Cooler US weather forecast is bearish for natural gas prices

Natural gas prices decline on cooler US weather forecast. Will natural gas prices continue falling?

Natural gas prices are falling on milder weather forecast in eastern US. Cooler temperatures are expected to lower power consumption for air conditioning, resulting in lower demand for natural gas for power generation. Lower expected demand when supplies are above normal for the time of year as production from shale fields rises is bearish for natural gas prices.

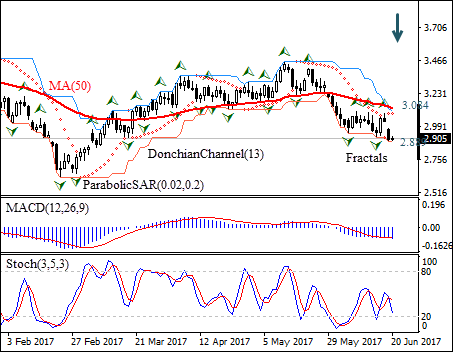

On the daily timeframe the NATGAS: D1 has been retracing lower following the rally after hitting six-month high in mid-May. The price has fallen below the 50-day moving average MA(50) which is falling.

- The Parabolic indicator has formed a sell signal.

- The Donchian channel indicates a downtrend: it is tilted downward.

- The MACD indicator gives a bearish signal.

- The Stochastic oscillator is falling but has not reached the oversold zone.

We expect the bearish momentum will continue after the price breaches below the lower Donchian bound at 2.889. This level can be used as an entry point for a pending order to sell. The stop loss can be placed above the fractal high at 3.084.

After placing the pending order, the stop loss is to be moved to the next fractal high, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (3.084) without reaching the order (2.889), we recommend canceling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position - Sell

Sell stop - Below 2.889

Stop loss - Above 3.084