VALUATION WATCH: Overvalued stocks now make up 48.67% of our stocks assigned a valuation and 17.08% of those equities are calculated to be overvalued by 20% or more. Nine sectors are calculated to be overvalued--with two at or near double digits.

--A Yen for Profit... ValuEngine STRONG BUY Toyota Motor Corp Ltd Ord (NYSE:TM) Impresses with Earnings

Toyota Motor Corporation (TM) produces, sells, leases, and repairs passenger cars, trucks, buses, boats, airplanes and other products in Japan and most foreign countries. The Company is also involved in the businesses of real estate, civil engineering, insurance,etc. Toyota posted US sales figures this week and the numbers were rather flat with a 0.6% increase overall led by the ever-popular--and reliable--Camry model. The Tacoma and Tundra pick ups were also good sellers for the company--up more than 15%. Overall, the company is posting stronger earnings numbers thanks to a weaker yen and strong overseas sales. That blip in exchange rates helped boost the company to an increased profit rather than a decline. The company possesses stronger margins than its rivals and some good benefits from plants located within Japan. The question mark for Toyota--and all auto makers, remains China. That market is now in a position to make or break all of the manufacturers. It is too early to tell how a slowdown there will effect the bottom line.

ValuEngine continues its STRONG BUY recommendation on TOYOTA MOTOR CP for 2015-08-03.

Based on the information we have gathered and our resulting research, we feel that TOYOTA MOTOR CP has the probability to OUTPERFORM average market performance for the next year.The company exhibits ATTRACTIVE Company Size and P/E Ratio.

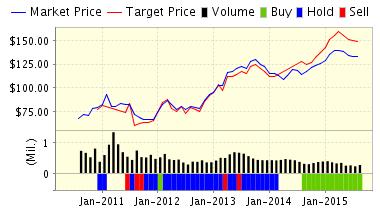

Below is today's more extensive data on TM: