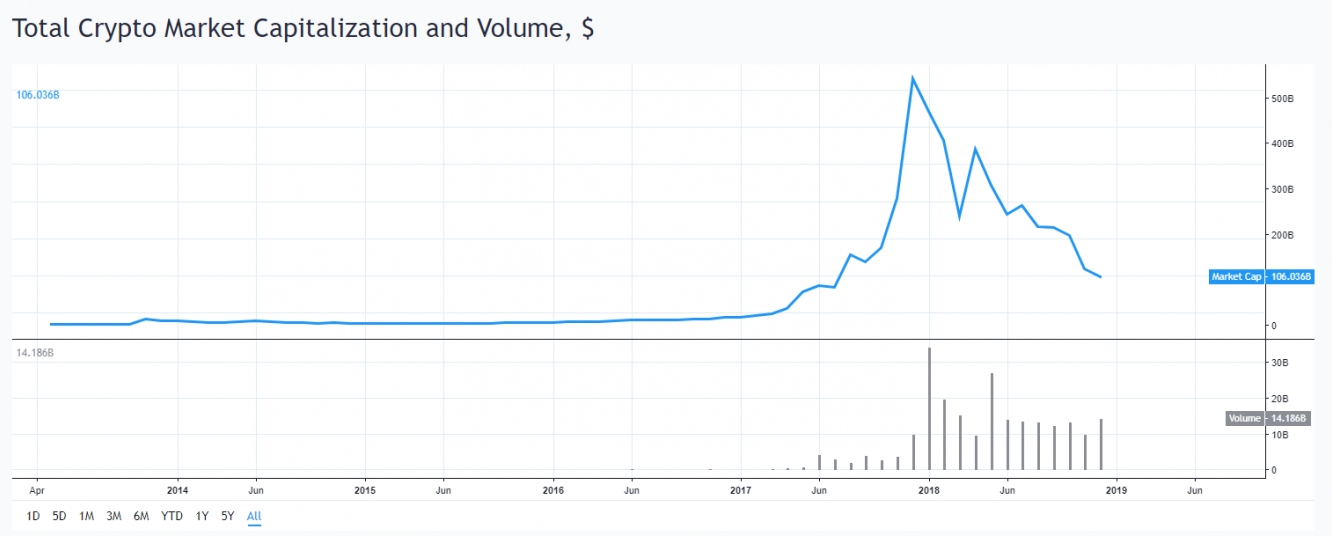

As 2018 comes to a close, the year offers a stark contrast for the blockchain space compared to last year. While 2017 wrapped up with a surge in cryptocurrency prices and market capitalization fueled by the so-called “crypto mania,” 2018 looks to end with a more muted tone for retail investors.

The total market capitalization for the cryptocurrency market is slightly above $100 billion this December ($105.995 billion at time of writing). When compared to the total cryptocurrency market capitalization around the same time frame as 2017, the markets have slumped to around 1/5th of their previous high reached last December of over $500 billion.

However, even as the cryptocurrency markets continue to cool down, Asian venture capital funds and other investors in the region are ramping up activity in the blockchain space. Here’s a look at the big players and what’s happening in the crypto industry.

