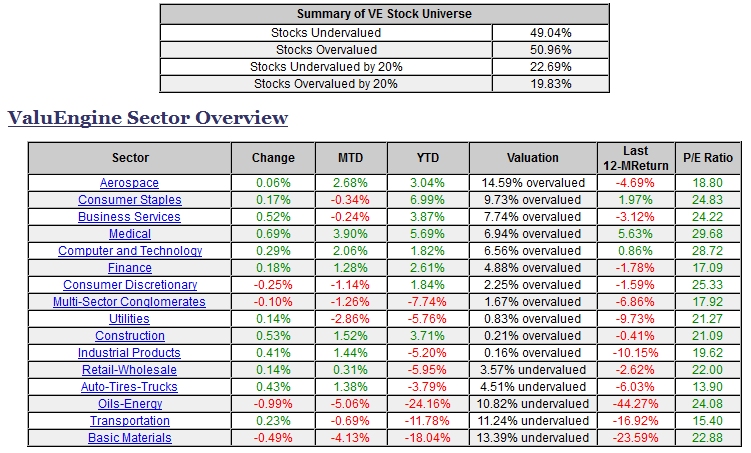

ValuEngine tracks more than 7000 US equities, ADRs, and foreign stocks that trade on US exchanges as well as @1000 Canadian equities. When EPS estimates are available for a given equity, our model calculates a level of mispricing or valuation percentage for that equity based on earnings estimates and what the stock should be worth if the market were totally rational and efficient--an academic exercise to be sure, but one which allows for useful comparisons between equities, sectors, and industries. Using our Valuation Model, we can currently assign a VE valuation calculation to more than 2800 stocks in our US Universe.

We combine all of the equities with a valuation calculation to track market valuation figures and use them as a metric for making calls about the overall state of the market. Two factors can lower these figures -- a market pullback or a significant rise in EPS estimates.

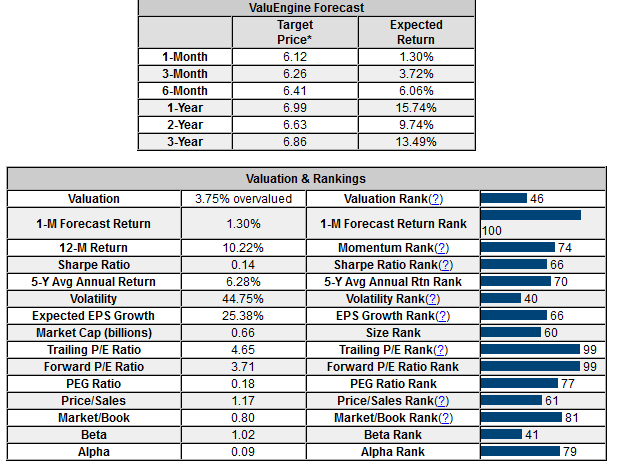

We also use trading data to provide forecast estimates for a variety of time horizons for almost ever equity in our database. Our Buy/Sell/Hold recommendations are based upon the 1-year forecast return figure. Using valuation and forecast figures, you can rank and rate our covered stocks against each other, to find out, in an objective and systematic way, the most attractive investment targets based on your own risk/reward parameters. We re-calculate the entire database every trading day, so you are assured that every proprietary valuation and forecast datapoint is as up-to-date as possible.

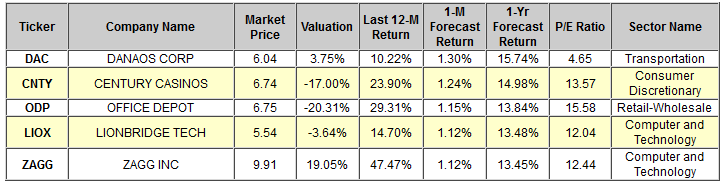

So, for today's bulletin we used our website's advanced screening functions to search for top-rated STRONG BUY US stocks that included valuation coverage. We further refined the list by selecting the most undervalued stocks according to our Valuation Model. These stocks are shown below, and presented in alphabetical order. Danaos Corporation (N:DAC) is the leader here.

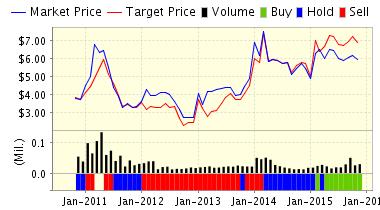

Below is today's data on Danaos Corporation:

Danaos Corporation is a leading international owner of containerships, chartering vessels to many of the world's largest liner companies. Danaos was set up by Dimitri Coustas, an experienced shipping investor who had been active in the industry. Having consistently developed sea transport services throughout its history, Danaos has forged a reputation for high-quality operational support to liner companies and other charterers throughout the world. The Company currently have a fleet of containerships aggregating TEU, making us among the largest containership charter owners in the world. We charter our containerships to a geographically diverse group of liner companies, including most of the largest ones globally. Such customers include Maersk (CO:MAERSKb), COSCO, Hapag Lloyd AG (DE:HLAG), CMA-CGM, Neptune Orient Lines Limited (SI:NEPS), Yang Ming Mari (TW:2609), China Shipping (HK:2866), Norasia Container Lines Ltd, Hyundai Merchant Marine (KS:011200), Wan Hai Lines (TW:2615) and Zim Israel Integrated Shipping Services Ltd.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on DANAOS CORP for 2015-11-27. Based on the information we have gathered and our resulting research, we feel that DANAOS CORP has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Book Market Ratio.