Main macro themes

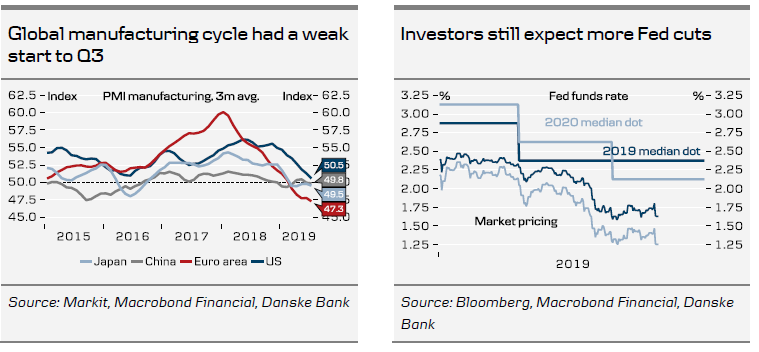

The Fed cut its target range by 25bp to 2.00-2.25% as expected and repeated its easing bias ("will act as appropriate to sustain the expansion"). Investors were disappointed Powell did not pre-commit to more cuts. We expect two more Fed cuts (September and December) but the Fed is more ad hoc than previously. For more, see FOMC review: 'Mid-cycle adjustment' without pre-commitment , 1 August.

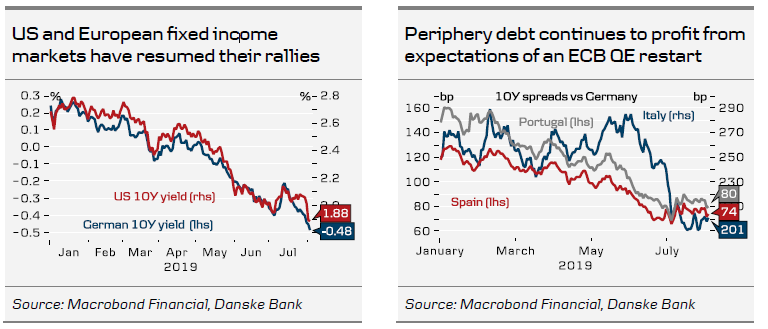

The ECB fell short of validating markets' dovish expectations by refraining to cut rates at the July meeting. However, Mario Draghi still delivered a very dovish policy message, all but confirming that a big stimulus package will be unveiled in September. We took note in particular of the ECB's newfound emphasis on the symmetry of the inflation target (see ECB Review - The Grande Finale is scheduled for 12 September , 25 July ).

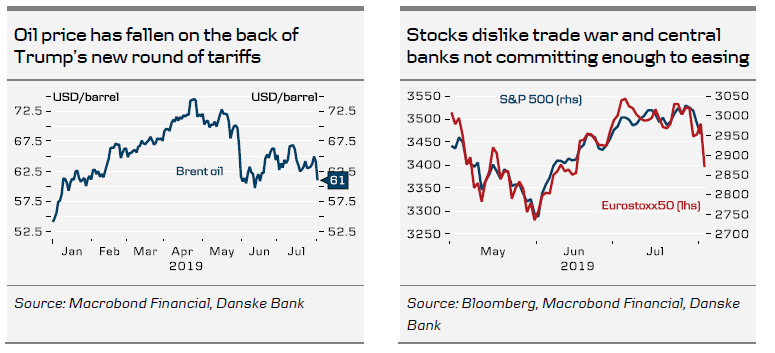

Trump escalated the trade war by imposing 10% tariffs on an additional USD300bn of imported goods from China. China says this strategy only markets it harder to make a deal. A deal is moving further away, as we are back in a deadlock with no signs of movement. See also China Weekly Letter: Trump continues failing strategy, trade deal is far away , 2 August.

Fears of a no deal Brexit have increased , as the EU and the UK have both toughened their rhetoric. Still, another extension or snap election are the two most likely outcomes ahead of the 31 October deadline, see Brexit Monitor: There is always a but , 29 July.

Fixed income developments

Global yields have continued to edge lower after the ECB meeting last week that paved the way for easing at the September meeting. The July FOMC meeting was a mild disappointment for fixed income markets as Powell fell short of promising a series of rate cuts. However, the market is once again pricing more than three rate cuts over the next 12 months after Trump announced new China tariffs. An increasing share of the global bond market is trading at negative yields . The German yield curve is nearly trading fully below zero.

