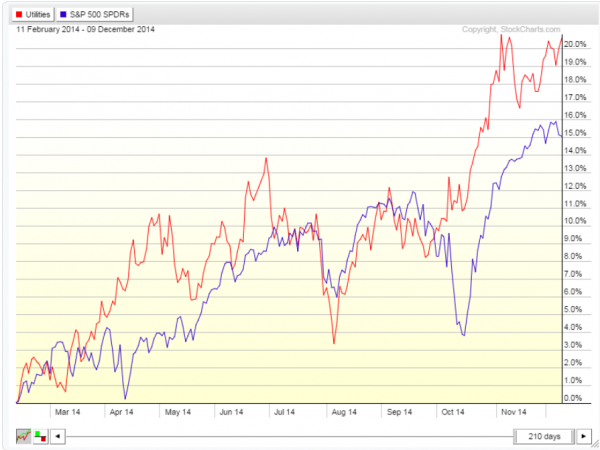

It is said that when defensive stocks lead that the market may be in trouble. So when Utilities, the most defensive of the defensive stocks are showing strength those with a bearish bent take notice.

Early in 2014 Utilities did just that. They moved higher. Using the Utilities Select Sector ETF (NYSE:XLU) they climbed from a base at 37 to 43.50 in May. But then Utilities consolidated for 6 months. The chart below shows the early run up and then long consolidation.

But since the October lows in the broad market, Utilities have gained strength again. First moving higher to a plateau at 46.50 and then consolidating. This is about halfway to the target of the initial consolidation break out, at about 49.50 (red arrows).

As it consolidates the RSI is making a series of higher lows and the MACD is trying to cross up. Translation: Momentum is building. And should it break above 46.50 the Measured Move higher targets 50.

Targets of 49.50 to 50 with supporting momentum. No wonder bears are looking for a top in the market. The only problem has been that Utilities strength has not been at the expense of the broad markets this year. Instead of pointing out a market problem, Utilities have been rising with the Market and just not selling off when the market does. A different kind of relative strength.