For today’s edition of our upgrade list, we used our website’s advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. All of our upgrades today are rated STRONG BUY with the exception of Nordson, which is rated BUY.

For today’s bulletin, we take a look at Bed Bath & Beyond Inc (NASDAQ:BBBY).

Bed Bath & Beyond is a retailer offering a wide selection of domestics merchandise and home furnishings. The company’s mission is to be trusted by its customers as the expert for the home and heart-related life events. These include certain life events that evoke strong emotional connections such as getting married, moving to a new home, having a baby, going to college and decorating a room, which the company supports through its wedding and baby registries, new mover and student life programs, and its design consultation services. The company operates a robust ecommerce platform consisting of various websites and applications. The company also operates an established retail store base under the names of Bed Bath & Beyond, Christmas Tree Shops, Harmon, Harmon Face Values or Face Values, buybuy BABY, World Market, Cost Plus World Market or Cost Plus. The company’s strategy is based on building and delivering a strong foundation of differentiated products, and services and solutions.

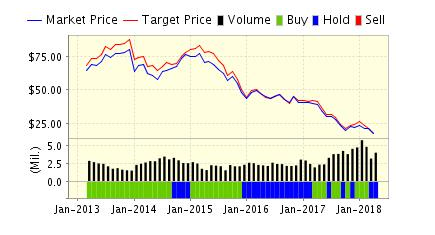

We have yet another retailer here, part of our big trend for 2018. Our models like this stock, but the street has not lately. They just reported Q4 2017 earnings last week, and investors were not pleased.

For the fiscal 2017 fourth quarter, the company reported net earnings of $1.41 per diluted share ($194.0 million), which included a net unfavorable $10.5 million tax expense related to the Tax Cuts and Jobs Act of 2017. Excluding the net unfavorable impact from the Tax Act, net earnings per diluted share in the fiscal 2017 fourth quarter would have been $1.48. Net earnings for the fiscal 2016 fourth quarter were $1.84 per diluted share ($268.7 million).

Net sales for the fiscal 2017 fourth quarter were approximately $3.7 billion, an increase of approximately 5.2% from the prior year quarter. Comparable sales in the fiscal 2017 fourth quarter decreased by approximately 0.6%, and included strong sales growth from the company’s customer-facing digital channels, and sales from stores that declined in the mid-single-digit percentage range.

In response to the latest numbers, the stock hit a 52-week low. The big problem was the company’s guidance moving forward. They have a negative outlook until 2020.

And what is the company best-known for? The ubiquitous coupons that provide 20% off to anyone with a pulse. While these giveaways are loved by the store’s hard-core fans, they are not helpful to the bottom line. Giving away profits just to get bodies into the store has not been a successful business model for retailers of home goods in the past.

And–yet again, we see the specter of Amazon) haunting a brick and mortar retailer. Does this company have what it takes to compete with that juggernaut? Can you even buy things from Bed, Bath & Beyond via the internet?

Nevertheless, our models calculate that this stock is a STRONG BUY because of its decent one-year forecast return. This may be a “buy on the dip” type opportunity here.

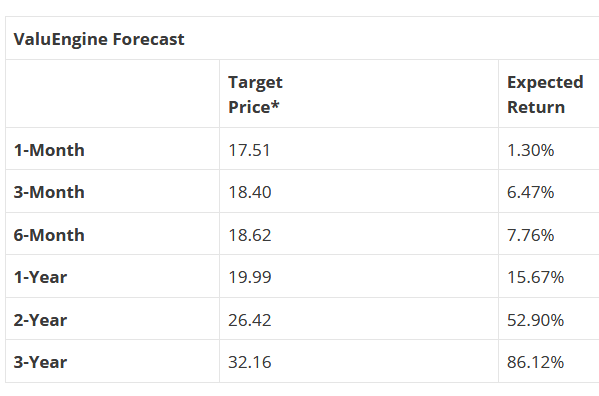

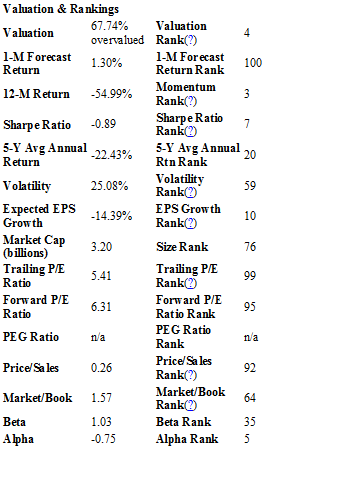

Below is our latest data for Bed Bath & Beyond (BBBY), one of our top STRONG BUY upgrades for the day.

ValuEngine updated its recommendation from BUY to STRONG BUY for BED BATH&BEYOND on 2018-04-13. Based on the information we have gathered and our resulting research, we feel that BED BATH&BEYOND has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Price Sales Ratio.

You can download a free copy of detailed report on Bed Bath & Beyond from the link below.