The Valspar Corporation (NYSE:VAL) said that it will be expanding production capacity at its Singapore facility to meet rising demand for its food and beverage packaging products in the Asia-Pacific region.

The expansion places the company to meet rising customer demands and leverage robust growth in that region. The company will also be able to make higher volumes of both existing and new technologies, including non-BPA coating solutions for the food and beverage markets. The expansion is expected to come on stream in 2017.

Recently, Valspar stated that its shareholders have voted in favor of the company's proposed acquisition by The Sherwin-Williams Co. (NYSE:SHW) at the former’s Special Meeting of Shareholders. The transaction is expected to conclude by the end of the first quarter of calendar year 2017.

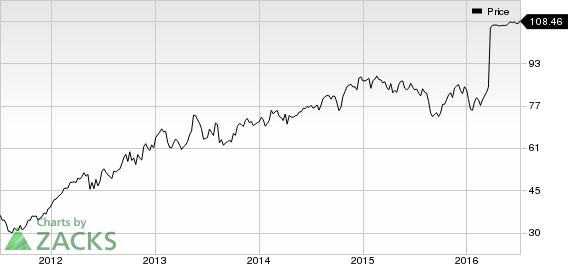

Valspar saw its profits decline roughly 9.2% year over year to 99 cents per share in second-quarter fiscal 2016 (ended Apr 29). Adjusted earnings of $1.22 per share missed the Zacks Consensus Estimate of $1.26. Revenues of $1.06 billion also trailed the Zacks Consensus Estimate of $1.12 billion. However, revenues from the paints segment saw an increase of 1% year over year to $407 million, although currency headwinds hurt sales by 2%.

Valspar, which is one of the prominent paint makers, along with Akzo Nobel (OTC:AKZOY) and PPG Industries (NYSE:PPG) , withdrew its guidance for fiscal 2016 in May 2016 in light of the impending merger with Sherwin-Williams.

Valspar is exposed to currency headwinds and volatility in raw material costs which can invariably reduce the company's profit margins. Moreover, the overall demand environment remains uneven.

Valspar currently holds a Zacks Rank #4 (Sell).

PPG INDS INC (PPG): Free Stock Analysis Report

AKZO NOBEL NV (AKZOY): Free Stock Analysis Report

VALSPAR CORP (VAL): Free Stock Analysis Report

SHERWIN WILLIAM (SHW): Free Stock Analysis Report

Original post

Zacks Investment Research