 1990 and aims to generate long-term capital growth from a diversified portfolio of small-cap European equities. The investment process involves screening the c 1,500 company universe to construct a relatively concentrated portfolio of 50-75 positions in firms with positive fundamentals and reasonable valuations. JESC has a very good investment track record, outperforming its benchmark over one, three, five and 10 years. It has also performed strongly versus the average of its four peers, ranking second over one, three and five years and first over the last 10 years, where its NAV total return is 23.6pp higher than its closest peer.

Investment strategy: Bottom-up stock selection

JESC’s three managers, Jim Campbell, Francesco Conte and Edward Greaves, are able to draw on the broad resources of J.P. Morgan Asset Management’s European equity team to construct a portfolio of 50-75 holdings in European small cap-equities. They seek long-term capital growth, selecting quality companies with positive earnings and share price momentum, that are trading on reasonable valuations. JESC is benchmarked against the EMIX (formerly Euromoney) Smaller Europe ex-UK Index. Liquidity and gearing is actively managed, with a range of 20% net cash to 20% gearing permitted. At end-October, net gearing was 5.2%.

To read the entire report Please click on the pdf File Below: