Confirming the growth trend

Interim results from Utilitywise Plc (LONDON:UTW) extended its track record of growth. We expect further growth in H2 and FY16, supported by contributions from both organic (consultant headcount) and acquired (T-mac) sources. The P/E multiple of c 10.5x (CY15) compares to 16.9x for the FTSE All-Share.

Continuing delivery of organic growth

UTW’s business continues to grow strongly (H115 vs H114) with revenues and adj. EBITDA +42%. As expected, the H1 numbers were helped by significant contract renewal, leading to a 1% drop in secured revenue pipeline (to £23.5m). However, since January, Utilitywise has renewed its focus on customer acquisition, with a record of 1,061 customers added in January-March, providing a boost to secured revenue pipeline (£26m at 31 March 2015). The recruitment of energy consultants continues and consultant headcount totalled 549 at the end of March (vs 449 at 31 January 2015). This renewed phase of growth will increase short-term costs but facilitate further revenue growth in the longer term, helping to offset the impact of having brought forward a portion of the customer renewals business. We expect that ongoing negotiations with suppliers to improve contract terms will improve cash generation compared to earnings over the medium term.

Acquisition of T-mac boosts service proposition

UTW also announced the acquisition of T-mac Technologies for an initial consideration of £10m (£6.25m cash/£3.75m equity) and up to a further £12m of deferred consideration spread over two years (70% cash/30% equity). T-mac is a provider of business energy management systems, which allow energy clients to monitor and reduce their energy consumption using its proprietary hardware and software applications (IP acquired by UTW). In the year to March 2015, T-mac reported revenue of £3.6m and EBITDA of £0.3m. If T-mac meets its targets, the acquisition price of £22m will represent c 6x EBITDA (in year two post acquisition).

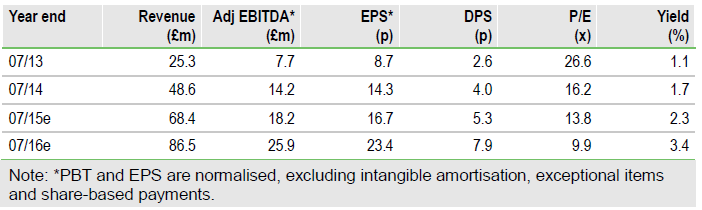

Valuation: Revised forecasts show continued growth

We have revised our forecasts to reflect higher forecasts for energy consultant headcount in FY16, tempered by lower productivity per head; higher costs to reflect the additional expansion; the announced acquisition of T-mac; the issue of shares to part-fund the acquisition; and the payment of £6m of deferred consideration in 2016. On the basis of our revised forecasts, Utilitywise is trading on a P/E for CY15(EPS 19.5p) of c 10.5x versus 16.9x for the FTSE All-Share.

To Read the Entire Report Please Click on the pdf File Below