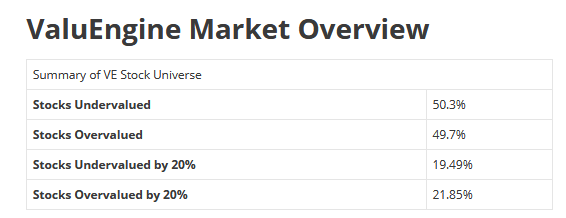

VALUATION WATCH: Overvalued stocks now make up 49.7% of our stocks assigned a valuation and 21.85% of those equities are calculated to be overvalued by 20% or more. Twelve sectors are calculated to be overvalued.

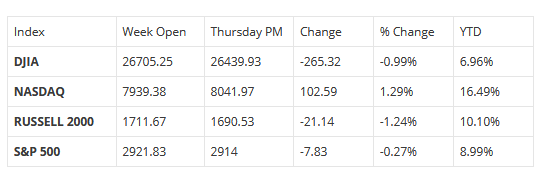

ValuEngine Index Overview

Sector Talk–Utilities

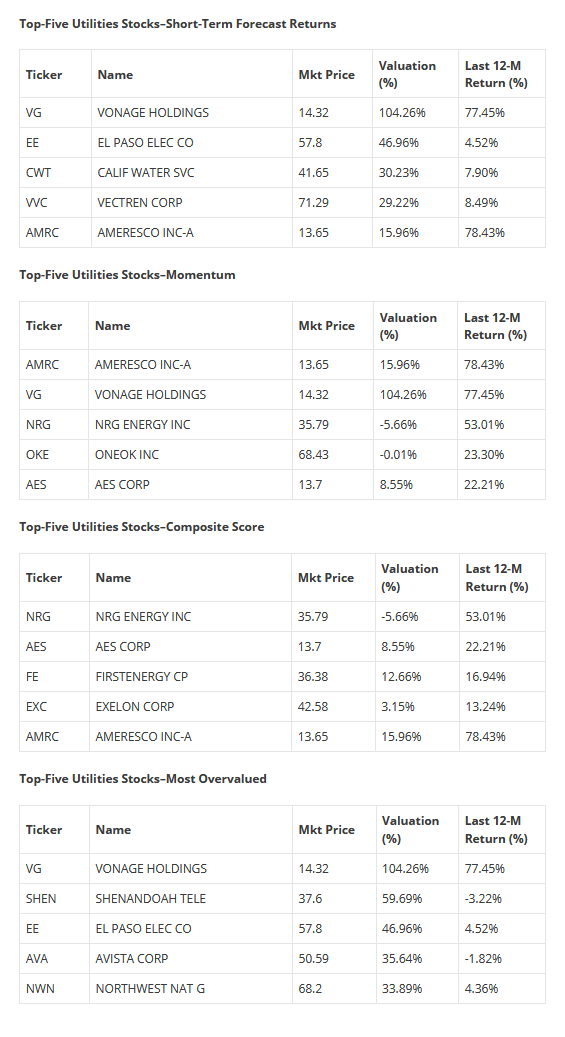

Below, we present the latest data on Utilities stocks from our Professional Stock Analysis Service. Top- five lists are provided for each category. We applied some basic liquidity criteria–share price greater than $3 and average daily volume in excess of 100k shares.

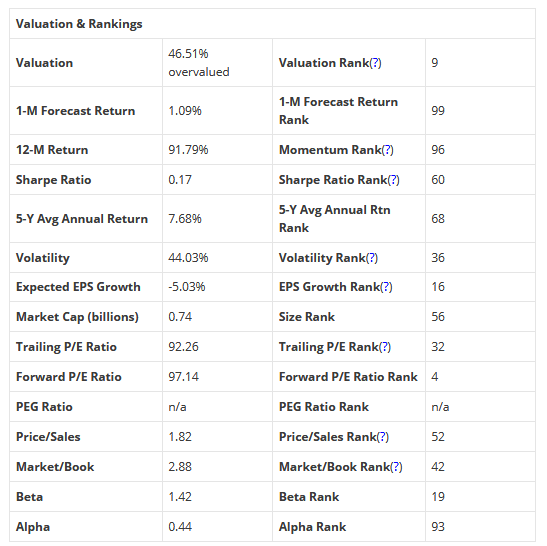

Shake Shack (NYSE:SHAK) is engaged in owning and operating restaurants. The company offers burgers, hot dogs, frozen custard, crinkle cut fries, beer and wine. It operates primarily in New York, New Jersey, Washington, D.C., Connecticut, Georgia, Illinois, Pennsylvania, Florida, Massachusetts, Virginia, Nevada, London, Istanbul and Dubai. Shake Shack Inc. is headquartered in New York.

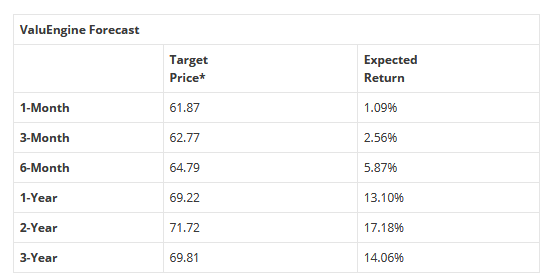

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on SHAKE SHACK. Based on the information we have gathered and our resulting research, we feel that SHAKE SHACK has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Momentum and Sharpe Ratio.