Summary

The utilities sector outperformed this week for the second week in a row.

Utilities are also one of the better performing sectors for the last month.

Morgan Stanley upgraded the utilities sector this week.

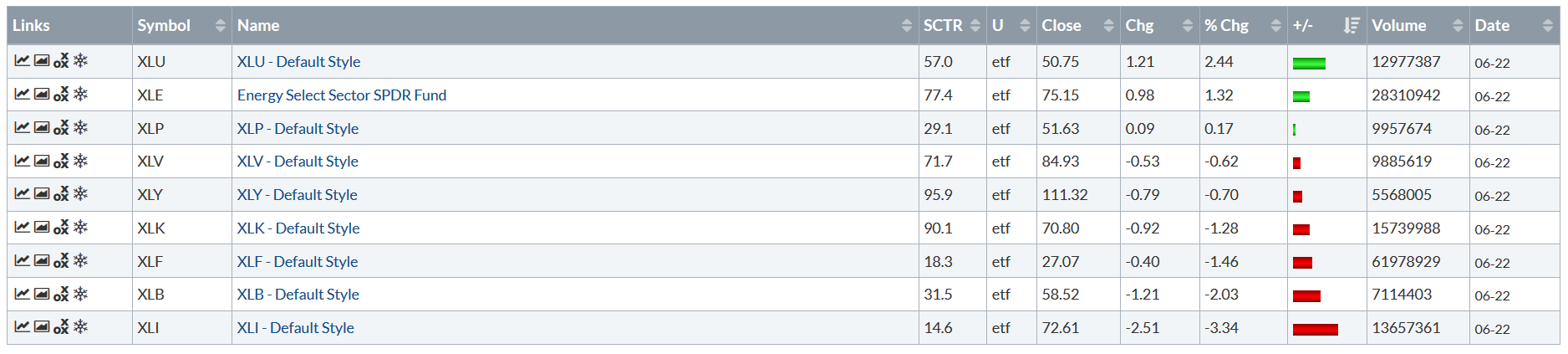

This week, utilities were once again the best performing sector:

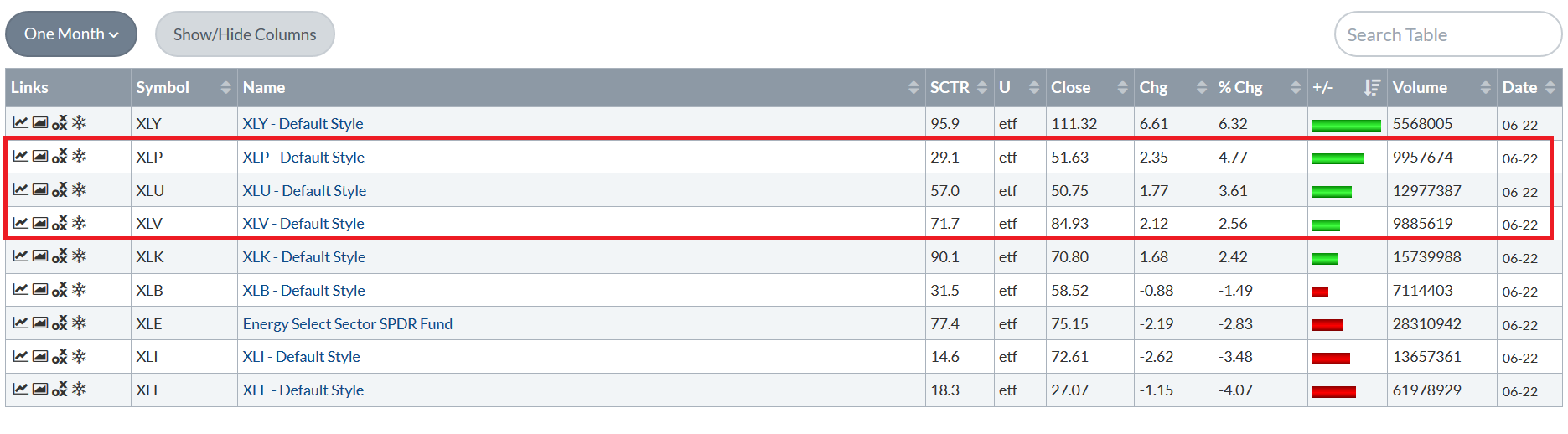

And they are one of the best performing sectors for the last month:

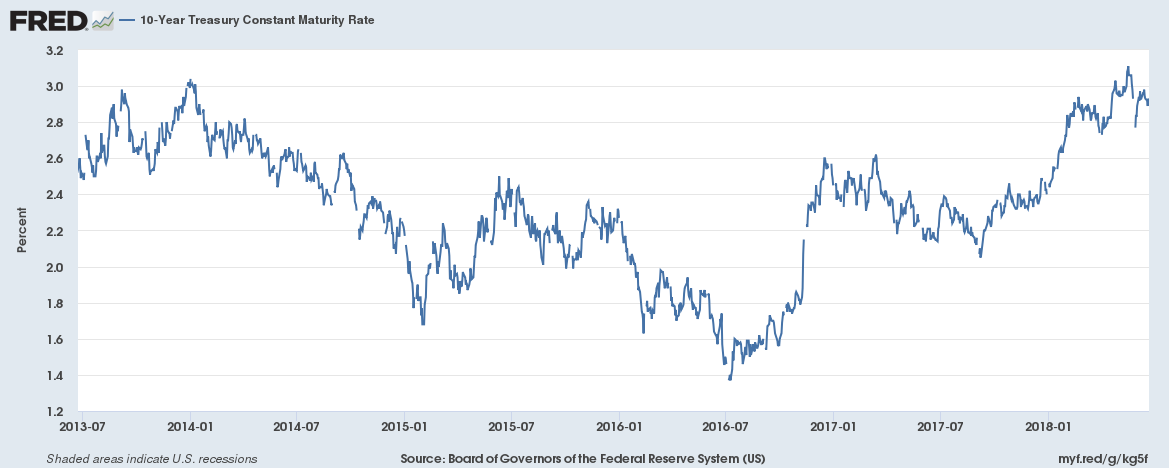

Part of the reason is that yields have steadied as of late:

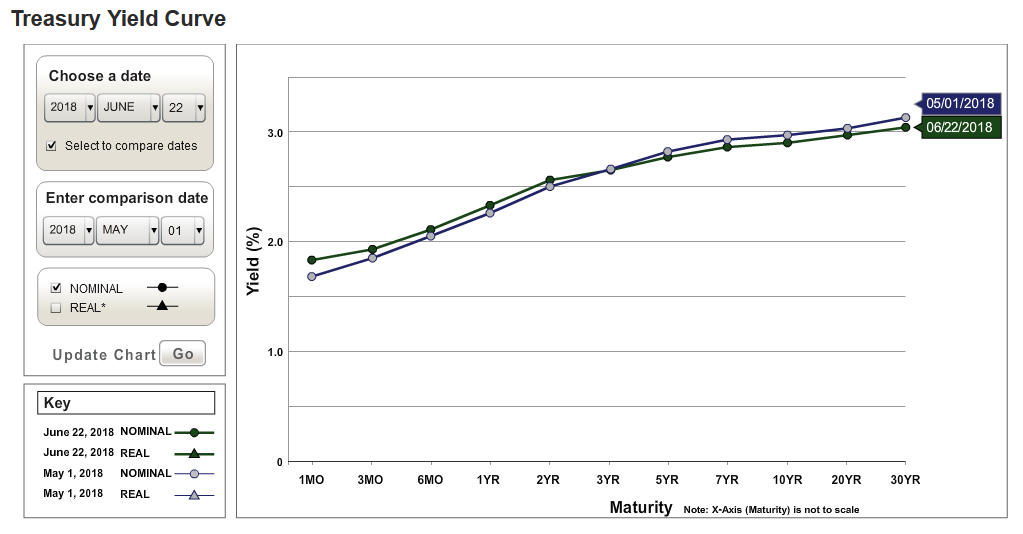

The 10-year yield rose ~60 basis points until the beginning of June. It has since come in a bit. This chart of the yield curve puts the situation into a more recent historical perspective:

The yield curve has really moved since May 1.

Another reason for utilities' outperformance is the more defensive nature of the recent price action among the sector. Over the last week and month, utilities, consumer staples, and health care are outperforming other sectors.

Several articles this week highlighted the more defensive nature of the recent market action. From Barron's:

All of this leads Wilson to be more positive about defensive sectors. He's yet another voice calling for a potential turn in the consumer-staples sector, and he also upgraded the utility sector to overweight today, citing his expectation on peak 10-year Treasury yields and improving relative earnings breadth. The firm has Overweight ratings on American Electric Power (NYSE:AEP), PG&E (NYSE:PCG), Public Service Enterprise Group (NYSE:PEG), and XCEL Energy (NASDAQ:XEL).

ETF Trends also noted utilities' overall outperformance (emphasis from the article):

Utilities stocks and utilities ETFs rallied over the past week as trade war concerns and a return to safety helped support this defensive play.

Over the past week, iShares Edge MSCI Multifactor Utillities (NYSE:UTLF) gained 3.9%, John Hancock Multifactor Utilities (NYSE:JHMU) rose 3.2%, Reaves Utilities (NYSE:UTES) added 3.2% and Invesco DWA Utilities Momentum Portfolio (NASDAQ:PUI) increased 3.0%. The Utilities Select Sector SPDR (XLU), the largest utilities related ETF, was 2.5% higher over the same period.

