Ten short weeks ago, financial journalists celebrated a growth stock renaissance in 2012, applauding the super-sized gains for growth funds and downplaying the performance of value-oriented counterparts. Year-to-date (through 10/1), large-company growth mutual funds had amassed 17.1% whereas large-cap value mutual funds had picked up 14.3%.

John Wagoner of USA Today explained that the lag had to do with the remarkable upside in Apple. The author also noted, albeit briefly, that the gap between growth and value had narrowed considerably in the third quarter. Astute readers would have been wise to recognize that such a narrowing was evidence of a style shift.

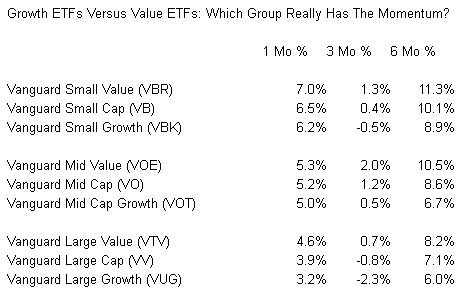

Not surprisingly, fiscal cliff fears and Apple’s -25% drawdown contributed to an ongoing migration to “Value Stock ETFs.” So much so, in fact, that the value style for all market capitalization levels (i.e., large company, mid-sized company, small company) beat the growth style at all market capitalization levels over the past one, three and six months.

A key takeaway here is, for all the concerns about the cliff’s adverse impact on dividend stocks, tax-gain harvesters went after their biggest capital appreciators (e.g., Apple, etc.) with an equal amount of ardor. It seems that, in the end, slower-growing dividend yielders still provide a measure of safety in volatile markets; value trumps growth during squeamish bulls.

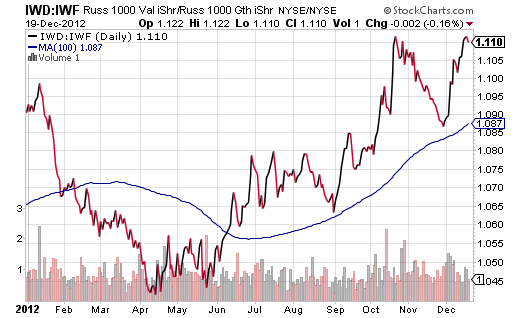

Even if you’d rather look at the year in aggregate, rather than over the last six months, value is still on top. Bill Maurer looked at the year-to-date performance (through 12/17) of iShares ETFs. iShares Russell 1000 Value (IWD) outperformed iShares Russell 1000 Growth (IWF), iShares Russell Midcap Value (IWS) outhustled iShares Ruselll Midcap Growth (IWP) and iShares Russell 2000 Value (IWN) beat iShares Russell 2000 Growth (IWO).

Granted, when tilting a portfolio one way or another -- big, small, value, growth, high beta, low beta -- the move must be made when the trend is in its early stages of development. It follows that what has already transpired may not be indicative of what will transpire in the weeks and months ahead.

One method for determining significant changes in relative strength is to check price ratios. A rising IWD:IWF price ratio tells me that the trend favoring value is still intact. Moreover, as long as IWD:IWF remains above an intermediate-term moving average like the 100-day, I am favoring dividend and value producers.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Value ETFs Have Momentum Growth Investors Crave

Published 12/20/2012, 01:05 PM

Value ETFs Have Momentum Growth Investors Crave

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.