For many years, investors have viewed utilities as sensitive to interest rates. Is this still true?

Whether they are sensitive to rates are not, an important test of channel support is very near at (1) above.

From 2003 to 2007, (NYSE:XLU) pretty did well. From 2007 to 2008, it appears a head-and-shoulders topping pattern formed and once support broke, XLU declined a large percentage.

Over the past few years, XLU has done well, inside of a rising channel? Is XLU forming a Head & Shoulders topping formation again? It would appear its a little soon to tell on the pattern. For sure XLU is nearing the bottom of its multi-year rising channel at (1) above. A break of support could bring in some sellers of the ETF.

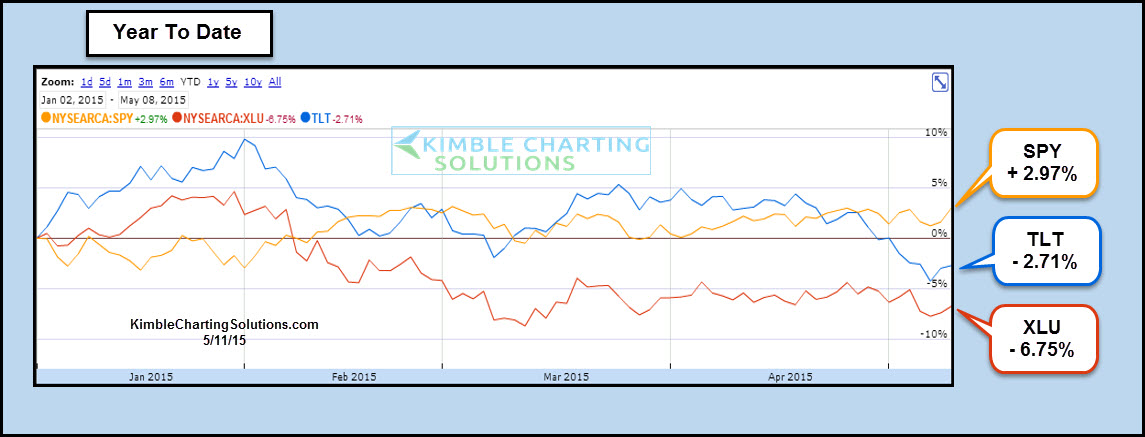

Below looks at year-to-date performance of (ARCA:TLT), XLU and (ARCA:SPY).

Even though TLT has had a rough go of it recently, XLU is down nearly 7% on the year as it nears rising support.

TLT has lost nearly 7% in the past month and the Yield on the 10-year note and 30-year bond are testing breakout levels! (See Post Here).

Whether XLU is as interest rates sensitive as it used to be or not, what XLU does at rising channel support looks to be an important test for it and rates at the same time and could impact the broad markets as well!