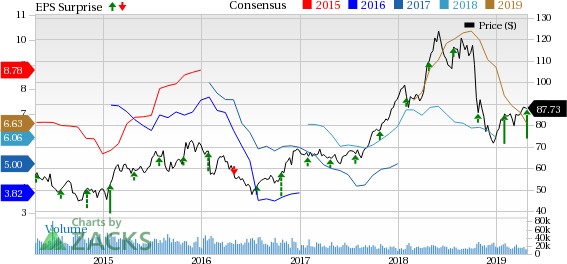

Valero Energy Corporation (NYSE:VLO) posted first-quarter 2019 income of 34 cents per share, beating the Zacks Consensus Estimate of 20 cents. However, quarterly earnings decreased from the year-ago figure of $1.00 per share.

Moreover, total revenues fell 8.2% from $26,439 million in the prior-year quarter to $24,263 million. However, the top line surpassed the Zacks Consensus Estimate of $23,574 million.

The better-than-expected results can be attributed to higher average ethanol production volumes and the expansion of the Diamond Green Diesel plant. It was partially offset by lower refining throughput volumes.

Segmental Performance

Gross operating income from the Refining segment plunged to $479 million from $811 million in the year-ago quarter and missed the Zacks Consensus Estimate of $690 million. The downside was caused by lower discounts for medium and heavy sour crude oils compared with Brent crude oil, and weak gasoline margins.

In the Ethanol segment, the company reported gross operating income of $3 million, lower than $45 million in the year-ago quarter. The downside was caused by lower ethanol prices.However, the reported figure beat the Zacks Consensus Estimate of operating loss of $24.1 million on the back of higher average ethanol production volumes.

The company created a new segment during the quarter, namely Renewable Diesel, which incorporated the operations of a consolidated joint venture, Diamond Green Diesel. Gross operating income from the segment was $49 million, which was supported by the expansion of the Diamond Green Diesel plant.

Gross expenses in the Corporate and other segment totaled $209 million compared with the prior-year level of $238 million.

Throughput Volumes

During the quarter, refining throughput volumes were approximately 2.9 million barrels per day (BPD), down 66,000 BPD from the prior-year quarter. Refinery throughput capacity utilization in the reported quarter was 91%.

By feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 51.5%, 11.8% and 14.3%, respectively. The remaining volumes came from residuals, other feedstock, and blendstocks and others.

The Gulf Coast contributed approximately 58.3% to the total throughput volume. The Mid-Continent, North Atlantic and West Coast regions accounted for 15.4%, 17.1% and 9.2%, respectively.

Throughput Margins

Refining margin per barrel of throughput decreased to $7.97 from the year-ago level of $8.65.

Refining operating expense per barrel was $4.15 compared with $3.83 in the year-ago quarter. Depreciation and amortization expenses increased to $1.96 a barrel from $1.74 in the prior-year quarter.

Share Repurchase

Valero returned $411 million to its shareholders, of which $36 million was used to repurchase around 414,000 shares of its common stock and award shareholders with dividends worth $375 million.

Capital Expenditure & Balance Sheet

First-quarter capital expenditure totaled $726 million, including $453 million for sustaining the business.

At the end of the quarter, the company had cash and temporary cash investments of $2.8 billion, and debt of $10.1 billion. The debt-to-capitalization ratio was 26%.

Outlook

Valero expects product fundamentals of gasoline to improve and distillate inventories to stay low in the near future. Global economic growth is anticipated to boost the company’s product demand.

Valero expects capital expenditure of $2.5 billion for 2019 and 2020. Around 40% of the budget will be used in growth projects. Notably, the company’s Houston alkylation unit and central Texas pipelines and terminals are projected to be completed in the second and third quarters of 2019, respectively. The Pasadena terminal, St. Charles alkylation unit and Pembroke cogeneration unit are expected to come online in 2020. Moreover, the company’s Diamond Green Diesel expansion and Port Arthur Coker projects are scheduled to be completed in 2021 and 2022, respectively.

Zacks Rank and Stocks to Consider

Currently, Valero has a Zacks Rank #3 (Hold). Investors interested in the energy sector can opt for some better-ranked stocks as given below:

Fort Lauderdale, FL-based Seacor Holdings Inc. (NYSE:CKH) is an oil and gas equipment and services provider. Its bottom line in 2019 is anticipated to improve 2% from the prior-year quarter. The company has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based Archrock, Inc. (NYSE:AROC) is a midstream energy infrastructure company. Its bottom line in first-quarter 2019 is expected to improve 39.6% from the year-ago period. The company has a Zacks Rank #2 (Buy).

Los Angeles, CA-based ProPetro Holding Corp. (NYSE:PUMP) is an oilfield services provider. Its bottom line in 2019 is expected to grow 21% year over year. The company has a Zacks Rank #2.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft (NASDAQ:MSFT) stock in the early days of personal computers… or Motorola (NYSE:MSI) after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Valero Energy Corporation (VLO): Free Stock Analysis Report

Archrock, Inc. (AROC): Free Stock Analysis Report

SEACOR Holdings, Inc. (CKH): Free Stock Analysis Report

ProPetro Holding Corp. (PUMP): Free Stock Analysis Report

Original post

Zacks Investment Research