Oil and gas refiner Valero Energy (NYSE:VLO) stock has had a strong 2021 performance with shares up over 30% as COVID-19 vaccinations accelerate the global re-opening. While the global decarbonization movement and adoption towards clean energy and renewables are strong tailwinds, the reality is that oil and gas have a long runway.

The rally in energy prices are driven by more cars on the roads, airplanes flying out and soon ships sailing again. Valero is one of the two largest oil refiners in the nation. Just as the hacker attack on the Colonial Pipeline exposed how vulnerable the nation’s energy infrastructure can be. Colonial transports nearly 2.5 million barrels of fuel daily from gas, diesel to jet fuel.

Refineries are just as important if they are shut down as evidenced by the temporary shutdowns during the rare artic freeze that hit Gulf Coast and Texas refineries in February through March 2021. This caused a decrease of 2.4 million barrels per day in February, just as bad as Colonial’s impact. Whether clean energy advocates want to admit it or not, the refineries and pipelines are a key component of the nation’s energy infrastructure. The significance tends to arise during crisis situations that affect the present. Valero has prioritized reducing carbon emissions and storage through various projects. Prudent investors looking for exposure in a critical energy infrastructure play can watch shares of VLO for opportunistic pullback entries.

Q1 FY2021 Earnings Release

On Apr. 22, 2021, Valero released its fiscal first-quarter 2021 results for the quarter ending March 2021. The Company reported an earnings-per-share (EPS) loss of (-$1.73) versus consensus analyst estimates for (-$0.77), a (-$0.96) miss. Revenues fell (-5.9%) year-over-year (YoY) to $20.81 billion missing analyst estimates for $17.42 billion.

The shortfall was mostly due to Winter Storm Uri which impacted U.S. Gulf Coast and U.S. Mid-Continent regions. This cut average daily refinery volumes by 414,000 per day. The Company continues to pursue projects to lower the carbon intensity of its products. The Company announced the partnering with BlackRock (NYSE:BLK) and Navigator for large-scale carbon capture and storage system in the Midwest for its eight ethanol plants to store five million metric tonnes of CO2 per year. Capex is expected to be $2 billion in 2021 split 60/40 for sustainable business and for growth projects.

Conference Call Takeaways

CEO Gorder set the tone:

“The refining business saw a strong recovery in the first quarter as various pandemic imposed restrictions were east or withdrawn and as more and more people received vaccinations. However, Winter Storm Uri disrupted many U.S. Gulf Coast and Mid-Continent facilities in February due to the freeze and utilities curtailments. Although our refineries and plants in those regions were also impacted, they did no suffer and significant mechanical damage and were started within a short period after the storm.”

The Company did incur high energy costs and the storm resulted in a 60 million barrel drawdown in U.S. surplus inventories. The Company intends to continue bolster its tax credit benefit for CO2 capture and storage through refinery optimization projects. He summed it up:

“As we head into summer, we believe that there’s a pent-up desire among much of the population to travel and take vacations, which should drive incremental demand for transformation fuels. We’re already seeing a strong recovery in gasoline and diesel demand at 93% and 100% or pre-pandemic levels respectively.”

Jones Act Waiver

After the Colonial Pipeline outage, sources claimed Valero and a number of refiners were granted Jones Act Waivers to ease fuel constraints between Gulf Coast and East Coast ports on May 13, 2021. This allows refiners to ship fuel aboard foreign flag vessels to hard hit east coast ports, as opposed to U.S. only ships containing U.S. crew and American built ships between U.S. ports.

VLO Price Trajectories

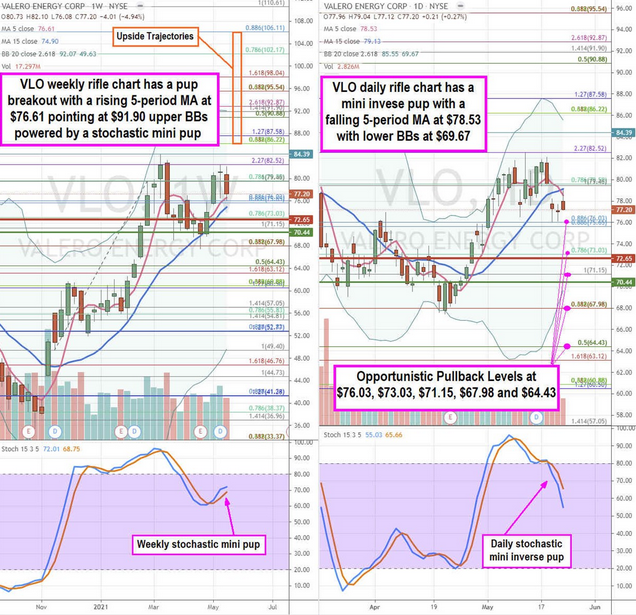

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for VLO stock. The weekly rifle chart has a pup breakout that peaked off the $82.52 Fibonacci (fib) level. The rising weekly 5-period moving average (MA) is at $76.61 and 15-period MA support at $74.90. The weekly stochastic is notably bullish above the weekly 5-period MA as it formed a mini pup. The weekly upper Bollinger Bands (BBs) sit at the $91.90 fib. This is a case of the unstoppable force (weekly pup breakout) versus the immovable object ($82.52 fib). The weekly market structure high (MSH) sell triggers under $72.65, thus become the key line in the sand support. The daily rifle chart is attempting to breakdown as the falling 5-period MA continues to drop at $78.53 driven by the bearish stochastic mini inverse pup oscillation down. The daily market structure low (MSL) buy triggered on the breakout through $70.44, which makes this level the final line in the sand for bulls to hold. Prudent investors can take advantage of the daily downturn to track opportunistic pullback entry levels at the $76.03 fib, $73.03 fib, $71.15 fib, $67.98 fib, and the $64.42 fib. Upside trajectories range from $5.40 on up to the $8 fib.