Veritiv (NYSE:VRTV) Corporation VRTV reported earnings per share of $1.62 in second-quarter 2021, marking a turnaround from the loss per share of $1.16 seen in the year-ago period. This upside was driven by continued Packaging (NYSE:PKG) sales growth and operational efficiencies. Also, the bottom line beat the Zacks Consensus Estimate of 81 cents by a wide margin.

Veritiv’s total revenues increased 18.1% year over year to $1,659 million.

Cost of sales was up 19.2% year on year to $1,319 million during the reported quarter. Gross profit improved 14% year over year to $339.6 million. Gross margin was 20.4% in the second quarter compared with the prior-year quarter’s 21.2%.

Adjusted EBITDA was a record $73.5 million, reflecting an 84.7% improvement from the $39.8 million reported in the year-earlier period. Adjusted EBITDA margin expanded to 4.4% compared with the prior-year quarter’s 2.8%.

Financial Position

Veritiv had cash and cash equivalents of $34.7 million as of Jun 30, 2021, down from $121 million held as on Dec 31, 2021. Long-term debt was at $520.4 million as of Jun 30, 2021, down from $589.1 million as of Dec 31, 2020. The company ended the quarter with a record low net leverage ratio of 1.7x.

Net cash provided by operating activities for the first half of 2021 was $50.1 million compared with the prior-year period’s $226.5 million. Veritiv repurchased approximately $50 million of its shares in the first half of 2021 as part of its previously-authorized share-repurchase program. During the second quarter, Veritiv expanded its share-repurchase program to $100 million.

2021 Guidance

Backed by the impressive first-half 2021 performance, Veritiv raised its guidance for 2021. The company now expects net income for 2021 in the range of $100 million to $120 million, up from prior guidance of $95 to $115 million. Earnings per share are expected in the band of $6.25-$7.50 for the year. Veritiv expects adjusted EBITDA in the range of $270 million to $290 million, up from the prior estimate of $220-$240 million.

Free cash flow for 2021 is expected to be at least $110 million with capital expenditures at around $35 million.

Price Performance

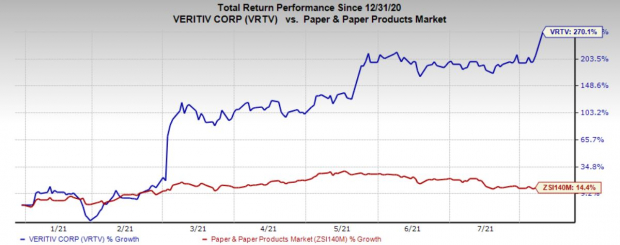

Shares of Veritiv have soared 270.1%, so far this year, compared with the industry’s growth of 14.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Veritiv currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Nucor Corporation (NYSE:NUE) NUE, Cabot (NYSE:CBT) Corporation CBT and Dow Inc. DOW.

Nucor has a projected earnings growth rate of 455% for 2021. The company’s shares have soared 97.9% so far this year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot has an expected earnings growth rate of 137% for the current fiscal year. The company’s shares have gained 21.8% so far this year. It currently sports a Zacks Rank #1.

Dow has an estimated earnings growth rate of 403% for the current year. So far this year, the company’s shares have gained 14.1%. It currently carries a Zacks Rank #2 (Buy).

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE): Free Stock Analysis Report

Dow Inc. (DOW): Free Stock Analysis Report

Cabot Corporation (CBT): Free Stock Analysis Report

Veritiv Corporation (VRTV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research