Varian Medical Systems, Inc. (NYSE:VAR) reported adjusted earnings of $1.09 per share in the fourth quarter of fiscal 2017, missing the Zacks Consensus Estimate of $1.19. Adjusted earnings also declined 21% on a year-over-year basis.

Meanwhile, revenues of $739 million were down 1% from the year-ago quarter. Revenues missed the Zacks Consensus Estimate of $742 million by a narrow margin. Varian Medical ended the year with $3.5 billion in backlog, up 10% on a year-over-year basis.

Unfavorable performance in the company’s proton therapy unit is the primary cause for the lackluster fourth-quarter performance. However, a solid guidance for fiscal 2018 instills confidence in the stock.

This Palo Alto, CA-based manufacturer of medical devices and software carries a Zacks Rank #3 (Hold).

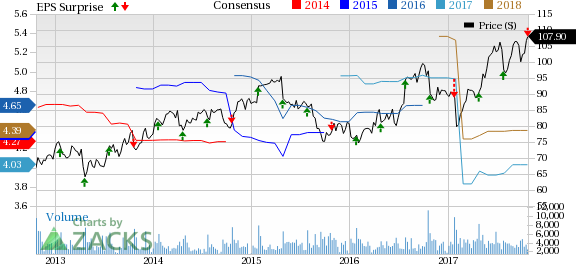

Varian Medical Systems, Inc. Price, Consensus and EPS Surprise

Segment Details

Oncology Systems: At this segment, revenues totaled $686 million, up 1% year over year at constant currency (cc). Oncology growth was driven by double-digit services growth and newly issued upgrades for hardware and software. Notably, Varian Medical registered 40 orders for the HyperArc platform in the fourth quarter. HyperArc is a recently-launched high definition radiotherapy technology.

Gross orders in the segment totaled $964 million, up 7% at cc from the year-ago quarter. In the United States, gross orders increased 2% at cc. In the EMEA region, gross orders rose 29% on a year-over-year basis, courtesy of solid growth in France, Germany, Poland and India. On the flipside, gross orders declined 9% at cc in the APAC region, thanks to weakness in Japan.

Proton Therapy: Fourth-quarter revenues at the segment were $52 million, down 23% on a year-over-year basis. During the quarter, Varian Medical booked two orders including the Concord Medical Proton Center in Guangzhou, China for $52 million and HCG in India for $19 million. Proton therapy orders growth was 94% on a year-over year basis.

Halcyon Drives Growth

Varian Medical has been taking initiatives to gain customer attention for its broad spectrum of products. The company unveiled the Halcyon radiotherapy treatment system at the ASTRO conference in Vienna last quarter. The Halcyon radiotherapy treatment system has been designed to offer cost-effective cancer care worldwide. The platform had 23 orders in the fourth quarter, of which 12 orders were from EMEA, 10 orders from North Africa and one from APAC.

Margins

In the fourth quarter, gross margin contracted 50 basis points (bps) to 42.3% of revenues. Oncology Systems gross margin contracted nearly 26 bps to 45 % owing to supply chain inefficiencies.

As a percentage of revenues, expenses on research and development (R&D) remained flat on a year-over-year basis. Meanwhile, selling, general and administrative (SG&A) expenses in the quarter were $136.8 million, up 180 bps a year-over-year basis. Operating margin in the quarter under review was 14.8% of net revenues, down 410 bps year over year. Notably, the fourth quarter of last year included a favorable $4-million bad debt release.

In addition to investments in R&D, Varian Medical had spent $18.7 million in CapEx and $25 million to buy back 250,000 shares of the company’s stock. As of the end of the fourth quarter, Varian Medical had 5.25 million shares remaining under its existing repurchase authorization.

FY17 at a Glance

For fiscal 2017, Varian Medical registered adjusted earnings of $3.60 per share. Revenues of $2.7 billion were up 2% at cc in the year. Oncology revenues of $2.5 billion were up 1% at cc. For the full year, revenues in the proton therapy unit totaled $182 million, up 12% year over year. The company booked six proton therapy orders in fiscal 2017.

Fiscal 2017 was favorable for Varian Medical in terms of product launches as well. The successful launches of Halcyon Therapy System and HyperArc Technology deserve a mention in this regard.

FY18 View

For fiscal 2018, management estimates adjusted earnings per share in the $4.20 to $4.32 range. Cash flow from operations is projected between $475 million and $550 million. Fiscal 2018 revenues are estimated to grow 2% to 4% year over year.

Companies Reporting Solid Earnings Results

Intuitive Surgical Inc. (NASDAQ:ISRG) posted adjusted earnings of $2.77 per share in the third quarter of 2017, beating the Zacks Consensus Estimate of $1.97 on stellar revenue growth. The stock carries a Zacks Rank #2 (Buy).

PetMed Express, Inc.’s (NASDAQ:PETS) adjusted earnings per share of 43 cents for the second quarter of fiscal 2018 were up 79.2% from the year-ago quarter. Also, earnings surpassed the Zacks Consensus Estimate by 43.3%. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abbott (NYSE:ABT) reported third-quarter 2017 adjusted earnings from continuing operations of 66 cents per share, up 11.9% year over year. Third-quarter worldwide sales came in at $6.83 billion, up 28.8% year over year. Abbott carries a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Original post

Zacks Investment Research