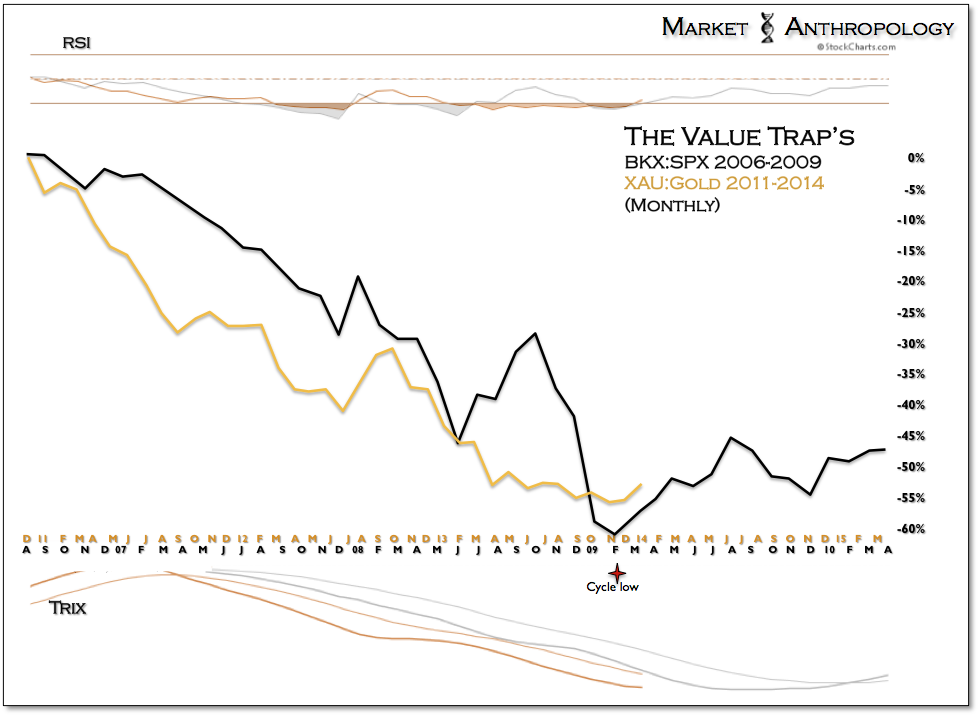

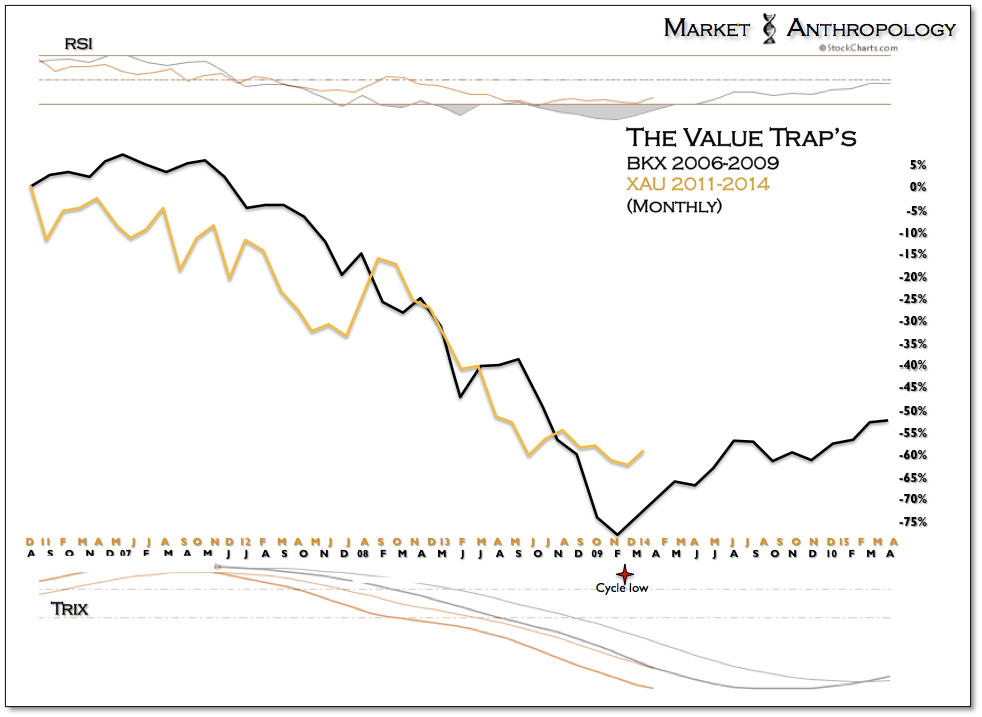

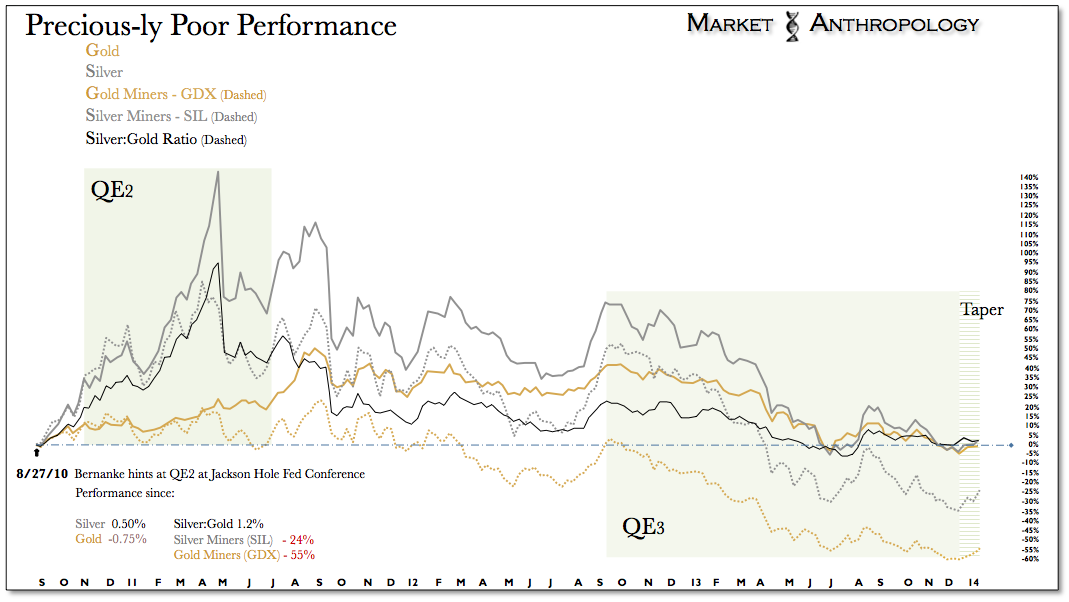

Here's another update of our Value Trap series that contrasts the precious metals miners with the biggest value trap of the previous cycle - the financials. Broadly speaking, the comparative looked at how a derivative sector capitulates - relative to its denominating backdrop. While we had been fervently bearish on the precious metals investment thesis since Q2-2011, we had looked for any further insights on what the end-game might look like. When we originally fit the markets last January, gold was still flirting with ~ $1700 an ounce, yet the comparative pointed towards a cycle low for the sector this past November. In essence, the work presented the perspective that the exhaustive move had yet to begin in spot prices - and therefore the mining sector likely still had significant room to run on the downside.

