Valero Energy Corporation ( (NYSE:VLO) ) is the largest independent refiner and marketer of petroleum products in the U.S. It has a refining capacity of 3.1 million barrels per day across 15 refineries located throughout the U.S., Canada and the Caribbean. Valero is also a leading ethanol producer with 11 ethanol plants in the Midwest that have a combined capacity of 1.4 billion gallons per year.

The company is one of the major independent retailers of refined petroleum products in central and southwestern U.S. and in eastern Canada, with about 7,500 retail outlets under various brand names, including Diamond Shamrock, Shamrock and Beacon.

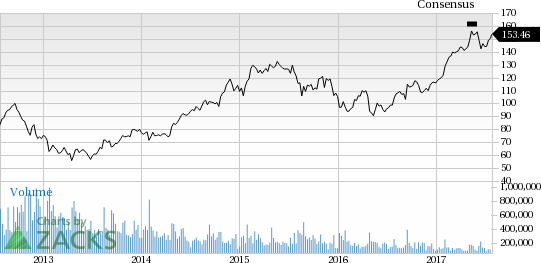

Currently, Valero has a Zacks Rank #3 (Hold) but that could change following its second quarter 2017 earnings report which has just released. We have highlighted some of the key details from the just-released announcement below:

Earnings: Valero beats on earnings. Adjusted earnings per share from continuing operations came in at $1.23, above the Zacks Consensus Estimate of $1.08.

Revenue: Revenues of $22.3 billion surpassed the Zacks Consensus Estimate of $21.5 billion.

Key Stats: During the quarter, refining throughput volumes were approximately 3.02 million barrels per day, up from 2.83 million barrels per day in the year-earlier level.

By feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 43.3%, 16.8% and 17.1%, respectively. The remaining volumes came from residuals, other feedstock as well as blendstocks and others.

Company-wide throughput margins increased to $8.66 per barrel from the year-ago level of $8.59 per barrel.

(You can see the complete list of today’s Zacks #1 Rank stocks here)

Check back later for our full write up on this Valero earnings report later!

"More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>> "

Valero Energy Corporation (VLO): Free Stock Analysis Report

Original post

Zacks Investment Research