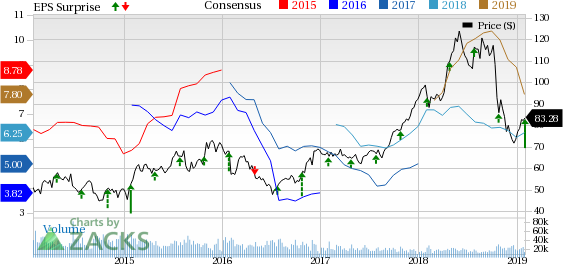

Valero Energy Corp (NYSE:VLO) posted fourth-quarter 2018 income of $2.12 per share, beating the Zacks Consensus Estimate of $1.03. Quarterly earnings improved from the year-ago quarter’s figure of $1.16.

Total revenues grew 8.9% year over year to $28,730.0 million from $26,392.0 million. The figure surpassed the Zacks Consensus Estimate of $23,256.0 million.

In 2018, adjusted earnings came in at $7.37, up 48.6% from the year-ago level of $4.96. The bottom line also beat the Zacks Consensus Estimate of $6.25. Revenues jumped 24.5% year over year to $117,033 million and outpaced the consensus mark of $111,690 million.

Higher throughput margin owing to 96% throughput capacity utilization supported Valero Energy’s impressive fourth-quarter results.

Q4 Segmental Performance

Gross operating income in the Refining segment increased to $1.5 billion from $971 million in the year-ago quarter and beat the Zacks Consensus Estimate of $981 million. The upside can be attributed to higher throughput margin owing to 96% throughput capacity utilization. Moreover, wider spreads between domestic sweet crude oil and Brent contributed to growth.

In the Ethanol segment, the company reported gross operating loss of $27 million, against operating income of $37 million in the year-ago quarter and wider than the Zacks Consensus Estimate of operating loss of $26.9 million. The downside was caused by lower ethanol prices.

Gross operating income in the VLP segment was $88 million, up from $80 million in the prior-year quarter and that beat the Zacks Consensus Estimate of $85 million. The upside can be attributed to new acquisitions made in the end of 2017. The acquired assets that boosted growth were the Port Arthur terminal assets and Parkway Pipeline.

Gross expenses in the Corporate and other segment totaled $230 million compared with the prior-year quarter’s level of $237 million. Also, the figure beat the Zacks Consensus Estimate of $221 million.

Throughput Volumes

During the quarter, refining throughput volumes were approximately 3 million barrels per day, in line with the prior-year quarter’s tally.

By feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 48.6%, 13.5% and 14.8%, respectively. The remaining volumes came from residuals, other feedstock as well as blendstocks and others.

The Gulf Coast contributed approximately 60% of the total throughput volume. The Mid-Continent, North Atlantic and West Coast regions accounted for 15%, 16% and 9%, respectively.

Throughput Margins

Refining margin per barrel of throughput increased to $11 per barrel from the year-ago quarter’s level of $8.75 per barrel.

Refining operating expense per barrel was $3.92 compared with $3.58 in the year-ago quarter. Depreciation and amortization expenses increased year over year to $1.72 a barrel from $1.60 in the prior-year quarter.

Capital Expenditure & Balance Sheet

Fourth-quarter capital expenditure totaled $771.0 million, including $254 million for turnarounds and catalyst expenditures. At the end of the quarter, the company had cash and temporary cash investments of $3 billion as well as debt of $9.1 billion. Valero Energy returned $965 million to shareholders, of which $627 million was used to repurchase 7.7 million of its common stock and award shareholders with dividends worth $338 million.

Valero Energy’s 2018 capital expenditures totaled $2.7 billion. For 2019 and 2020, Valero expects capital expenditures of $2.5 billion. Of the total, about 60% is for sustaining the business and about 40% will be allocated toward growth projects.

Q4 Price Performance

During the October-to-December quarter, Valero Energy’s shares lost 34.2% compared with the industry’s 27.6% fall.

Zacks Rank & Key Picks

Valero currently carries a Zacks Rank #3 (Hold).

A few better-ranked players in the energy space are Evergy, Inc (NYSE:EVRG) , Sunoco L.P (NYSE:SUN) and Contura Energy (NYSE:CTRA) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Evergy, through its operating subsidiaries Kansas City Power & Light Company (KCP&L) and Westar Energy, Inc, provides clean, safe and reliable energy in Kansas and Missouri. The company delivered average negative earnings surprise of 11.1% in the last four quarters.

Headquartered in Houston, TX, Sunoco operates as a wholesale fuel distributor. The company is expected to witness year-over-year earnings decline of 38.9% in 2018.

Bristol, U.S-based Contura Energy is a mining company. The company generated average negative surprise of 17.9% in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Sunoco LP (SUN): Get Free Report

Valero Energy Corporation (VLO): Get Free Report

CONTURA ENERGY (CTRA): Get Free Report

Evergy Inc. (EVRG): Free Stock Analysis Report

Original post

Zacks Investment Research