On Aug 14, we issued an updated research report on Palo Alto, CA-based Varian Medical Systems Inc. (NYSE:VAR) . The company is the world’s leading provider of radiotherapy, radiosurgery, proton therapy and brachytherapy for treating cancer and other medical conditions.

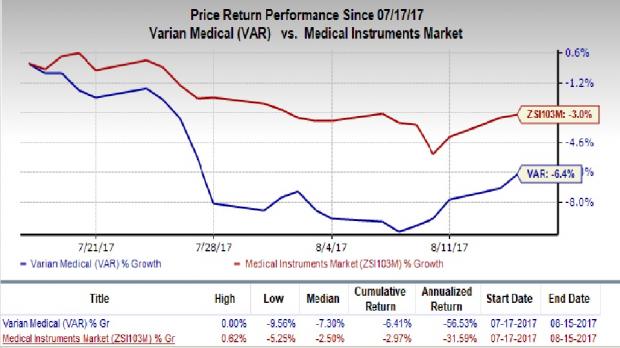

Varian Medical had an unimpressive run on the bourse over the last one month, trading below the industry in terms of price performance. A glimpse at the share price movement reveals that Varian Medical’s shares have lost 6.4%, comparing unfavorably with 3.0% decline of the industry.

Looking forward, Varian Medical's oncology and Proton therapy business' growth prospects remain impressive. The company is addressing both the tier 1 and mid-tier markets through its Edge, Truebeam and VitalBeam, Halcyon products. The company is winning contracts, not only in the Americas but also in the emerging international markets, which is a huge positive. We believe that China and Africa present significant top-line growth opportunity in the near term. The company is opening new offices in Africa and the Middle East, which will provide growth opportunities in the region.

Varian Medical operates in a technology-driven environment where success depends on innovation and frequent product updates. The company has been successful on the R&D front as evident from year-over-year growth in its top line. The company has approximately $1 billion revenue opportunity from its various Oncology and Imaging Component products over the next five years. The varied offerings include TrueBeam and Edge platforms, InSightive Analytics, Qumulate QA and RapidPlan knowledge-based treatment planning. We believe that Varian Medical’s innovative product pipeline will continue to drive growth over the long term.

Apart from enjoying a dominant market share in conventional radiotherapy, we believe that proton therapy also holds significant promise for Varian Medical. This is because ProBeam Compact proton therapy system is superior to other external beam radiotherapies in precisely locating cancerous tumors and causes lesser side effects to surrounding tissues. Proton therapy system uses the same interface used by the company in its TrueBeam platform.

Finally the company’s strong overseas presence is expected to enable it to leverage this opportunity in emerging markets. In line with growing demand for cancer treatment in overseas markets, Varian Medical’s sales, in Europe, Africa and particularly Asia, are growing at a faster rate than in the domestic market.

On the flip side, unfavorable currency translation continues to be a major dampener for the stock. Management fears that further strengthening of the dollar against foreign currencies will lead to deteriorating operating results.

Intense competition as well as the possibility that Varian Medical’s new test might not generate meaningful profits to outweigh the costs associated with its development, continues to raise concern.

Zacks Rank and Key Picks

Varian Medical carries a Zacks Rank #3 (Hold). Some better-ranked medical stocks are Edwards Lifesciences Corp. (NYSE:EW) , Steris Plc (NYSE:STE) and Align Technology, Inc. (NASDAQ:ALGN) . Edwards Lifesciences and Align Technology sport a Zacks Rank #1 (Strong Buy), while Steris carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a positive earnings surprise of 10.75% over the trailing four quarters. The stock has gained around 0.9% over the last three months.

Align Technology has a long-term expected earnings growth rate of 26.6%. The stock has rallied roughly 25.4% over the last three months.

Steris has a positive earnings surprise of 0.78% over two of the trailing four quarters. The stock has gained 13.1% over the last three months.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

STERIS PLC (STE): Free Stock Analysis Report

Original post

Zacks Investment Research