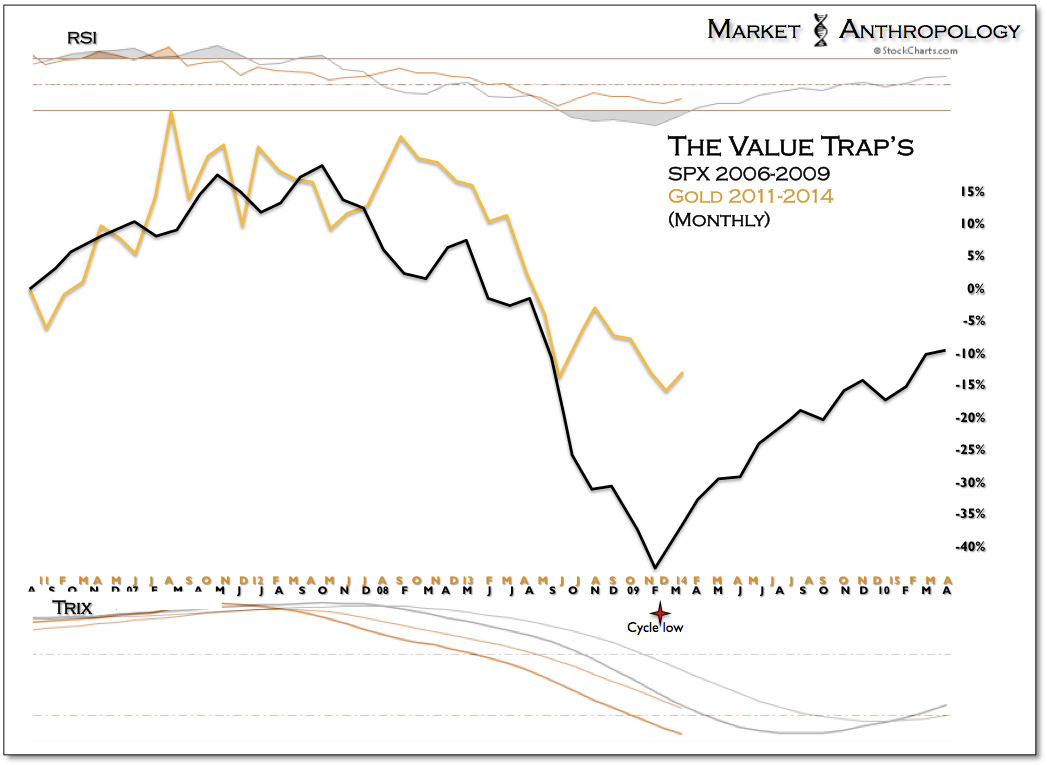

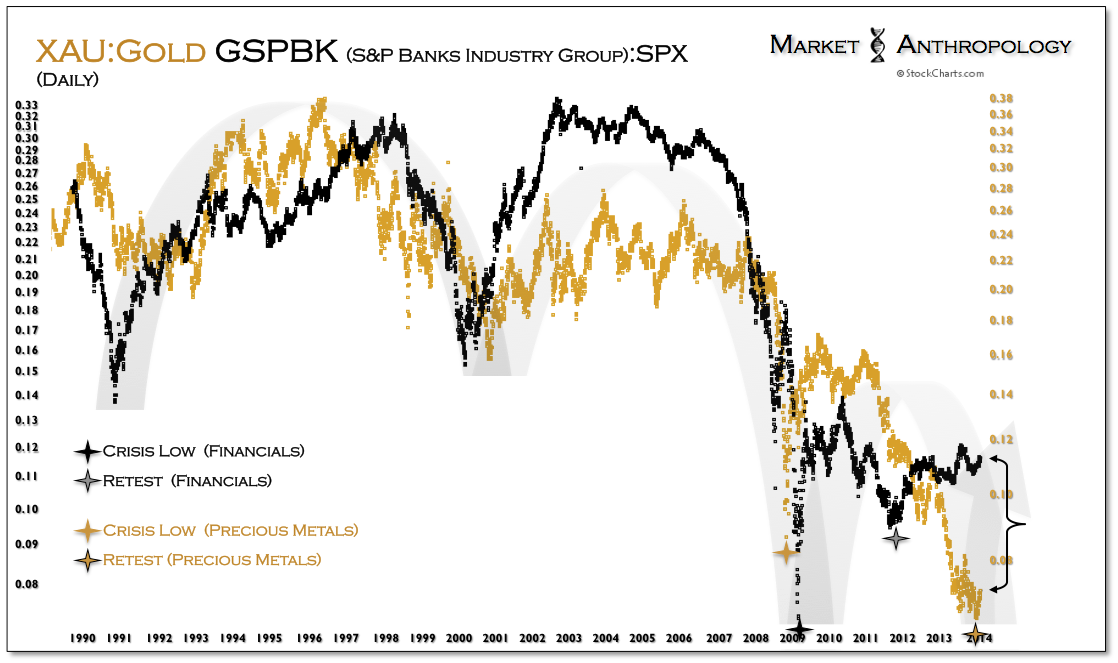

The study was normalized to the secondary highs preceding the downtrend pivot for each ratio - a ratio that was understood as a leading proxy for the underlying sector. The XAU Philadelphia Gold and Silver Index was chosen as a more representative basket for the overall gold and silver space - and the BKX Philadelphia Bank Index was used for the financial sector. The denominators (gold and the SPX) were chosen as the least volatile representatives for each sector.

