Vermilion Energy Inc. (TO:VET) is an international E&P with assets in Europe, North America and Australia. Its defensive qualities include asset and commodity diversification, low financial leverage, high margins and low finding and development (F&D) costs. Management has distributed a consistent and growing dividend yield to shareholders since 2003, while retaining sufficient capital to grow production by 13% CAGR (five years). The company’s 6.6% forecast dividend yield remains one of the highest in the E&P sector. Our valuation stands at C$48.2/share and is based on a number of approaches including P/CF, EV/EBIDAX, Gordon’s growth model and SOTP based on sustainable FCF and drilling inventory NPV10.

FCF to drive growth in production and dividend

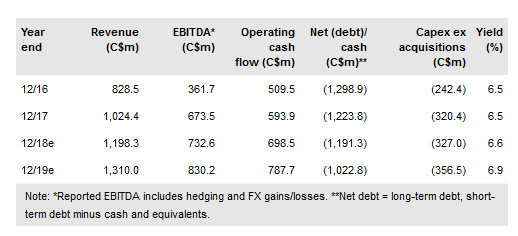

We forecast a material increase in free cash flow, post-maintenance capex and dividend payments in FY18/19, based on current commodity prices. We believe this should enable organic investment in the company’s drilling inventory, where well costs average c C$3m and unrisked returns are typically in excess of 50%. In addition, we expect FCF to be used to fund bolt-on acquisitions, dividend growth and debt repayment. Current leverage remains undemanding at FY18e total debt/ EBITDA of 1.5x.

To read the entire report Please click on the pdf File Below: