Why the U.S. dollar still reigns supreme

Summary

- The XLUs have rallied back from their mild sell-off in early May.

- Yields for the 10 largest members of the XLU are attractive relative to the 10-year Treasury.

- FERC has released their latest assessment of the summer utility market.

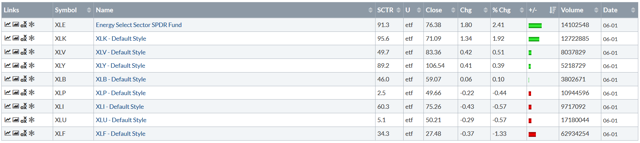

- Let's start with a comparison of the XLUs to the other nine major sector ETFs:

The Utilities Select Sector SPDR (NYSE:XLU) was one of the worst performing ETFs last week. That, however, is a relative term, as it was only off .6%.

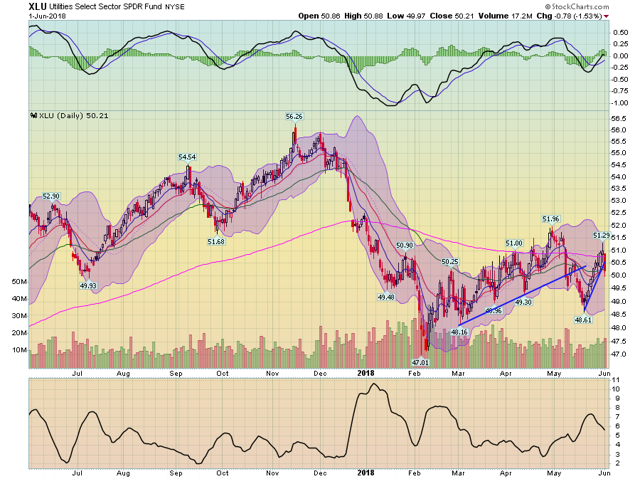

The daily chart of the XLUs adds the appropriate technical color:

After being hit by the double-whammy of rising interest rates and a huge market sell-off, the XLU had a three-month rally that lasted from early February to early May. But prices broke that trend line a month ago. After dropping during the first two weeks of May, they rallied, but have hit resistance at the 200-day EMA - a standard technical development.

This wasn't the result of one member of the ETF dropping; the 10 largest members of the XLUs all moved lower:

So, why did the XLUs drop? We have to look to the Treasury market for answers:

In Mid-May, the Treasury market sold-off pretty sharply, raising rates. This bled into all stock sectors that are interest rate dependent, which explains the sell-off. As the treasury market ETFs have rallied over the last two weeks (which lowers rates) so have the XLUs.

Finally, let's look at the XLU's weekly chart:

There's a lot to like here. First, after falling for three months, the chart has formed four consecutive small bars on modest volume, indicating a lack of movement from a historical perspective. Moreover, prices are in the upper 40s, an area with technical support from late 2016. And prices are right above the 200-week EMA, another technical support area. Currently, the XLU is yielding 3.41%, which will attract buyers.

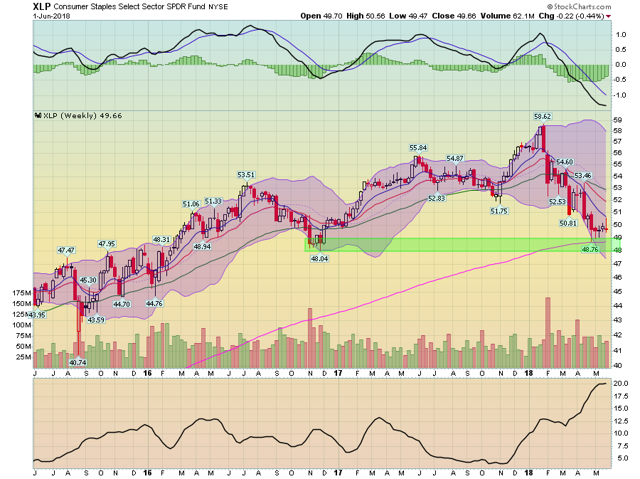

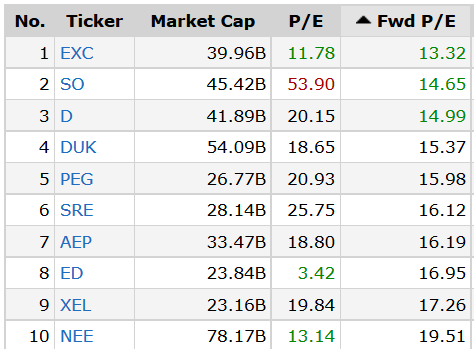

Turning to the XLU's largest members, the good news from this sell-off is that dividend yields are now very attractive:

Right now, the 10-Year Treasury is at 2.9%. Nine of the members of the XLU offer more yield. Two offer yields over 5%. In addition, the XLU members with higher yields will attract bidders, which will help to put a floor under their respective stock prices.

And forward valuations are attractive:

In industry news, we had a very big development at the national level:

“The Department [of Energy] is exercising its DPA and FPA authority by directing System Operators (as defined in the Directive),” a draft plan reads, “for a period of twenty-four (24) months, to purchase or arrange the purchase of electric energy or electric generation capacity from a designated list of Subject Generation Facilities (SGFs) sufficient to forestall any further actions toward retirement, decommissioning, or deactivation of such facilities during the pendency of DOE’s Order.”

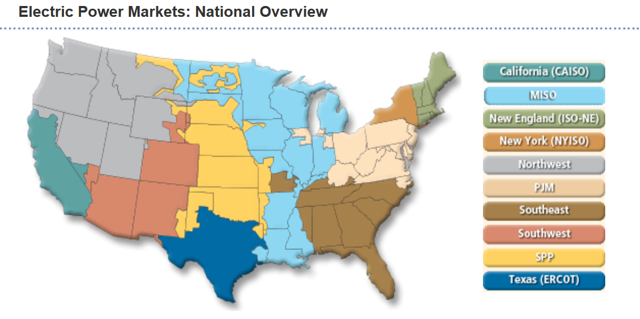

Here's some background. The FERC divides the country into 11 different power regions:

(the SE region is further divided into Florida and all other states). Some of these - like the SE region - have vertically integrated utilities while others - like my home state of Texas - have competitive markets. At the same time, rules from the previous administration were biased against coal companies, as were directives from some states (such as New York and California). This has led some utilities to decommission old coal plants and move into alternative energy sources.

This new rule at the federal level would give coal and nuclear power companies a competitive edge when members of the power grid bid for electricity, placing them further up the line when municipalities are bidding on electricity. This development is occurring at a very important time - the summer, when heat waves may lead to an imbalance between energy supply and demand.

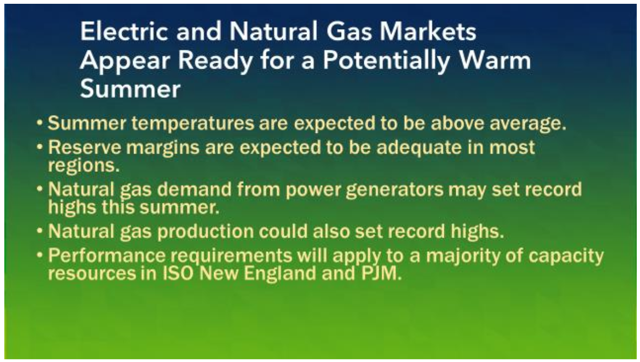

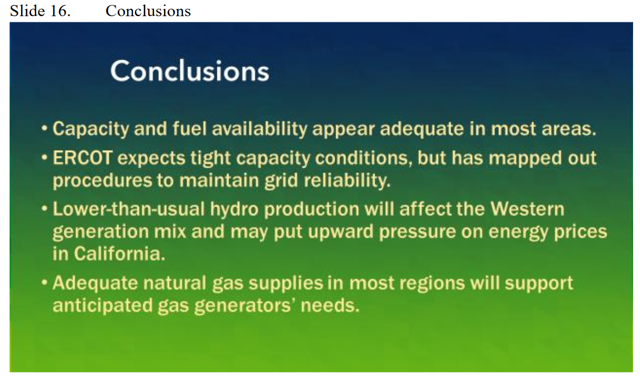

In other news, the FERC released their latest summer projections for the utility market:

The report had the following conclusions:

This means that certain areas will be attractive from a fundamental perspective, which I'll write about later this week.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.