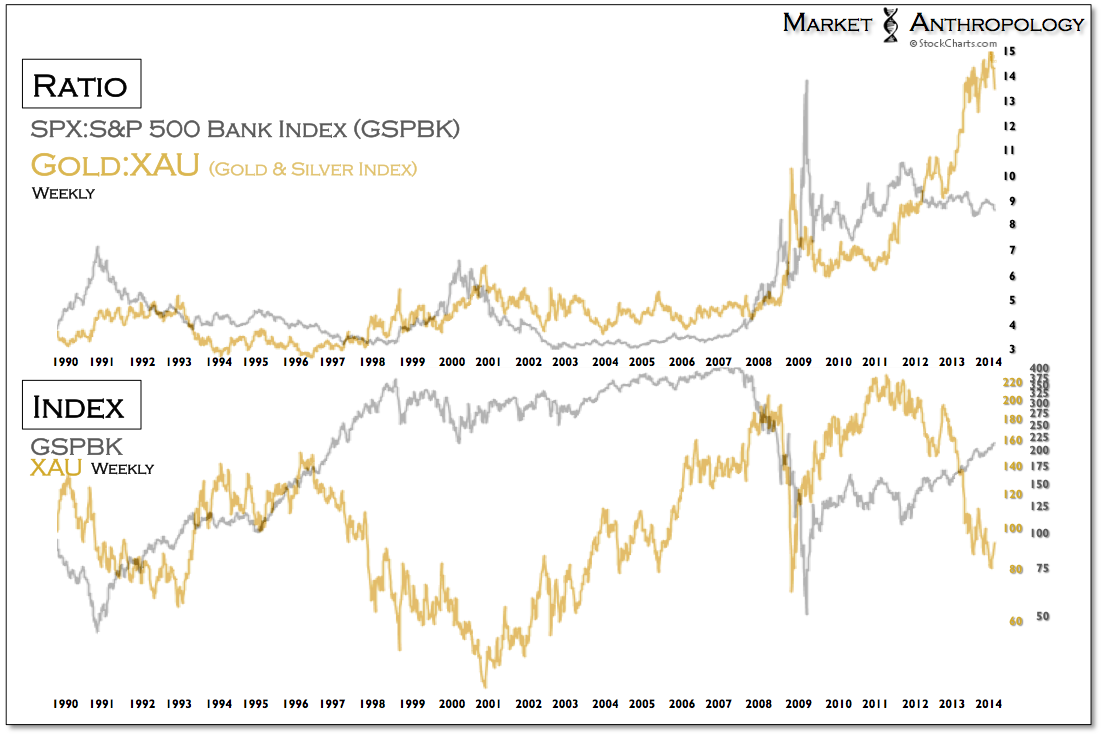

The general rationale behind the study was that from a historical point-of-view, the banks have been a leading proxy to gauge the overall health for the broader equity market cycle - both higher and lower. Very similar to how the miners led the bear market in spot prices by several months this time around, the banks - relative to the SPX - started to strongly underperform the market way back in the summer of 2006.

While some might question if the miners could be used as a proxy - or even a leveraged play on the overall space, we would strongly argue they would be ignoring how presciently they turned first and heavily underperformed spot prices throughout the most recent bear market. Just like the financials in the previous cycle, they became in fact a very leveraged short on the broader investment thesis over the past three years. From our perspective, it seems reasonable to expect that similar to the financials the inverse dynamic should materialize as the sector turns out of the bear market lows found last year.

The chart below which we have brought up periodically over the past year depicts how both ratios have trended together over the past twenty five years. We had used the S&P Banks Industry Group (GSPBK) in this series - rather than the BKX, simply because the data went further back.

Comparatively speaking, we maintain the perspective that the most recent lows found in the XAU are a retest of the crisis lows found during the financial crisis.The twist, however - and as indicated in the Value Trap series, is that the ratio extremes in performance of the miners relative to spot prices, had occurred during the retest - rather than during the crisis itself. Like the financials, we continue to believe that the reflexive bounce in the miners should run commensurate with the reversion from the historic extreme found in the ratio today. Having said that, we find it interesting that from a purely simpleton technical perspective, the long-term uptrend in the XAU that began in late 2000 has continued to make higher highs and higher lows - despite the perennial pressures maintained across the sector over the past three years.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Value Trap Update: Mining For Gold

Published 01/19/2014, 12:29 AM

Updated 07/09/2023, 06:31 AM

Value Trap Update: Mining For Gold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.