Varian Medical Systems, Inc. (NYSE:VAR) is scheduled to report third-quarter fiscal 2017 earnings on Jul 26, after market close.

Last quarter, the company reported earnings of 89 cents per share, which beat the Zacks Consensus Estimate by a penny. However, adjusted earnings declined 18.3% on a year-over-year basis.

Factors at Play

We are particularly upbeat about Varian’s oncology business that accounted for around 95% of the company’s total revenue in second-quarter 2017. Notably, the company has been addressing both the tier 1 and mid-tier markets through its Edge, Truebeam and VitalBeam products and has also been winning international contracts in the oncology space. For the third quarter of fiscal 2017, Varian expects adjusted earnings per share in the range of 92 cents–96 cents and revenues are expected to increase about 3% on a year-over-year basis.

Further, strengthening its foothold in the oncology business, the company launched its FDA approved product Halcyon in May. Also, in June, the company signed an agreement with Vijametech and UPMC to establish radiation oncology centers in Vietnam.We are also upbeat about Varian’s prospects internationally where it primarily banks on proton therapy as an advanced treatment option for cancer patients. In this regard, we note that Varian Medical recently received Shonin approval in Japan to market the ProBeam system for proton therapy.

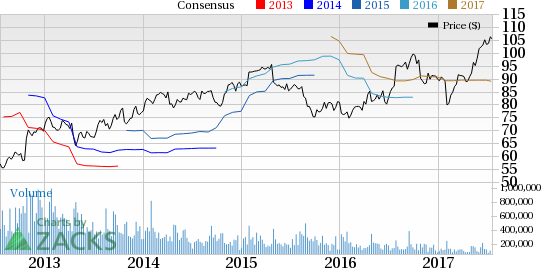

Varian Medical Systems, Inc. Price and EPS Surprise

This apart, Varian Medical recently entered into two international agreements concerning its Proton therapy platform. Bangkok-based King Chulalongkorn Memorial Hospital has selected its ProBeam Compact single-room proton therapy system for cancer treatment in Thailand along with Delray Medical Center in Florida.

We believe Western Europe, China and Africa present significant top-line growth opportunities in the near term. The company is opening new offices in Africa and the Middle East, which shows that it is aware of the opportunities in the region. Moreover, Varian’s strong product pipeline is a key catalyst.

Nevertheless, increasing local competition is a primary headwind. Unfavorable foreign currency might affect the company’s revenues in the to-be-reported quarter. Also, the company is exposed to seasonal demand fluctuations and higher operating expenses pertaining to increased investments targeted toward growth acceleration in geographical expansion and portfolio expansion.

Earnings Whispers

Our proven model does not conclusively show an earnings beat for Varian Medical this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Varian Medical currently has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 94 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Varian Medical carries a Zacks Rank #3 which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

Please note that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revision.

Stocks to Consider

Here are some companies you may consider as our model shows that they have the right combination of elements to post an earnings beat in the upcoming quarter:

Becton, Dickinson and Company (NYSE:BDX) has an Earnings ESP of +0.41% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Thermo Fisher Scientific Inc. (NYSE:TMO) has an Earnings ESP of +0.44% and a Zacks Rank #2.

Stryker Corporation (NYSE:SYK) has an Earnings ESP of +0.66% and a Zacks Rank #2.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Varian Medical Systems, Inc. (VAR): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post

Zacks Investment Research