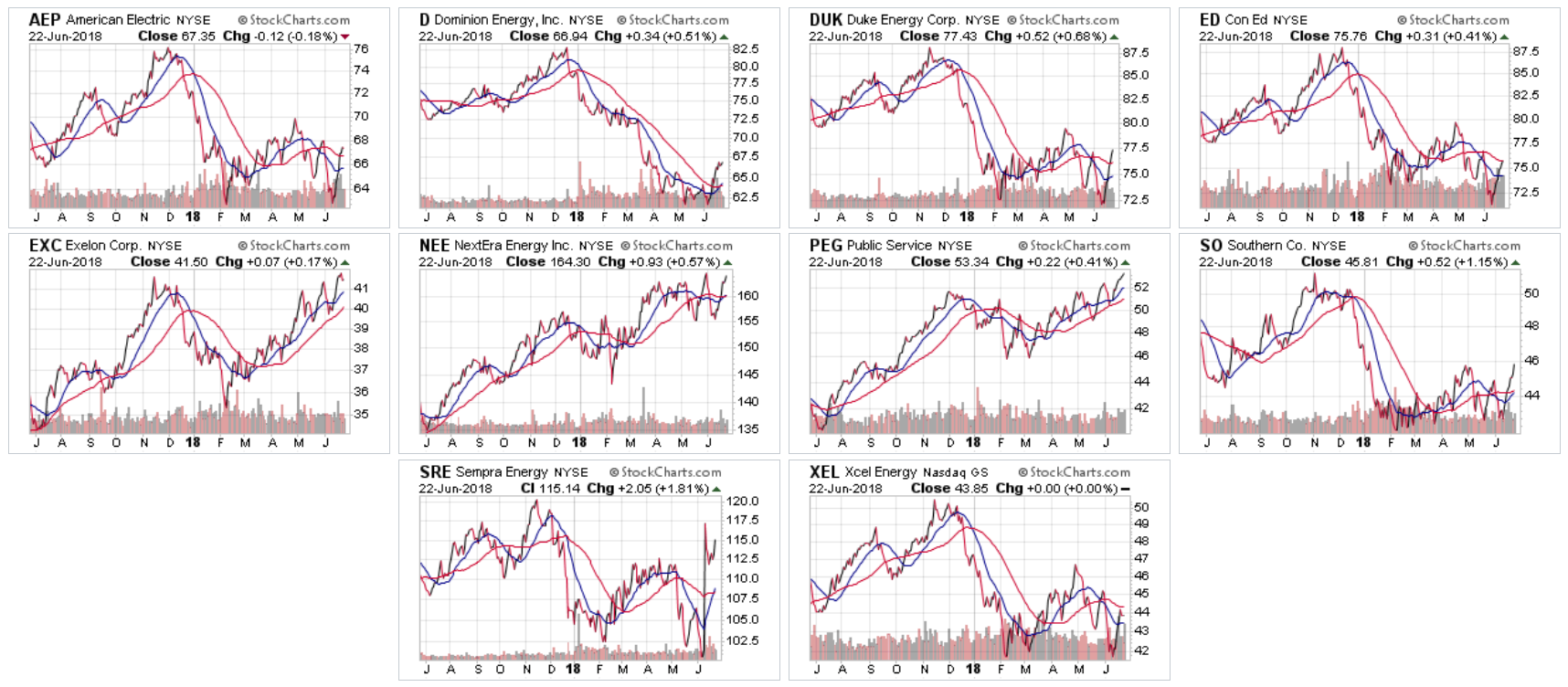

Turning to the largest members of XLU, we have the following year-long charts:

Three are at/near 52-week highs: Exelon (NYSE:EXC), NextEra Energy (NYSE:NEE), and Public Service Enterprise (NYSE:PEG) (all three are in the middle row). Sempra Energy (NYSE:SRE) (bottom row, left) recently rallied after an activist investor publicly called for a change in the board of directors. All the other issues are trading at/near 52-week lows.

There was a smattering of news from the major issues:

American Electric Power gained approval from a regulator to build the largest windfarm in the US:

A titanic $4.5 billion plan by AEP Corp. to build the largest wind power in the United States has landed another key approval.

The Columbus-based utility's proposed Wind Catcher Energy Connection project has landed required approvals from two of the four states it will ultimately serve. The Louisiana Public Service Commission approved the project on Wednesday, following the May approval by its counterpart in Arkansas.

That leaves Texas and Oklahoma to approve the plan.

The project would create a 2,000-megawatt wind farm in Texas and in Cimarron County on the Oklahoma panhandle. About 800 wind turbines supplied by GE Renewable Energy will power the project that would be developed by Chicago-based Invenergy LLC.

- After a report, Duke could see an 11%+ increase in rates due to this winter's cold snap; the Carolina Utility Board approved a 3-6% increase.

- Exelon has signed on to a lobbying effort to impose a carbon tax in the US.

- NextEra (NYSE:NEE) and AT&T (NYSE:T) signed a deal for NEE to deliver 300 MW of wind power.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.