Vale SA (NYSE:VALE) was upgraded by Vetr from a "hold" rating to a "buy" rating in a research report issued to clients and investors on Saturday, MarketBeat.com reports.

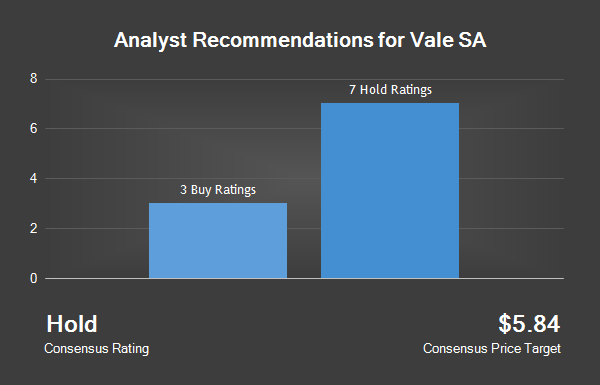

Several other equities analysts have also recently issued reports on the stock. Jefferies Group set a $6.00 price objective on shares of Vale SA and gave the stock a "hold" rating in a research note on Thursday, September 22nd. RBC Capital Markets reaffirmed a "sector perform" rating and issued a $6.00 price objective (up previously from $5.50) on shares of Vale SA in a research note on Thursday, September 8th. Royal Bank Of Canada lifted their price objective on shares of Vale SA from $5.50 to $6.00 and gave the stock a "sector perform" rating in a research note on Thursday, September 8th. Morgan Stanley raised shares of Vale SA from an "underweight" rating to an "equal weight" rating and lifted their price objective for the stock from $4.80 to $6.20 in a research note on Tuesday, August 9th. Finally, Barclays PLC raised shares of Vale SA from an "underweight" rating to an "equal weight" rating and set a $5.11 price objective on the stock in a research note on Wednesday, September 21st. Seven research analysts have rated the stock with a hold rating, four have given a buy rating and one has given a strong buy rating to the stock. Vale SA has an average rating of "Buy" and a consensus price target of $5.77.

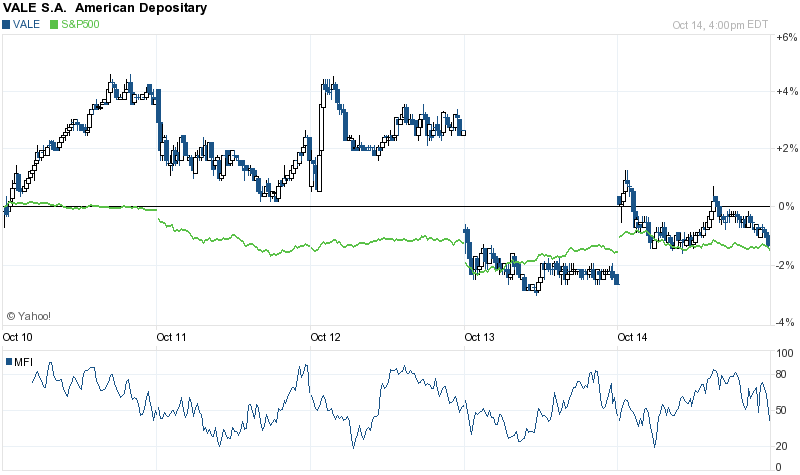

Vale SAtraded up 0.90% during mid-day trading on Friday, reaching $5.58. 29,115,120 shares of the company traded hands. The stock has a 50-day moving average of $5.45 and a 200 day moving average of $5.10. The stock's market capitalization is $28.76 billion. Vale SA has a 52-week low of $2.13 and a 52-week high of $6.26.

Hedge funds and other institutional investors have recently made changes to their positions in the company. Capital Growth Management LP boosted its position in shares of Vale SA by 125.8% in the second quarter. Capital Growth Management LP now owns 7,000,000 shares of the company's stock valued at $35,420,000 after buying an additional 3,900,000 shares during the last quarter. Van ECK Associates Corp boosted its stake in Vale SA by 49.7% in the second quarter. Van ECK Associates Corp now owns 2,291,058 shares of the company's stock valued at $11,593,000 after buying an additional 760,668 shares in the last quarter. Exane Derivatives bought a new stake in Vale SA during the second quarter valued at approximately $10,106,000. American Century Companies Inc. bought a new stake in Vale SA during the second quarter valued at approximately $9,768,000. Finally, ClariVest Asset Management LLC bought a new stake in Vale SA during the second quarter valued at approximately $7,786,000.

About Vale SA

Vale SA (Vale) is a metals and mining company. The Company is also a producer of iron ore and iron ore pellets, and nickel. The Company's segments include Ferrous minerals, Coal, Base metals, Fertilizers and Others. Its Ferrous minerals segment consists of the production and extraction of ferrous minerals, as iron ore, pellets and its logistic services, manganese and ferroalloys, and other ferrous products and services.