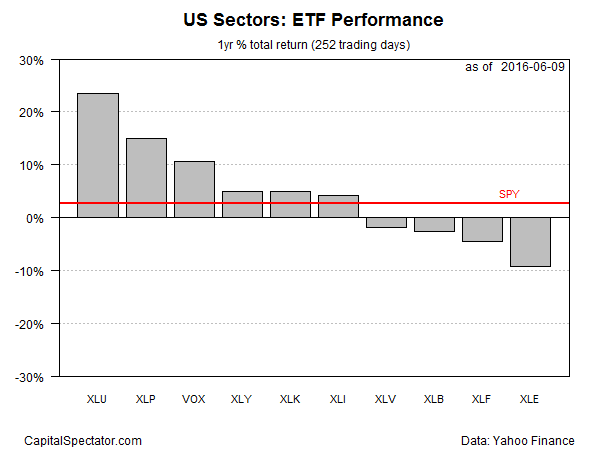

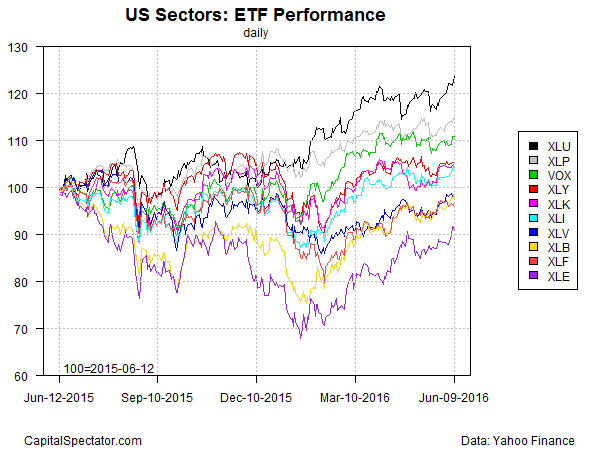

Utility stocks still hold the top-spot among US sectors for the trailing one-year return slot, based on a set of proxy ETFs. As horse races go, there’s nothing subtle here. This interest-rate sensitive slice of the stock market enjoys a sizable—and expanding—performance lead over the rest of the field.

The Utilities Select Sector SPDR ETF (NYSE:XLU) is higher by more than 24% on a total-return basis as of yesterday (June 9) vs. the fund’s year-ago price. That’s a substantial eight-percentage-point lead over the number-two performer—considerably wider in relative and absolute terms, in fact, vs. last month’s review.

XLU’s advance looks even stronger relative to the stock market overall. Although the SPDR S&P 500 (NYSE:SPY) is again posting a year-over-year gain, the ETF’s 3.9% total return for the trailing 12 months is a mild party compared with the revelry in utility shares.

Meanwhile, energy stocks remain in last place for the one-year column. Note, however, that that the red ink has been fading lately. The Energy Select Sector ETF (XLE (NYSE:XLE)) has shed roughly 8% over the past 12 months, but that’s a relatively light setback compared with the one-year losses posted in recent history.

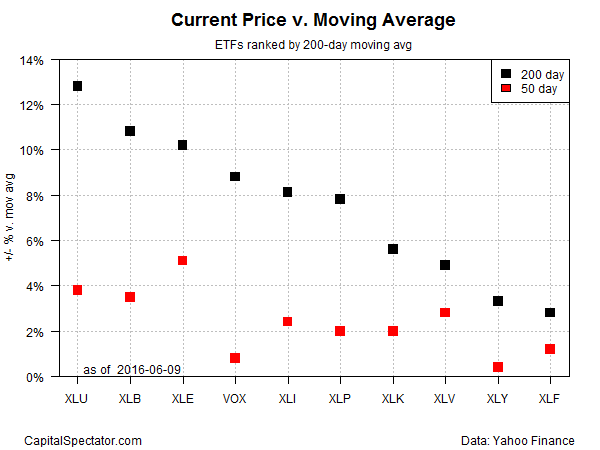

A rising tide lifts all boats, or at least it does in the current environment by way of sector funds. As the next chart reminds, upside momentum remains a conspicuous force across the board for sector ETFs in the second quarter.

Note, too, that all the sector ETFs are now trading above their respective 50- and 200-day moving averages—a sign that positive price momentum is widespread. To the extent that positive momentum begets positive momentum, the near-term outlook appears to have a rosy glow.