Shares of Cummins Inc. (NYSE:CMI) scaled a fresh 52-week high of $173.77 on Jul 1, before closing the session at $172.86.

The company has a market cap of roughly $27 billion and average volume of shares traded in the past three months was around 1,199.6K. The company has expected long-term earnings per share (EPS) growth rate of 8%.

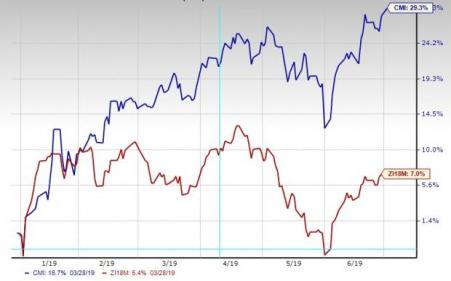

Year to date, the stock has rallied 29.3% compared with the sector’s rise of 7%.

Driving Factors

Strong performance in North America, higher truck production, rising sales of construction equipment and improved power generation equipment sales to data center customers are contributing to the rally in Cummins’ shares.

For the current fiscal, the company expects EBITDA to be 16.25-16.75%, as a percentage of sales, compared with previously projection of 15.75-16%. Moreover, the company anticipates returning 75% of operating cash flow to shareholders in forms of dividends and share repurchases.

The stock has impressive record of positive earnings surprises. The company’s earnings missed the consensus mark in only one of the last four quarters. In the last reported quarter, the company generated EPS of $4.2 that surpassed the Zacks Consensus Estimate of $3.51. Currently, the stock has a VGM score of A.

For 2019, the company expects heavy-duty truck production in North America to improve 5% year over year to 300k units from the prior view of 292k units, with market share of 32-34%. For the medium-duty truck market, the company expects an increase of 6% year over year to 140,000 units, with market share of 74-76%.

Zacks Rank & Other Stocks to Consider

Cummins currently sports a Zacks Rank #1 (Strong Buy).

A few other top-ranked stocks in the auto space are PACCAR Inc (NASDAQ:PCAR) , CarMax, Inc (NYSE:KMX) and AutoZone, Inc (NYSE:AZO) , each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PACCAR has an expected long-term growth rate of 8.4%. In the past six months, shares of the company have gained 27.8%.

CarMax has an expected long-term growth rate of 12.6%. In the past six months, shares of the company have surged 40.8%.

AutoZone has an expected long-term growth rate of 12.2%. In the past six months, shares of the company have rallied 30%.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

CarMax, Inc. (KMX): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

AutoZone, Inc. (AZO): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research