FX developments

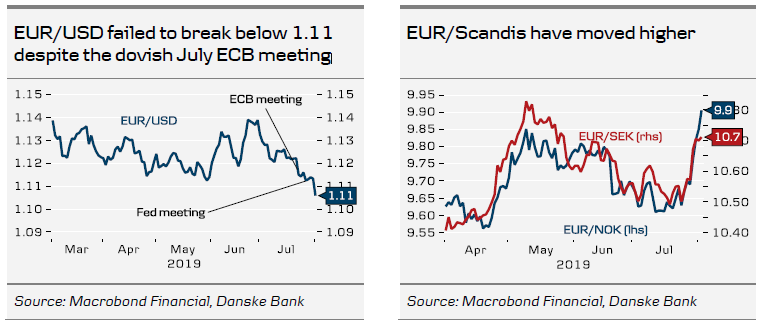

The most important move in FX markets over the past weeks has arguably been the rise in the USD and EUR/USD setting two-year lows below 1.11. Initially, the USD rebound was driven by US data outperforming peers. However, the latest leg has been driven by the FOMC delivering a less committed easing message to markets, returning the dollar to the position of an attractive long in a low FX volatility environment. The stronger USD, lower commodity prices and the shaky global environment for global risk appetite have been negative for commodity currencies (AUD, NZD, CAD, NOK) and high beta currencies such as the SEK. USD/CNY has moved back into the mid-6.90s on the escalating trade war. EUR/GBP has shifted above 0.91 on the back of weak UK data and markets pricing various Brexit scenarios with Boris Johnson as the new Prime Minister.

Market themes in pictures

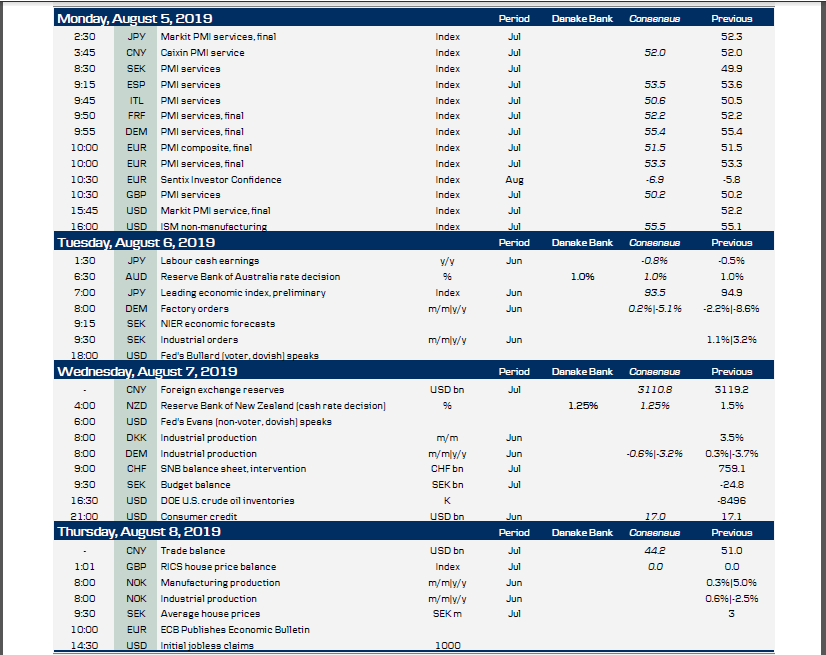

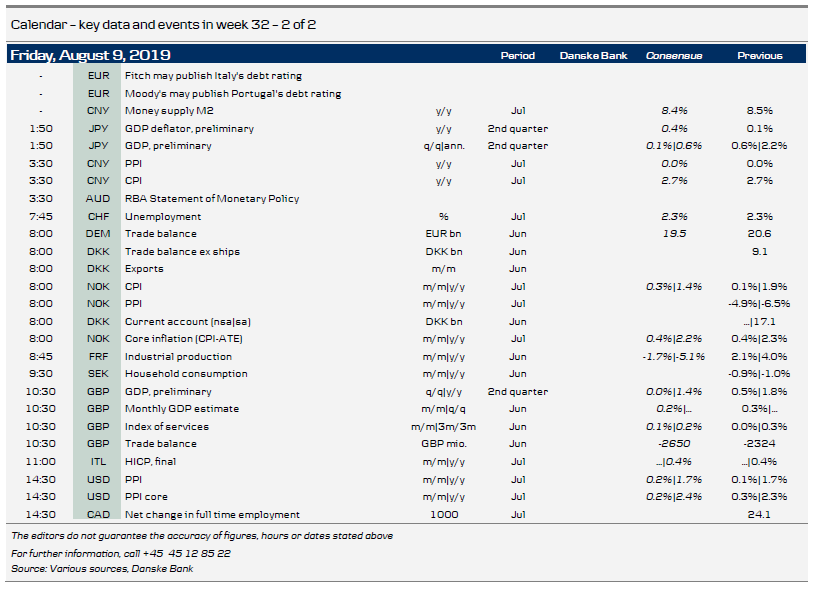

Calendar – key data and events in week 32 – 1 of 2