Increasing Interest From Asian Funds

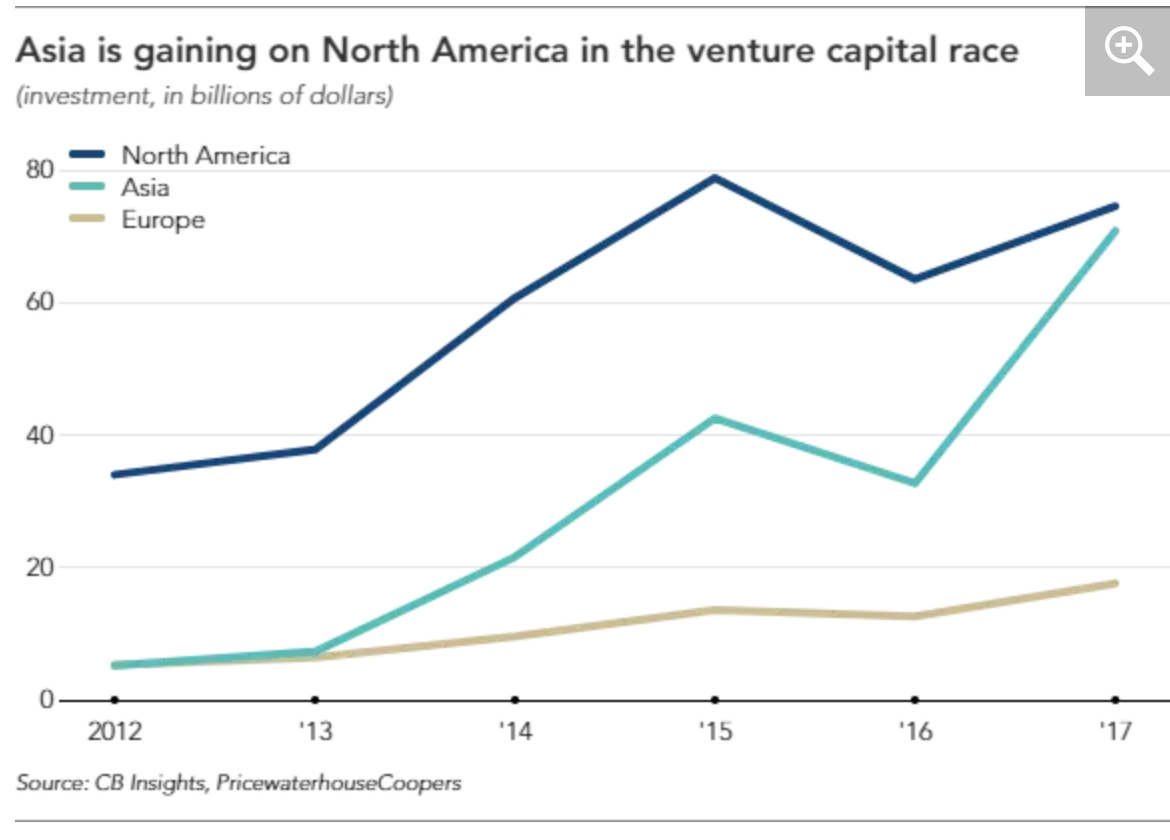

As a whole, venture capital continues to grow year over year with the United States leading the way as the single largest source of global venture capital. However, the dynamic in the VC scene is undergoing significant change over recent years as Asian funding continues to grow its presence.

According to analysis from The Wall Street Journal, Asian countries are making strides in the amount of venture capital invested compared to other regions. In 2017, Asian VC made up roughly 40% of all global venture capital, meaning the region is nearing the US dominance of 44%. The move is a drastic increase from Asia’s position just 10 years ago when the region’s share of global venture capital was less than 5%. While the US used to lead the global industry by being the source for as much as 97% of global capital in 1992, the country now leads less than half of all venture finance.

Blockchain Investments

As the region grows its activity in the VC space, there’s one industry in particular that Asian VC is positioned well

for: blockchain. Asia has long been a hotbed for cryptocurrencies and blockchain-related projects and the region is often seen as an example of early adoption and even a barometer for the industry as a whole.

Though China has not always taken the most hospitable stance on cryptocurrencies in the past — going so far as to even ban its citizens from trading them — the government’s tone is changing, at least on the technology itself. A Chinese party outlet released a guide on blockchain technology for government officials and Chinese President Xi has even called blockchain “a breakthrough technology.”

Besides China’s Communist Party, others in the country are investing in the new technology as well.

Alibaba (NYSE:BABA), whose Jack Ma has said in the past that bitcoin is “likely a bubble,” is taking a serious look at the underlying technology. A $150 billion financial affiliate of Alibaba, Ant Financial, has launched a blockchain-based payment remittance system of their own to service Hong Kong’s large Filipino population sending money overseas. In addition, it’s reported that Alibaba has filed more than 10% of the world’s blockchain patents.

Other Asian countries are looking for blockchain solutions of their own in both the private and public sector. Take South Korea for example: the country is testing out the use of a blockchain-based solution for voting and has many private companies investing in blockchain startups. In the private sector, VC firms like Korean Investment Partners (KIP) are continuing to invest in blockchain despite market downturns. As a VC known for investing in high growth industries, the firm still sees room to grow in the blockchain space. In a recent move, KIP invested in blockchain startup TEMCO which is working to integrate blockchain to disrupt and reinvent the supply chain.

Like other blockchain startups, TEMCO is bringing the technology that’s created such a buzz over the last year to market with actionable solutions. KIP and other VCs see startups like TEMCO as lucrative opportunities due to their ability to properly implement such disruptive technology in a practical way with significant room for growth. Unlike the more casual investor, VCs apply more scrutiny in their investments and get excited by startups that can provide real value to businesses and consumers. That translates to more meaningful projects being propped up and not just another ICO that gets celebrity endorsements.

At the same time, new funds are being started with the explicit purpose of investing in blockchain-based startups and initiatives. Just this August in Singapore, Golden Gate Ventures launched LuneX Ventures, a $10 million fund created specifically for early-stage investing in cryptocurrency and blockchain startups, and they’re not alone.

Fenbushi Capital, China’s first VC to focus exclusively on blockchain companies, is still investing heavily in the blockchain and crypto industry. Fenbushi’s most recent investment was less than a month ago with a $22 million investment in decentralized gaming ecosystem Plair.

In Japan, some are looking to blockchain as the catalyst for the next economic boom. During the Japan Blockchain Conference in Tokyo, chief executive of SBI Holdings, Yoshitaka Kitao, said that he is betting that blockchain-related technologies will fuel the next economic boom for the country. SBI Holdings is just one of many groups in Japan investing in blockchain; the company has a blockchain and AI fund of $460 million.

The Takeaway

Cryptocurrency markets are on the decline with a massive portion of their all-time high market capitalization gone; however, venture capital money is still flowing, especially from sources in Asia. The region’s VC prominence is not only growing en masse but is taking on an expanding role in the blockchain space. With industry leaders and government officials in Asia seeing the high growth potential in blockchain, investors should consider that the blockchain boom isn’t over — it’s only just beginning.