Utilico Emerging Markets Ltd (LON:UEM) aims to generate long-term growth in capital and income from a portfolio of 60-90 emerging market equities. Exposure is diversified by geography, with a large concentration in infrastructure, utility and related sectors. Manager Charles Jillings is bullish on the outlook for emerging market equities in 2018 due to a widespread economic improvement, which should result in another year of robust corporate profits. UEM has announced that it is proposing to change its domicile from Bermuda to the UK, which has the potential to improve investor perception and may lead to a narrower discount.

Investment strategy: Fundamental research

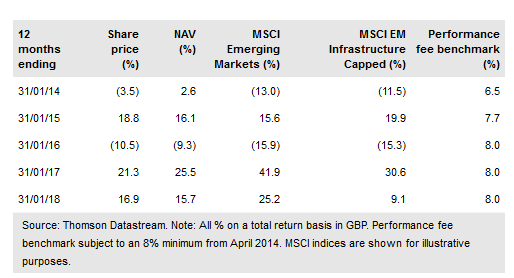

Jillings invests for the long term, avoiding stock market ‘noise’, seeking companies that can generate strong margins and cash flow, which can support above-average dividend yields. The investible universe of c 900 companies is screened and companies passing the selection criteria undergo thorough fundamental research, which includes construction of detailed financial models and valuation targets. Company meetings and site visits are an integral part of the research process. Since UEM’s launch in July 2005 to end-January 2018, its NAV total returns have compounded at 12.0% per annum.

To read the entire report Please click on the pdf File Below: